Asian currencies fell this week, led by the South Korean won and Indian rupee, as emerging markets took a beating after Dubai sought to delay debt payments, bolstering demand for safety in US Treasuries and the US dollar.

The MSCI Asia-Pacific Index of local shares slumped to the lowest level in almost eight weeks. The greenback rose against 15 of 16 major currencies on Friday after state-owned Dubai World, with US$59 billion of liabilities, requested a “standstill” agreement from creditors. The Philippine peso dropped after data on Thursday showed third-quarter growth fell short of analysts’ estimates.

“Dubai prompted a wave of risk aversion globally,” said Mitul Kotecha, Hong Kong-based head of global foreign-exchange strategy at Calyon, the investment-banking unit of France’s Credit Agricole SA. “We see Asian currencies a bit vulnerable in this environment. It’s not going to be a huge fallout because Asia looks more solid in terms of fundamentals.”

The won on Friday dropped 1.7 percent to 1,175.35 per US dollar and was down 1.4 percent on the week, the biggest loss in five, according to data compiled by Bloomberg. India’s rupee declined 0.4 percent to 46.6387 and fell 0.01 percent from Nov. 20. Markets in Indonesia, Singapore and Malaysia were closed on Friday.

South Korea’s financial companies were owed a combined US$32 million from Dubai World and its property unit Nakheel PJSC as of the end of September, the MoneyToday newspaper reported, citing the nation’s financial regulator.

The New Taiwan dollar dropped 0.3 percent this week to NT$32.345.

The Philippine peso declined 0.8 percent in Manila on Friday to 47.205 and lost 0.3 percent for the week.

Thailand’s baht was down 0.1 percent from the end of last week at 33.26 per dollar. The Malaysian ringgit declined 0.2 percent to 3.3910 and Indonesia’s rupiah fell 0.7 percent to 9,535 from a week ago. The Singapore dollar dropped 0.1 percent to S$1.3897.

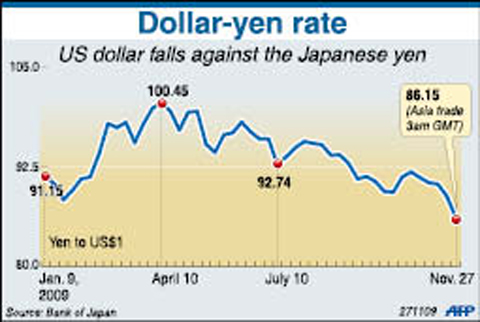

The US dollar dropped to the lowest level versus the yen since July 1995 and fell against the euro as the Federal Reserve’s signal that it would tolerate a weaker greenback encouraged investors to buy higher-yielding assets outside the US.

The US currency touched as low as ¥84.83 on Friday, the weakest in 14 years, spurring speculation Japan would intervene to curtail gains in its currency. For the week, the greenback fell 2.6 percent to ¥86.57, the fifth consecutive weekly decline.

The greenback declined 0.7 percent to US$1.4962 per euro from US$1.4862 last Friday. The yen rose 2 percent to ¥129.41 per euro, from ¥132.09. The US currency fell 2.8 percent to ¥86.49, from ¥88.88.

The US dollar has depreciated 7 percent against the euro, 4.5 percent against the yen and 13 percent versus the pound this year.

‘CHARM OFFENSIVE’: Beijing has been sending senior Chinese officials to Okinawa as part of efforts to influence public opinion against the US, the ‘Telegraph’ reported Beijing is believed to be sowing divisions in Japan’s Okinawa Prefecture to better facilitate an invasion of Taiwan, British newspaper the Telegraph reported on Saturday. Less than 750km from Taiwan, Okinawa hosts nearly 30,000 US troops who would likely “play a pivotal role should Beijing order the invasion of Taiwan,” it wrote. To prevent US intervention in an invasion, China is carrying out a “silent invasion” of Okinawa by stoking the flames of discontent among locals toward the US presence in the prefecture, it said. Beijing is also allegedly funding separatists in the region, including Chosuke Yara, the head of the Ryukyu Independence

UNITED: The premier said Trump’s tariff comments provided a great opportunity for the private and public sectors to come together to maintain the nation’s chip advantage The government is considering ways to assist the nation’s semiconductor industry or hosting collaborative projects with the private sector after US President Donald Trump threatened to impose a 100 percent tariff on chips exported to the US, Premier Cho Jung-tai (卓榮泰) said yesterday. Trump on Monday told Republican members of the US Congress about plans to impose sweeping tariffs on semiconductors, steel, aluminum, copper and pharmaceuticals “in the very near future.” “It’s time for the United States to return to the system that made us richer and more powerful than ever before,” Trump said at the Republican Issues Conference in Miami, Florida. “They

GOLDEN OPPORTUNITY: Taiwan must capitalize on the shock waves DeepSeek has sent through US markets to show it is a tech partner of Washington, a researcher said China’s reported breakthrough in artificial intelligence (AI) would prompt the US to seek a stronger alliance with Taiwan and Japan to secure its technological superiority, a Taiwanese researcher said yesterday. The launch of low-cost AI model DeepSeek (深度求索) on Monday sent US tech stocks tumbling, with chipmaker Nvidia Corp losing 16 percent of its value and the NASDAQ falling 612.46 points, or 3.07 percent, to close at 19,341.84 points. On the same day, the Philadelphia Stock Exchange Semiconductor Sector index dropped 488.7 points, or 9.15 percent, to close at 4,853.24 points. The launch of the Chinese chatbot proves that a competitor can

‘VERY SHALLOW’: The center of Saturday’s quake in Tainan’s Dongshan District hit at a depth of 7.7km, while yesterday’s in Nansai was at a depth of 8.1km, the CWA said Two magnitude 5.7 earthquakes that struck on Saturday night and yesterday morning were aftershocks triggered by a magnitude 6.4 quake on Tuesday last week, a seismologist said, adding that the epicenters of the aftershocks are moving westward. Saturday and yesterday’s earthquakes occurred as people were preparing for the Lunar New Year holiday this week. As of 10am yesterday, the Central Weather Administration (CWA) recorded 110 aftershocks from last week’s main earthquake, including six magnitude 5 to 6 quakes and 32 magnitude 4 to 5 tremors. Seventy-one of the earthquakes were smaller than magnitude 4. Thirty-one of the aftershocks were felt nationwide, while 79