Asian stocks fell for a third week, dragging the MSCI Asia-Pacific Index to its longest stretch of declines in eight months, on concern the easing of government stimulus measures will jeopardize the global economic recovery.

Hyundai Motor Co sank 4.6 percent this week after South Korea’s government said it’s “unclear” if the economic rebound will be sustained. National Australia Bank Ltd, Australia’s largest bank by sales, lost 3.7 percent after the nation’s central bank lifted borrowing costs.

The MSCI Asia-Pacific Index slumped 0.08 percent to 116.37 this week. The gauge has surged 64 percent from its lowest in more than five years on March 9 amid signs lower borrowing costs and spending packages are reviving the global economy.

“We’re tending towards the view that we will see some relapse next year as people basically lose faith in governments’ ability to continue to come to the rescue,” said Peter Elston, a Singapore-based strategist at Aberdeen Asset Management PLC, which manages about US$234 billon.

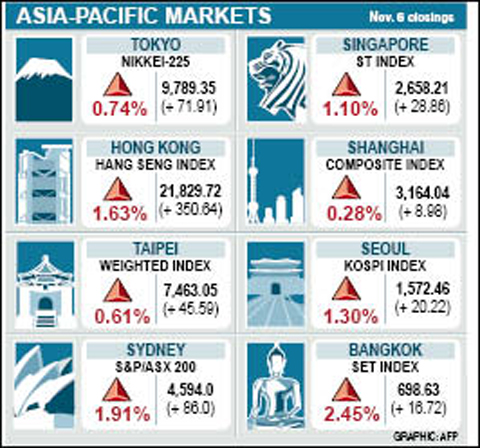

Japan’s Nikkei 225 Stock Average lost 2.5 percent this holiday-shortened week. Australia’s S&P/ASX 200 Index dropped 1.1 percent. The KOSPI Index fell 0.5 percent in Seoul. The Hang Seng Index rose 0.4 percent in Hong Kong.

Global policymakers are trying to ensure growth continues after the withdrawal of measures introduced to drag the global economy out of recession. This week, Australia raised benchmark interest rates for the second time in four weeks, and the Bank of Japan said it would maintain “the accommodative financial environment” even after deciding to end the purchase of corporate debt next month.

The MSCI Asia-Pacific Index has declined 4.3 percent from a 13-month high on Oct. 20, driving down its price-estimated earnings ratio to 21.7 on Thursday, the lowest level since May 1.

Taiwanese share prices are expected to move in a narrow range in the week ahead before market heavyweights report their sales figures for last month, dealers said on Friday.

With institutional investors sidelined amid cautious sentiment, the bellwether electronic sector is unlikely to gain sufficient momentum to steam ahead and lift the broader market, they said.

Worries over possible volatility on Wall Street may prevent investors from chasing prices here even if the market stages a rebound, they added.

The market is expected to encounter a cap at around 7,600 points next week, while downward pressure may see a technical floor at 7,300, dealers said.

For the week to Friday, the TAIEX rose 122.97 points, or 1.68 percent to 7,463.05 after a 4.04 percent increase a week earlier.

President Securities (統一證券) analyst Steven Huang said institutional investors may continue to pocket recent profit, in particular on large cap electronic firms ahead of their sales data for last month.

Other markets on Friday:

BANGKOK: Up 2.45 percent from Thursday. The Stock Exchange of Thailand rose 16.72 points to 698.63.

KUALA LUMPUR: Up 0.54 percent from Thursday. The Kuala Lumpur Composite Index gained 6.80 points to 1,260.76.

JAKARTA: Up 1.18 percent from Thursday. The Jakarta Composite Index gained 27.89 points to 2,395.10. The index has gained 77 percent since the start of the year.

MANILA: Down 0.44 percent from Thursday. The index fell 13.04 points to 2,931.47.

WELLINGTON: Up 0.50 percent from Thursday. The NZX-50 closed up 15.66 points at 3,160.16.

MUMBAI: Up 0.59 percent from Thursday. The 30-share SENSEX rose 94.38 points to 16,158.28.

SECURITY: The purpose for giving Hong Kong and Macau residents more lenient paths to permanent residency no longer applies due to China’s policies, a source said The government is considering removing an optional path to citizenship for residents from Hong Kong and Macau, and lengthening the terms for permanent residence eligibility, a source said yesterday. In a bid to prevent the Chinese Communist Party (CCP) from infiltrating Taiwan through immigration from Hong Kong and Macau, the government could amend immigration laws for residents of the territories who currently receive preferential treatment, an official familiar with the matter speaking on condition of anonymity said. The move was part of “national security-related legislative reform,” they added. Under the amendments, arrivals from the Chinese territories would have to reside in Taiwan for

CRITICAL MOVE: TSMC’s plan to invest another US$100 billion in US chipmaking would boost Taiwan’s competitive edge in the global market, the premier said The government would ensure that the most advanced chipmaking technology stays in Taiwan while assisting Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) in investing overseas, the Presidential Office said yesterday. The statement follows a joint announcement by the world’s largest contract chipmaker and US President Donald Trump on Monday that TSMC would invest an additional US$100 billion over the next four years to expand its semiconductor manufacturing operations in the US, which would include construction of three new chip fabrication plants, two advanced packaging facilities, and a research and development center. The government knew about the deal in advance and would assist, Presidential

‘DANGEROUS GAME’: Legislative Yuan budget cuts have already become a point of discussion for Democrats and Republicans in Washington, Elbridge Colby said Taiwan’s fall to China “would be a disaster for American interests” and Taipei must raise defense spending to deter Beijing, US President Donald Trump’s pick to lead Pentagon policy, Elbridge Colby, said on Tuesday during his US Senate confirmation hearing. The nominee for US undersecretary of defense for policy told the Armed Services Committee that Washington needs to motivate Taiwan to avoid a conflict with China and that he is “profoundly disturbed” about its perceived reluctance to raise defense spending closer to 10 percent of GDP. Colby, a China hawk who also served in the Pentagon in Trump’s first team,

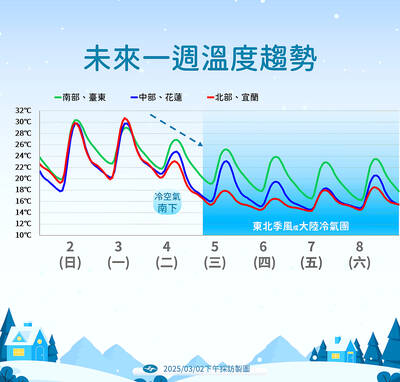

The arrival of a cold front tomorrow could plunge temperatures into the mid-teens, the Central Weather Administration (CWA) said. Temperatures yesterday rose to 28°C to 30°C in northern and eastern Taiwan, and 32°C to 33°C in central and southern Taiwan, CWA data showed. Similar but mostly cloudy weather is expected today, the CWA said. However, the arrival of a cold air mass tomorrow would cause a rapid drop in temperatures to 15°C cooler than the previous day’s highs. The cold front, which is expected to last through the weekend, would bring steady rainfall tomorrow, along with multiple waves of showers