The earnings-driven rally of the past few weeks appears to have run out of steam on Wall Street, leaving the market in search of a new catalyst heading into the final stretch of this year.

The main stock indexes remain near 12-month highs, but gains have been harder to achieve following the sizzling move since March of some 60 percent for the broad market.

Wall Street has been pleasantly surprised by the strength of third-quarter corporate earnings. Analysts, though, say their ability to spark fresh gains appears to be diminished.

The Dow Jones Industrial Average lost 0.24 percent for the week to end at 9,972.18, as it hovered around the 10,000 level topped a week earlier.

The Standard & Poor’s 500 broad-market index shed 0.74 percent to 1,079.60 and the technology-rich NASDAQ composite drifted down 0.11 percent on the week to 2,154.47.

Over the past week, the market warmed to earnings from Apple, Microsoft and Yahoo in the tech sector, as well as Morgan Stanley and Wells Fargo in banking, but they only gave a temporary boost to stocks.

“The earnings have been tremendous, not just beating estimates but blowing away estimates. That’s been the catalyst for holding the market together,” Marc Pado at Cantor Fitzgerald said.

Because many had already anticipated a strong season, “we see selling on the news,” he said.

In the coming week, investors will see more quarterly results and economic data including GDP for the third quarter, expected to show the economy expanded after four consecutive declines.

Douglas McIntyre at 24/7 Wall Street says he believes the rally has strong momentum and can carry further despite some skepticism.

“Each week most market experts say that the Dow cannot go any higher,” he said. “Earnings are not good enough. The economy is not strong enough. Unemployment is too high and so is the federal deficit. None of that has kept the market from its persistent climb.”

He said there was room to rise further in view of the fact that the Dow index is still well below its all-time high above 14,000 set in October 2007.

“The Dow is not going back to 14,000 next year, but there are several arguments that it could rise much more between now and the middle of 2010,” he said.

Even if some earnings disappoint, McIntyre said, “they are not going to be shocking enough to knock the market off its present course.”

Gregory Drahuschak at Janney Montgomery Scott said the market is now looking further ahead at the potential for a slowdown in activity as the impact of government stimulus fades.

“As we approach 2010 the market increasingly will look not at potential fourth quarter GDP or earnings but rather what both will be like by the middle of next year,” he said.

Al Goldman at Wells Fargo Advisors said the sharp swings of the market over the past months are a reflection of the shifts in investor sentiment.

“What we have witnessed the past seven months is classic market action,” he said. “Most folks just can’t buy stocks when they are fearful, but they do buy after a big rally when they are feeling good.”

In view of the strong rally this year, he said a pause is needed.

“For the short term, we believe the market has entered a correction that will take the popular averages down about 5 percent,” he said.

“If things heat up further in Iran and oil leaps up in price, a 10 percent correction is likely. Last week we advised adding some caution to our optimism and assumed better buying opportunities lie ahead before a higher market by year-end. That remains our opinion,” Goldman said.

Bonds failed to benefit from stock market weakness. The yield on the 10-year Treasury bond rose to 3.475 percent from 3.417 percent a week earlier and that on the 30-year bond climbed to 4.289 percent from 4.247 percent. Bond yields and prices move in opposite directions.

In the coming week, the market is expected to react to data on consumer confidence, durable goods orders and new home sales as well as Thursday’s key report on GDP.

Earnings news will be dominated by oil giants ExxonMobil and Chevron, with reports also coming from International Paper and Colgate-Palmolive.

AIR SUPPORT: The Ministry of National Defense thanked the US for the delivery, adding that it was an indicator of the White House’s commitment to the Taiwan Relations Act Deputy Minister of National Defense Po Horng-huei (柏鴻輝) and Representative to the US Alexander Yui on Friday attended a delivery ceremony for the first of Taiwan’s long-awaited 66 F-16C/D Block 70 jets at a Lockheed Martin Corp factory in Greenville, South Carolina. “We are so proud to be the global home of the F-16 and to support Taiwan’s air defense capabilities,” US Representative William Timmons wrote on X, alongside a photograph of Taiwanese and US officials at the event. The F-16C/D Block 70 jets Taiwan ordered have the same capabilities as aircraft that had been upgraded to F-16Vs. The batch of Lockheed Martin

GRIDLOCK: The National Fire Agency’s Special Search and Rescue team is on standby to travel to the countries to help out with the rescue effort A powerful earthquake rocked Myanmar and neighboring Thailand yesterday, killing at least three people in Bangkok and burying dozens when a high-rise building under construction collapsed. Footage shared on social media from Myanmar’s second-largest city showed widespread destruction, raising fears that many were trapped under the rubble or killed. The magnitude 7.7 earthquake, with an epicenter near Mandalay in Myanmar, struck at midday and was followed by a strong magnitude 6.4 aftershock. The extent of death, injury and destruction — especially in Myanmar, which is embroiled in a civil war and where information is tightly controlled at the best of times —

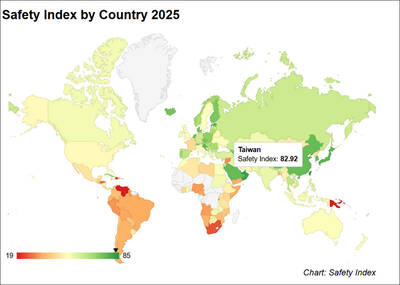

Taiwan was ranked the fourth-safest country in the world with a score of 82.9, trailing only Andorra, the United Arab Emirates and Qatar in Numbeo’s Safety Index by Country report. Taiwan’s score improved by 0.1 points compared with last year’s mid-year report, which had Taiwan fourth with a score of 82.8. However, both scores were lower than in last year’s first review, when Taiwan scored 83.3, and are a long way from when Taiwan was named the second-safest country in the world in 2021, scoring 84.8. Taiwan ranked higher than Singapore in ninth with a score of 77.4 and Japan in 10th with

SECURITY RISK: If there is a conflict between China and Taiwan, ‘there would likely be significant consequences to global economic and security interests,’ it said China remains the top military and cyber threat to the US and continues to make progress on capabilities to seize Taiwan, a report by US intelligence agencies said on Tuesday. The report provides an overview of the “collective insights” of top US intelligence agencies about the security threats to the US posed by foreign nations and criminal organizations. In its Annual Threat Assessment, the agencies divided threats facing the US into two broad categories, “nonstate transnational criminals and terrorists” and “major state actors,” with China, Russia, Iran and North Korea named. Of those countries, “China presents the most comprehensive and robust military threat