Wall Street enters the first trading week of the year on a bullish note, but the market remains dogged by concerns on the timing of any interest rate hike by the Federal Reserve amid economy recovery.

The US central bank may shed some light on how the central bank will unwind its unconventional monetary policy that helped jolt the world’s largest economy from prolonged recession.

Fed Chairman Ben Bernanke is scheduled to speak to the American Economic Association forum in Atlanta tiday, while the minutes of the Dec. 15-16 Fed policy-making body meeting will be released on Wednesday.

They could provide more detailed clues on the Fed’s updated outlook for the economy and evolving plans for an eventual “exit” strategy from virtually zero interest rates, with the market flush with liquidity.

“We still expect the Fed to stick to its guns on the current low-interest policy through at least the first half of 2010,” said IHS Global Insight US economists Brian Bethune and Nigel Gault in a joint report.

They cited both inflation and output, which were “running below the Fed’s target,” as well as tight credit conditions and constrained demand for credit.

Wall Street stocks slumped at the close of a turbulent year on Thursday, after positive jobs data sparked concerns that interest rates may rise sooner than anticipated.

However, shares settled only slightly below their 52-week highs with strong gains for the year.

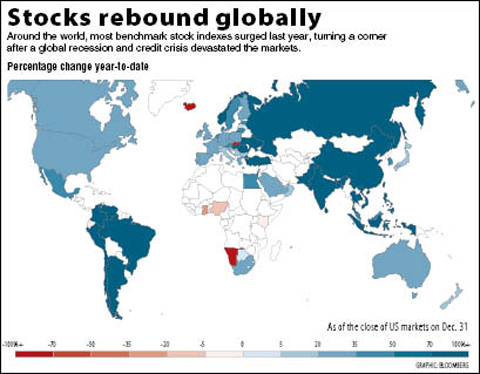

For the holiday-shortened week, the blue-chip Dow Jones Industrial Average lost 0.9 percent to 10,428.05, but gained 18.82 percent over the course of the year.

The technology-rich NASDAQ composite shed 0.7 percent for the week to 2,269.15 and the broad-market Standard & Poor’s 500 index retreated 1 percent to 1,115.10.

The NASDAQ index racked up the largest percentage gain for the year, wrapping up the year with a 43.9 percent jump, while the S&P 500 index jumped 23.5 percent.

Analysts are confident the market will continue its ascent, considering the 2.2 percent US economic growth chalked up in the July-September period — the first quarter of recovery after a year of contraction — as well as rising existing-home sales and durable-goods orders.

For the week, bonds were mixed. The yield on the 10-year Treasury bond rose to 3.843 percent from 3.807 percent a week earlier while that on the 30-year bond dipped to 4.641 percent from 4.687 percent. Bond yields and prices move in opposite directions.

CRITICAL MOVE: TSMC’s plan to invest another US$100 billion in US chipmaking would boost Taiwan’s competitive edge in the global market, the premier said The government would ensure that the most advanced chipmaking technology stays in Taiwan while assisting Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) in investing overseas, the Presidential Office said yesterday. The statement follows a joint announcement by the world’s largest contract chipmaker and US President Donald Trump on Monday that TSMC would invest an additional US$100 billion over the next four years to expand its semiconductor manufacturing operations in the US, which would include construction of three new chip fabrication plants, two advanced packaging facilities, and a research and development center. The government knew about the deal in advance and would assist, Presidential

‘DANGEROUS GAME’: Legislative Yuan budget cuts have already become a point of discussion for Democrats and Republicans in Washington, Elbridge Colby said Taiwan’s fall to China “would be a disaster for American interests” and Taipei must raise defense spending to deter Beijing, US President Donald Trump’s pick to lead Pentagon policy, Elbridge Colby, said on Tuesday during his US Senate confirmation hearing. The nominee for US undersecretary of defense for policy told the Armed Services Committee that Washington needs to motivate Taiwan to avoid a conflict with China and that he is “profoundly disturbed” about its perceived reluctance to raise defense spending closer to 10 percent of GDP. Colby, a China hawk who also served in the Pentagon in Trump’s first team,

SEPARATE: The MAC rebutted Beijing’s claim that Taiwan is China’s province, asserting that UN Resolution 2758 neither mentions Taiwan nor grants the PRC authority over it The “status quo” of democratic Taiwan and autocratic China not belonging to each other has long been recognized by the international community, the Mainland Affairs Council (MAC) said yesterday in its rebuttal of Beijing’s claim that Taiwan can only be represented in the UN as “Taiwan, Province of China.” Chinese Minister of Foreign Affairs Wang Yi (王毅) yesterday at a news conference of the third session at the 14th National People’s Congress said that Taiwan can only be referred to as “Taiwan, Province of China” at the UN. Taiwan is an inseparable part of Chinese territory, which is not only history but

INVESTMENT WATCH: The US activity would not affect the firm’s investment in Taiwan, where 11 production lines would likely be completed this year, C.C. Wei said Investments by Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) in the US should not be a cause for concern, but rather seen as the moment that the company and Taiwan stepped into the global spotlight, President William Lai (賴清德) told a news conference at the Presidential Office in Taipei yesterday alongside TSMC chairman and chief executive officer C.C. Wei (魏哲家). Wei and US President Donald Trump in Washington on Monday announced plans to invest US$100 billion in the US to build three advanced foundries, two packaging plants, and a research and development center, after Trump threatened to slap tariffs on chips made