European stocks posted a weekly decline as Fitch Ratings downgraded Greece and Standard & Poor’s Ratings Services cut its outlook for Spain, sparking concern there will be more debt-grade reductions.

National Bank of Greece SA and Piraeus Bank SA slumped more than 19 percent, pacing declines in European banking shares, as Fitch followed the reduction of Greece’s sovereign debt rating by cutting five of the nation’s lenders. Telekom Austria AG tumbled 13 percent as the country’s former telephone monopoly said earnings will drop next year.

The Dow Jones STOXX 600 Index lost 1.6 percent this week, the steepest decline since Nov. 20. The reliability of sovereign credit is under increased scrutiny after Dubai World, a state-owned holding company, said Nov. 25 it would seek a standstill agreement on its debt. Spain had the outlook on its debt grade lowered to negative from stable by S&P on Dec. 9, a day after Fitch cut Greece’s rating to BBB+ from A-.

“Dubai was a fire drill,” said Philip Gijsels, a senior structured-equity strategist at Fortis Global Markets in Brussels. “Worse than Dubai is Greece and what it means for other countries. A failure of governments would be worse than banks’ bankruptcies because governments have acted as lenders of last resource in this crisis.”

National benchmark indexes fell in all western European countries except Iceland and Luxembourg. Germany’s DAX, the UK’s FTSE 100 and France’s CAC 40 all slipped 1.1 percent. Greece’s ASE Index plummeted 9.4 percent, the most in more than a year, and Spain’s IBEX 35 retreated 3.5 percent.

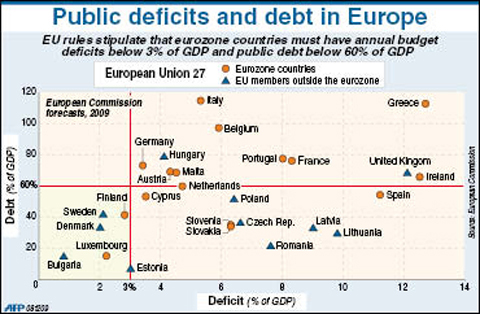

Greece, the lowest-rated country in the euro region, may be the first major nation in the EU to default on its debt since 1948, said Willem Buiter, the former Bank of England official who will join Citigroup Inc as its chief economist next month. The nation is heading for a budget deficit of 12.7 percent of GDP this year, the highest in the 27-nation bloc.

National Bank of Greece, the country’s largest lender, sank 20 percent, the most since October last year. Piraeus Bank, the fourth-biggest, fell 19 percent and EFG Eurobank Ergasias SA, the second-largest, slumped 18 percent.

Banco Santander SA, Spain’s biggest bank, retreated 6.6 percent. Bank of Ireland PLC and Allied Irish Banks PLC, the nation’s two largest lenders, sank 13 percent and 16 percent, respectively. Banks lost 4.4 percent this week, the worst performance among the 19 industry groups in the STOXX 600.

Greece and Ireland are among countries in an “intolerable” economic situation, which may lead to bailouts or even an exit from the euro area by the end of next year, according to Steve Barrow, head of G10 foreign-exchange strategy at Standard Bank PLC in London. “Countries like Ireland and Greece may not be able to grow out of the current crisis,” he wrote in a note.

Greek Prime Minister George Papandreou said his government was committed to taming the budget gap and Finance Minister George Papaconstantinou said there was “absolutely” no risk it will default.

EU rules are ambiguous on possible support for Greece. While the euro treaty bars governments from bailing out each other, another clause foresees financial assistance for countries in duress.

Fortis, the insurer that was once Belgium’s largest financial-services firm, dropped 8.6 percent, after Fitch said it may downgrade its rating to reflect the increased risk of holding Greek government bonds.

Telekom Austria sank 13 percent. The company said earnings before interest, tax, depreciation and amortization in 2010 will fall 11 percent to 1.6 billion euros (US$2.3 billion) from a forecast of 1.8 billion euros this year. S&P put Telekom Austria’s BBB+ long-term corporate credit rating on CreditWatch with negative implications.

‘LAGGING BEHIND’: The NATO secretary-general called on democratic allies to be ‘clear-eyed’ about Beijing’s military buildup, urging them to boost military spending NATO Secretary-General Mark Rutte mentioning China’s bullying of Taiwan and its ambition to reshape the global order has significance during a time when authoritarian states are continuously increasing their aggression, the Ministry of Foreign Affairs (MOFA) said yesterday. In a speech at the Carnegie Europe think tank in Brussels on Thursday, Rutte said Beijing is bullying Taiwan and would start to “nibble” at Taiwan if Russia benefits from a post-invasion peace deal with Ukraine. He called on democratic allies to boost defense investments and also urged NATO members to increase defense spending in the face of growing military threats from Russia

PEACEFUL RESOLUTION: A statement issued following a meeting between Australia and Britain reiterated support for Taiwan and opposition to change in the Taiwan Strait Canada should support the peaceful resolution of Taiwan’s destiny according to the will of Taiwanese, Canadian lawmakers said in a resolution marking the second anniversary of that nation’s Indo-Pacific strategy on Monday. The Canadian House of Commons committee on Canada-Chinese relations made the comment as part of 34 recommendations for the new edition of the strategy, adding that Ottawa should back Taiwan’s meaningful participation in international organizations. Canada’s Indo-Pacific Strategy, first published in October 2022, emphasized that the region’s security, trade, human rights, democracy and environmental protection would play a crucial role in shaping Canada’s future. The strategy called for Canada to deepen

LEAP FORWARD: The new tanks are ‘decades more advanced than’ the army’s current fleet and would enable it to compete with China’s tanks, a source said A shipment of 38 US-made M1A2T Abrams tanks — part of a military procurement package from the US — arrived at the Port of Taipei early yesterday. The vehicles are the first batch of 108 tanks and other items that then-US president Donald Trump announced for Taiwan in 2019. The Ministry of National Defense at the time allocated NT$40.5 billion (US$1.25 billion) for the purchase. To accommodate the arrival of the tanks, the port suspended the use of all terminals and storage area machinery from 6pm last night until 7am this morning. The tanks are expected to be deployed at the army’s training

TECH CONFERENCE: Input from industry and academic experts can contribute to future policymaking across government agencies, President William Lai said Multifunctional service robots could be the next new area in which Taiwan could play a significant role, given its strengths in chip manufacturing and software design, Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) chairman and chief executive C.C. Wei (魏哲家) said yesterday. “In the past two months, our customers shared a lot of their future plans with me. Artificial intelligence [AI] and AI applications were the most talked about subjects in our conversation,” Wei said in a speech at the National Science and Technology Conference in Taipei. TSMC, the world’s biggest contract chipmaker, counts Nvidia Corp, Advanced Micro Devices Inc, Apple Inc and