Gold blazed a record-breaking trail above US$1,123 this week owing to buoyant equities and the weak greenback, which makes it cheaper for buyers using stronger currencies and tends to boost demand.

Elsewhere, crude dived close to one-month lows as oil traders switched focus to weak demand and rising inventories in key energy consuming nation the US, analysts said.

PRECIOUS METALS: The price of gold surged to an all-time pinnacle of US$1,123.38 per ounce here on Thursday.

“The metal remained supported by stronger equities and the weaker dollar,” said James Moore, analyst at the specialist metals Web site TheBullionDesk.com.

The metal also won support from fears over a possible spike in inflation, as gold is widely regarded by investors as a safe store of value.

Gold, which has risen more than 20 percent in value this year, has a bright future thanks to improving demand caused by the financial crisis, according to industry experts.

However, the glamorous commodity pared gains ahead of the weekend as many traders cashed in profits.

“The rally in gold looks exhausted at current levels as traders talk of taking money off the table ahead of the weekend,” ETX Capital trader Manoj Ladwa said. “While the long-term trend remains in place, some are happy booking a profit in case of any sharp sell-off.”

By late Friday on the London Bullion Market, gold rose to US$1,104 an ounce from US$1,096.75 a week earlier.

Silver slid to US$17.32 an ounce from US$17.52.

On the London Platinum and Palladium Market, platinum was unchanged at US$1,359 an ounce at the late fixing on Friday from the previous week.

Palladium climbed to US$354 an ounce from US$330.

OIL: World oil prices sank heavily this week as traders fretted over weak US energy demand, and despite news that the eurozone has officially emerged from recession.

“Prices fall to their lowest level in almost a month, pressurized by a bearish set of US weekly oil data,” Barclays Capital analyst Kevin Norrish said in a research note to clients. “Yesterday’s US data shows a continuation of the trend that has now been in place for a while, whereby the supply system tries to adjust to continued weak demand.”

Crude futures had slumped on Thursday on a huge jump in US crude stockpiles indicating weaker US demand for oil. New York crude had dropped US$2.34 and London Brent oil shed US$1.93.

The US Department of Energy said US crude oil reserves surged 1.8 million barrels in the week ending last Friday, more than the 200,000 barrels anticipated by the market.

GRAINS AND SOYA: Prices rose in choppy deals as traders tracked weather conditions in the United States.

“We continue to have a choppy market,” analyst Jason Roose at US Commodities said. “If we continue to see good weather ... we could see weakness in the market.”

By Friday on the Chicago Board of Trade, maize for delivery in December rose to US$3.91 a bushel from US$3.67 a week earlier.

January-dated soyabean meal — used in animal feed — climbed to US$9.99 from US$9.55.

Wheat for December increased to US$5.38 a bushel from US$4.97.

SECURITY: The purpose for giving Hong Kong and Macau residents more lenient paths to permanent residency no longer applies due to China’s policies, a source said The government is considering removing an optional path to citizenship for residents from Hong Kong and Macau, and lengthening the terms for permanent residence eligibility, a source said yesterday. In a bid to prevent the Chinese Communist Party (CCP) from infiltrating Taiwan through immigration from Hong Kong and Macau, the government could amend immigration laws for residents of the territories who currently receive preferential treatment, an official familiar with the matter speaking on condition of anonymity said. The move was part of “national security-related legislative reform,” they added. Under the amendments, arrivals from the Chinese territories would have to reside in Taiwan for

CRITICAL MOVE: TSMC’s plan to invest another US$100 billion in US chipmaking would boost Taiwan’s competitive edge in the global market, the premier said The government would ensure that the most advanced chipmaking technology stays in Taiwan while assisting Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) in investing overseas, the Presidential Office said yesterday. The statement follows a joint announcement by the world’s largest contract chipmaker and US President Donald Trump on Monday that TSMC would invest an additional US$100 billion over the next four years to expand its semiconductor manufacturing operations in the US, which would include construction of three new chip fabrication plants, two advanced packaging facilities, and a research and development center. The government knew about the deal in advance and would assist, Presidential

‘DANGEROUS GAME’: Legislative Yuan budget cuts have already become a point of discussion for Democrats and Republicans in Washington, Elbridge Colby said Taiwan’s fall to China “would be a disaster for American interests” and Taipei must raise defense spending to deter Beijing, US President Donald Trump’s pick to lead Pentagon policy, Elbridge Colby, said on Tuesday during his US Senate confirmation hearing. The nominee for US undersecretary of defense for policy told the Armed Services Committee that Washington needs to motivate Taiwan to avoid a conflict with China and that he is “profoundly disturbed” about its perceived reluctance to raise defense spending closer to 10 percent of GDP. Colby, a China hawk who also served in the Pentagon in Trump’s first team,

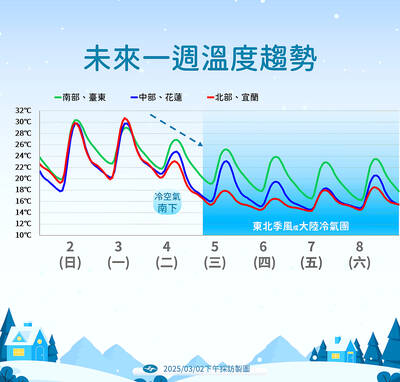

The arrival of a cold front tomorrow could plunge temperatures into the mid-teens, the Central Weather Administration (CWA) said. Temperatures yesterday rose to 28°C to 30°C in northern and eastern Taiwan, and 32°C to 33°C in central and southern Taiwan, CWA data showed. Similar but mostly cloudy weather is expected today, the CWA said. However, the arrival of a cold air mass tomorrow would cause a rapid drop in temperatures to 15°C cooler than the previous day’s highs. The cold front, which is expected to last through the weekend, would bring steady rainfall tomorrow, along with multiple waves of showers