Commodities enjoyed a bright start to the year, with oil bouncing above US$83 and sugar striking a 29-year high as traders eyed recovery hopes despite poor US jobs data.

“We have been highlighting for some time that there is still considerable upside risk to commodity prices in early 2010,” Barclays Capital analyst Kevin Norrish said in a research note to clients.

Markets tailed off somewhat on Friday as traders digested news that the US, a major consumer of raw materials, shed more jobs than expected last month.

OIL: The market jumped in the first trading week of the year, largely because of a cold snap across the northern hemisphere which boosted heating fuel demand but players pared gains after a downbeat US jobs report.

New York crude topped US$83 on Wednesday for the first time in 14 months before closing lower on Thursday for the first time in 10 sessions as traders banked profits.

Oil begun the year with a bang on Monday, soaring by more than US$2 as freezing temperatures spread. Reports that Russia had cut supplies to Belarus also helped push prices higher, but officials in Belarus later denied the reports.

Gains for oil tailed off toward the end of the week in the wake of the latest US energy inventory data and the downbeat US non-farm payrolls report.

By late on Friday, New York’s main futures contract, light sweet crude for delivery next month, rallied to US$82.22 a barrel from US$79.36 on Thursday of the previous week.

London’s Brent North Sea crude for next month advanced to US$81.05 from US$77.93.

PRECIOUS METALS: Platinum and palladium prices soared to equal recent highs after the US launch of exchange traded funds (ETFs) for both metals.

Platinum rallied as high as US$1,578 per ounce, the best level since August 2008 while palladium hit US$434.25 an ounce, the best since July that year.

By Friday on the London Bullion Market, gold rose to US$1,126.75 an ounce, from US$1,104 the previous Thursday before the New Year holiday break.

Silver soared to US$18.12 an ounce from US$16.99.

On the London Platinum and Palladium Market, platinum soared to US$1,569 an ounce from US$1,466.

Palladium jumped to US$431 an ounce from US$402.

BASE METALS: Base metals diverged but copper hit multi-month highs on news of a strike in key producer Chile which was later settled.

Copper struck US$7,796 per tonne on Thursday, its highest level since August 2008.

By Friday on the London Metal Exchange, copper for delivery in three months jumped to US$7,525 a tonne from US$7,408 on Thursday the previous week.

SUGAR: Sugar prices scaled 29-year highs, lifted by predictions of lower output in emerging economic giant India.

By Friday on the New York Board of Trade, the price of unrefined sugar for March rose to US$0.2814 a pound from US$0.2724 on Thursday the previous week.

On LIFFE, London’s futures exchange, the price of a tonne of white sugar for delivery in March climbed to £730.30 from £706.30.

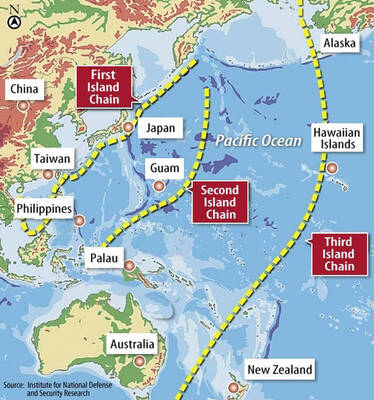

The US government has signed defense cooperation agreements with Japan and the Philippines to boost the deterrence capabilities of countries in the first island chain, a report by the National Security Bureau (NSB) showed. The main countries on the first island chain include the two nations and Taiwan. The bureau is to present the report at a meeting of the legislature’s Foreign Affairs and National Defense Committee tomorrow. The US military has deployed Typhon missile systems to Japan’s Yamaguchi Prefecture and Zambales province in the Philippines during their joint military exercises. It has also installed NMESIS anti-ship systems in Japan’s Okinawa

‘WIN-WIN’: The Philippines, and central and eastern European countries are important potential drone cooperation partners, Minister of Foreign Affairs Lin Chia-lung said Minister of Foreign Affairs Lin Chia-lung (林佳龍) in an interview published yesterday confirmed that there are joint ventures between Taiwan and Poland in the drone industry. Lin made the remark in an exclusive interview with the Chinese-language Liberty Times (the Taipei Times’ sister paper). The government-backed Taiwan Excellence Drone International Business Opportunities Alliance and the Polish Chamber of Unmanned Systems on Wednesday last week signed a memorandum of understanding in Poland to develop a “non-China” supply chain for drones and work together on key technologies. Asked if Taiwan prioritized Poland among central and eastern European countries in drone collaboration, Lin

TRAGEDY STRIKES TAIPEI: The suspect died after falling off a building after he threw smoke grenades into Taipei Main Station and went on a killing spree in Zhongshan A 27-year-old suspect allegedly threw smoke grenades in Taipei Main Station and then proceeded to Zhongshan MRT Station in a random killing spree that resulted in the death of the suspect and two other civilians, and seven injured, including one in critical condition, as of press time last night. The suspect, identified as a man surnamed Chang Wen (張文), allegedly began the attack at Taipei Main Station, the Taipei Fire Department said, adding that it received a report at 5:24pm that smoke grenades had been thrown in the station. One man in his 50s was rushed to hospital after a cardiac arrest

ON ALERT: Taiwan’s partners would issue warnings if China attempted to use Interpol to target Taiwanese, and the global body has mechanisms to prevent it, an official said China has stationed two to four people specializing in Taiwan affairs at its embassies in several democratic countries to monitor and harass Taiwanese, actions that the host nations would not tolerate, National Security Bureau (NSB) Director-General Tsai Ming-yen (蔡明彥) said yesterday. Tsai made the comments at a meeting of the legislature’s Foreign Affairs and National Defense Committee, which asked him and Minister of National Defense Wellington Koo (顧立雄) to report on potential conflicts in the Taiwan Strait and military preparedness. Democratic Progressive Party (DPP) Legislator Michelle Lin (林楚茵) expressed concern that Beijing has posted personnel from China’s Taiwan Affairs Office to its