Despite the return of US economic growth, Wall Street was in no mood to celebrate as it braced for a Federal Reserve interest rate decision and crucial monthly labor data in the week ahead.

“Volatility is clearly on the increase as markets attempt to digest what appear to be contradictory signals on the economy,” Brian Bethune and Nigel Gault, economists at IHS Global Insight, said in a client note.

After a slight dip the previous week, the blue-chip Dow Jones Industrial Average slid 2.6 percent over the week to finish Friday at 9,712.73.

The tech-heavy NASDAQ composite index plunged a sharp 5.1 percent to 2,045.11 over the week, while the broad-market Standard & Poor’s index gave back 4 percent at 1,036.19.

The major indices on Friday remained stuck in negative territory from the opening bell, a day after the steep rally had snapped four consecutive sessions of losses.

The downtrend followed the market’s 14-month high in the middle of last month, when the blue-chip Dow topped the psychological barrier of 10,000 points.

Though the Dow ended last month with its eighth consecutive monthly gain, the other two indices posted their first monthly drop since February.

“We are getting increasingly the sentiment expressed by investors that there are a lot of gains that have been generated this year after a dreadful 2008,” said Craig Peckham, an analyst with Jefferies, a US securities and investment banking group.

“That led to a fair amount of performance protection. We have not seen a great deal of willingness after this big rally to commit more capital to stocks,” he said.

Many analysts have pointed out that the market appeared overextended after the Dow rose more than 50 percent since its early March lows.

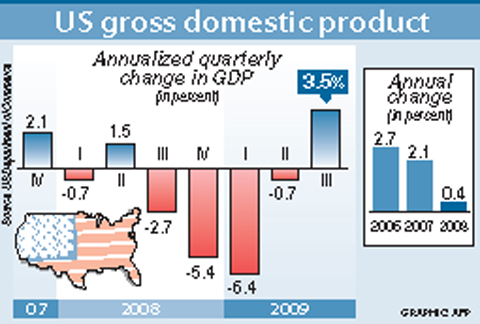

Spirits were only temporarily lifted after the US government reported on Thursday that GDP rose a stronger-than-expected 3.5 percent at an annual rate in the third quarter, after a year of contractions.

The news sparked the strongest single-session Dow rally since July, with blue-chips up 2.05 percent, but the euphoria quickly faded amid worries about the sustainability of GDP growth once emergency government support is withdrawn, despite a series of better-than-expected company earnings reports.

The Federal Reserve’s policymaking committee, the Federal Open Market Committee (FOMC), meets on Tuesday and Wednesday. The FOMC is widely expected to keep the Fed’s base interest rate target at an historic low of zero to 0.25 percent to help stimulate growth.

All eyes will be fixed on the FOMC rate decision to be announced on Wednesday and the accompanying statement, which will be pored over for signals on the direction of monetary policy as the economy emerges from recession that began in December 2007. Markets will also be focused on similar meetings of the European Central Bank and the Bank of England.

Bonds benefited from stock market weakness. The yield on the 10-year Treasury bond fell to 3.392 percent from 3.475 percent a week earlier and that on the 30-year bond dropped to 4.236 percent from 4.289 percent.

Bond yields and prices move in opposite directions.

Wall Street ended the week gripped by speculation that embattled CIT Group, a major lender to small and medium-sized businesses, would likely file for bankruptcy protection over the weekend.

Next week’s hefty macroeconomic calendar concludes with the closely watched monthly labor market report for last month.

The US unemployment rate rose to a 26-year high of 9.8 percent in September.

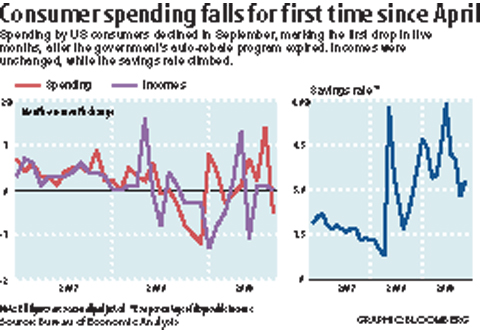

“There is a great deal of concern at this late stage of the year with where we are with jobs because the next two months are all about the consumer,” Marc Pado at Cantor Fitzgerald said. “Will they have the confidence to shop for the holidays?”

The calendar includes data on construction spending and the ISM manufacturing index tomorrow and industrial orders and the ISM services index on Tuesday.

Taiwan is gearing up to celebrate the New Year at events across the country, headlined by the annual countdown and Taipei 101 fireworks display at midnight. Many of the events are to be livesteamed online. See below for lineups and links: Taipei Taipei’s New Year’s Party 2026 is to begin at 7pm and run until 1am, with the theme “Sailing to the Future.” South Korean girl group KARA is headlining the concert at Taipei City Hall Plaza, with additional performances by Amber An (安心亞), Nick Chou (周湯豪), hip-hop trio Nine One One (玖壹壹), Bii (畢書盡), girl group Genblue (幻藍小熊) and more. The festivities are to

Auckland rang in 2026 with a downtown fireworks display launched from New Zealand’s tallest structure, Sky Tower, making it the first major city to greet the new year at a celebration dampened by rain, while crowds in Taipei braved the elements to watch Taipei 101’s display. South Pacific countries are the first to bid farewell to 2025. Clocks struck midnight in Auckland, with a population of 1.7 million, 18 hours before the famous ball was to drop in New York’s Times Square. The five-minute display involved 3,500 fireworks launched from the 240m Sky Tower. Smaller community events were canceled across New Zealand’s

‘IRRESPONSIBLE’: Beijing’s constant disruption of the ‘status quo’ in the Taiwan Strait has damaged peace, stability and security in the Indo-Pacific region, MOFA said The Presidential Office yesterday condemned China’s launch of another military drill around Taiwan, saying such actions are a “unilateral provocation” that destabilizes regional peace and stability. China should immediately stop the irresponsible and provocative actions, Presidential Office spokeswoman Karen Kuo (郭雅慧) said, after the Chinese People’s Liberation Army (PLA) yesterday announced the start of a new round of joint exercises around Taiwan by the army, navy and air force, which it said were approaching “from different directions.” Code-named “Justice Mission 2025,” the exercises would be conducted in the Taiwan Strait and in areas north, southwest, southeast and east of Taiwan

UNDER WAY: The contract for advanced sensor systems would be fulfilled in Florida, and is expected to be completed by June 2031, the Pentagon said Lockheed Martin has been given a contract involving foreign military sales to Taiwan to meet what Washington calls “an urgent operational need” of Taiwan’s air force, the Pentagon said on Wednesday. The contract has a ceiling value of US$328.5 million, with US$157.3 million in foreign military sales funds obligated at the time of award, the Pentagon said in a statement. “This contract provides for the procurement and delivery of 55 Infrared Search and Track Legion Enhanced Sensor Pods, processors, pod containers and processor containers required to meet the urgent operational need of the Taiwan air force,” it said. The contract’s work would be