Asian stocks posted their biggest weekly drop in almost a month as commodity prices fell and disappointing earnings damped confidence the global economy would sustain a recovery.

Mitsui & Co, a Japanese trading company that counts commodities as its biggest source of profit, slumped 6.1 percent. PetroChina Co (中石油) lost 8.4 percent in Hong Kong after quarterly earnings dropped. National Australia Bank Ltd retreated 3.4 percent in Sydney as the lender swung to a loss.

The MSCI Asia-Pacific Index lost 2.6 percent to 116.46 in the past week, its steepest dive since the five days ended Oct. 2, and retreated 1.3 percent last month. The gauge had risen for seven straight months to September on speculation government spending and looser monetary policies would accelerate the global rebound.

“Investors are wise to take some of their money off the table,” said Jonathan Ravelas, a strategist at Manila-based Banco de Oro Unibank Inc, which has about US$8 billion of assets.

“There is a lingering doubt in the market if the corporate earnings we are seeing are being driven by actual demand or is it all because of government stimulus spending,” he said.

The Asian stock index rose 1.55 percent on Friday, breaking a three-day losing streak, after separate government reports showed Japan’s jobless rate unexpectedly dropped and the US economy grew faster than economists had estimated.

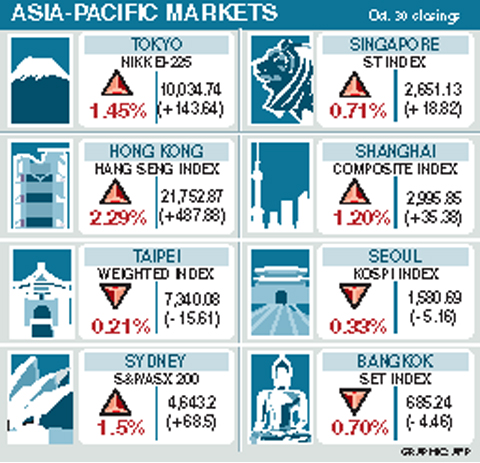

The Nikkei 225 Stock Average fell 2.4 percent in Tokyo, while Australia’s S&P/ASX 200 Index dropped 4.5 percent. Oil prices fell about 1 percent before Asian stock markets closed for the week, the first weekly drop this month.

The Hang Seng Index retreated 3.7 percent after the Hong Kong Monetary Authority raised deposit levels for luxury apartments last Friday.

Taiwanese share prices are expected to encounter further pressure next week with real estate firms in focus on worries that the central bank may reduce liquidity to prevent speculation, dealers said.

Hindered by high valuations, investors are likely to avoid large-cap electronic stocks amid fears that foreign institutional investors will cut their holdings, they said.

The market is expected to move down next week, testing the nearest support at around 7,250 points or even falling below the level, while any profit-taking may be capped at about 7,500, dealers said.

For the week to Friday, the weighted index fell 309.20 points, or 4.04 percent, to 7,340.08 after a 0.85 percent decline a week earlier.

Average daily turnover stood at NT$111.72 billion (US$3.44 billion), compared with NT$123.52 billion dollars a week ago.

“Investors, in particular foreign institutions, have embraced concerns that the market will suffer more corrections. Many are afraid that a dip below the key 7,000 point [level] is possible,” Taiwan International Securities (金鼎證券) analyst Arch Shih (施博元) said.

A Chinese freighter that allegedly snapped an undersea cable linking Taiwan proper to Penghu County is suspected of being owned by a Chinese state-run company and had docked at the ports of Kaohsiung and Keelung for three months using different names. On Tuesday last week, the Togo-flagged freighter Hong Tai 58 (宏泰58號) and its Chinese crew were detained after the Taipei-Penghu No. 3 submarine cable was severed. When the Coast Guard Administration (CGA) first attempted to detain the ship on grounds of possible sabotage, its crew said the ship’s name was Hong Tai 168, although the Automatic Identification System (AIS)

An Akizuki-class destroyer last month made the first-ever solo transit of a Japan Maritime Self-Defense Force ship through the Taiwan Strait, Japanese government officials with knowledge of the matter said yesterday. The JS Akizuki carried out a north-to-south transit through the Taiwan Strait on Feb. 5 as it sailed to the South China Sea to participate in a joint exercise with US, Australian and Philippine forces that day. The Japanese destroyer JS Sazanami in September last year made the Japan Maritime Self-Defense Force’s first-ever transit through the Taiwan Strait, but it was joined by vessels from New Zealand and Australia,

CHANGE OF MIND: The Chinese crew at first showed a willingness to cooperate, but later regretted that when the ship arrived at the port and refused to enter Togolese Republic-registered Chinese freighter Hong Tai (宏泰號) and its crew have been detained on suspicion of deliberately damaging a submarine cable connecting Taiwan proper and Penghu County, the Coast Guard Administration said in a statement yesterday. The case would be subject to a “national security-level investigation” by the Tainan District Prosecutors’ Office, it added. The administration said that it had been monitoring the ship since 7:10pm on Saturday when it appeared to be loitering in waters about 6 nautical miles (11km) northwest of Tainan’s Chiang Chun Fishing Port, adding that the ship’s location was about 0.5 nautical miles north of the No.

SECURITY: The purpose for giving Hong Kong and Macau residents more lenient paths to permanent residency no longer applies due to China’s policies, a source said The government is considering removing an optional path to citizenship for residents from Hong Kong and Macau, and lengthening the terms for permanent residence eligibility, a source said yesterday. In a bid to prevent the Chinese Communist Party (CCP) from infiltrating Taiwan through immigration from Hong Kong and Macau, the government could amend immigration laws for residents of the territories who currently receive preferential treatment, an official familiar with the matter speaking on condition of anonymity said. The move was part of “national security-related legislative reform,” they added. Under the amendments, arrivals from the Chinese territories would have to reside in Taiwan for