Wall Street suffered the slings and arrows of one of the most tumultuous years in stock market history last year, but managed a stunning recovery that eclipsed a weak finish.

Wall Street stocks stumbled on Thursday amid thin volumes as many traders were away from their desks ahead of the New Year holiday yesterday.

The Dow Jones Industrial Average slid 1.19 percent to 10,428.05.

PHOTO: BLOOMBERG

The technology-rich NASDAQ composite shed 0.97 percent at 2,269.15 and the broad-market Standard & Poor’s 500 index lost 1 percent at 1,115.10.

However, compared with 12 months ago, the blue-chip Dow was up 18.82 percent, its steepest annual gain since 2003.

The NASDAQ gained a whopping 43.89 percent over the year and the S&P 500 index was up 23.45 percent.

Still, the blue-chip Dow remains down 26 percent from its 2007 highs and is still struggling around the 10,000 level first reached in 1999.

The story is similar for the S&P 500 index, up 23.45 percent for last year, but still hovering near 1999 levels and 29 percent below record highs in October 2007.

The NASDAQ has failed to even come close to the boom days that pushed the index above 5,000 in March 2000, but closed last year with a blistering rise of 43.89 percent.

Though the market ended the year with solid gains, that hardly tells the story of a dramatic near-meltdown for the main indexes followed by a rebound that capped the final year of a “lost decade” for stocks.

The market opened last year sinking fast as the financial crisis deepened with the September 2008 collapse of Lehman Brothers. In 2008, the Dow lost 33.84 percent, the steepest drop since 1931, while the S&P slid 38.49 percent. The NASDAQ tumbled 40.54 percent in 2008, the biggest loss year since its creation in 1971.

It was a Depression-like scenario, with the broad market plunging more than 60 percent from October 2007 to March last year — farther and faster than in 1929.

However, by the spring, some began to sense a recovery in the economy, and Wall Street regained confidence, setting up one of the biggest market rallies in history over the ensuing months.

Ed Yardeni, at Yardeni Research, said the market appeared to turn when the S&P index slid to the ominous number of 666.

“When the S&P 500 bounced off 666 on March 6, I felt like Professor Robert Langdon in The Da Vinci Code,” he said.

The question for many investors now is whether this snapback was a “bear market rally” or the beginning of a new bull run that carries the market to new highs.

“Investors are nervous but optimistic heading into the new year,” said Michael Hartnett, chief global equity strategist at Bank of America Merrill Lynch Global Research.

Milton Ezrati, economist and market strategist at investment firm Lord Abbett, said the stock market is still licking its wounds as optimism rebounds.

“It has been a humbling and sobering experience, to say the least,” he said. “But for all the caution taught by the events of 2008-2009, signs of recovery have become unmistakable, and, as expected, the market has moved up in anticipation of the economic improvement likely in 2010.”

Other world markets also recorded a spectacular rebound last year even though the economy was in crisis, but confidence had not been completely restored and there were fears for this year.

In Frankfurt, the market ended the year 23 percent higher, Paris closed 22.32 percent up and London registered a 22.07 percent gain for the year.

In Asia, the rebound was even more spectacular. Shanghai gained 80 percent over the year and Hong Kong 52 percent. In Tokyo, the leading Nikkei index grew by 19.04 percent over the year.

In Europe, the Lisbon stock exchange rose 34 percent over the year, in Brussels it was up 31 percent. Madrid gained 30 percent, Amsterdam 36.34 percent, Milan 19.47 percent and the Swiss market more than 18 percent.

It was a similar situation in the Gulf where all the markets registered gains over the year. In South America, the Sao Paulo stockmarket grew 82 percent for the year.

However, despite improvements in the stock markets, most of the world’s economies remained limp: Growth was generally negative, except in emerging countries such as India, Brazil and China.

Unemployment had exploded, reaching a historic high of 10 percent in the US and 18 percent in Spain.

This year will be a “test year” for the markets, analysts said.

“Investors want to see if the financial system can again function on its own without help,” said Gregori Volokhine, an analyst from the Meeschaert investment group in New York.

Larry Hatheway and Kenny Liew from Swiss Bank UBS predicted the markets would next year see less significant gains than last year.

The analysts said the cautious outlook hinged on economic uncertainties: the dollar-euro relationship, possible price hikes for raw materials, questions over interest rates and the explosion of US and European deficits.

SECURITY: The purpose for giving Hong Kong and Macau residents more lenient paths to permanent residency no longer applies due to China’s policies, a source said The government is considering removing an optional path to citizenship for residents from Hong Kong and Macau, and lengthening the terms for permanent residence eligibility, a source said yesterday. In a bid to prevent the Chinese Communist Party (CCP) from infiltrating Taiwan through immigration from Hong Kong and Macau, the government could amend immigration laws for residents of the territories who currently receive preferential treatment, an official familiar with the matter speaking on condition of anonymity said. The move was part of “national security-related legislative reform,” they added. Under the amendments, arrivals from the Chinese territories would have to reside in Taiwan for

CRITICAL MOVE: TSMC’s plan to invest another US$100 billion in US chipmaking would boost Taiwan’s competitive edge in the global market, the premier said The government would ensure that the most advanced chipmaking technology stays in Taiwan while assisting Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) in investing overseas, the Presidential Office said yesterday. The statement follows a joint announcement by the world’s largest contract chipmaker and US President Donald Trump on Monday that TSMC would invest an additional US$100 billion over the next four years to expand its semiconductor manufacturing operations in the US, which would include construction of three new chip fabrication plants, two advanced packaging facilities, and a research and development center. The government knew about the deal in advance and would assist, Presidential

‘DANGEROUS GAME’: Legislative Yuan budget cuts have already become a point of discussion for Democrats and Republicans in Washington, Elbridge Colby said Taiwan’s fall to China “would be a disaster for American interests” and Taipei must raise defense spending to deter Beijing, US President Donald Trump’s pick to lead Pentagon policy, Elbridge Colby, said on Tuesday during his US Senate confirmation hearing. The nominee for US undersecretary of defense for policy told the Armed Services Committee that Washington needs to motivate Taiwan to avoid a conflict with China and that he is “profoundly disturbed” about its perceived reluctance to raise defense spending closer to 10 percent of GDP. Colby, a China hawk who also served in the Pentagon in Trump’s first team,

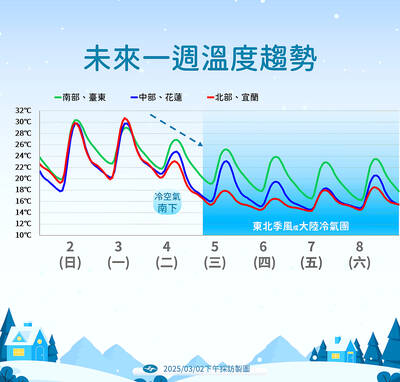

The arrival of a cold front tomorrow could plunge temperatures into the mid-teens, the Central Weather Administration (CWA) said. Temperatures yesterday rose to 28°C to 30°C in northern and eastern Taiwan, and 32°C to 33°C in central and southern Taiwan, CWA data showed. Similar but mostly cloudy weather is expected today, the CWA said. However, the arrival of a cold air mass tomorrow would cause a rapid drop in temperatures to 15°C cooler than the previous day’s highs. The cold front, which is expected to last through the weekend, would bring steady rainfall tomorrow, along with multiple waves of showers