Wall Street has stepped back from a spectacular six-month rally, leaving investors pondering the depth of the latest pullback in the context of a fragile economic recovery.

Some analysts say a “correction” would be healthy for the market by working off some of the gains and easing speculative fervor from short-term traders.

Still in doubt, however, is whether the bull market can keep running even after stunning gains of some 60 percent for the broad market as the economy struggles to emerge from recession.

Over the past week, the Dow Jones Industrial Average lost 1.58 percent to end Friday at 9,665.19, as the market pulled back from 11-month highs.

The tech-dominant NASDAQ slipped 1.97 percent to 2,090.92 while the Standard & Poor’s 500 broad-market index retreated 2.24 percent to 1,044.38.

The market appeared to hit a roadblock on Wednesday as stocks rallied in the wake of a Federal Reserve announcement that it intended to hold interest rates near zero for some time.

The rally pushed the Dow briefly above 9,900 but then a pullback began. Analysts said the market used the occasion to lock in hefty gains and wait for further evidence that the economy is pulling out of recession.

Al Goldman, chief market strategist at Wells Fargo Advisors, urged clients to wait out the correction.

“A several-day pullback has begun,” he said. “We believe it will be measured in days, not weeks, but it still must be respected after the 60 percent rally from the March 9 lows. The big picture is still a bull market which we believe will be higher by year-end.”

Bob Dickey at RBC Wealth Management said the market is in “an established bull trend” until proven otherwise.

“Today the market is likely telling us what the economic condition may be six to 12 months from now, and although it currently may not make sense, the market has tended to lead these economic changes historically,” he said.

Gregory Drahuschak at Janney Montgomery Scott said that “for the very short-term that the market is getting a bit tired” but that does not alter the long-term outlook.

“We are not concerned about a short-term pullback since we are focused more on GDP and earnings potential into the first half of 2010 — potential we do not think the market has discounted fully yet,” he said.

Also optimistic was John Praveen at Prudential International Investments, saying: “Equity markets are now facing the sweet spot in the economic cycle with a stronger and faster rebound from the recession, inflation close to a trough, but not yet picking up enough to cause concern, ample liquidity and interest rates remaining low.”

Others remained skeptical, including David Rosenberg, chief economist and strategist at Gluskin Sheff & Associates.

Rosenberg said he saw “a bear market rally as opposed to the onset of a new secular bull market” and urged investors to stay cautious.

“I am always skeptical of rallies that are purely premised on technicals and liquidity but bereft of a solid economic foundation,” he said. “While green shoots did appear in the economic data, all the growth we have seen globally, and in the USA in particular, has come courtesy of unprecedented government stimulus. We see nothing organically in the economy to get us excited.”

Bonds firmed as investors shifted away from equities. The yield on the 10-year Treasury bond eased to 3.329 percent from 3.474 percent a week earlier while that on the 30-year bond dropped to 4.093 percent from 4.231 percent.

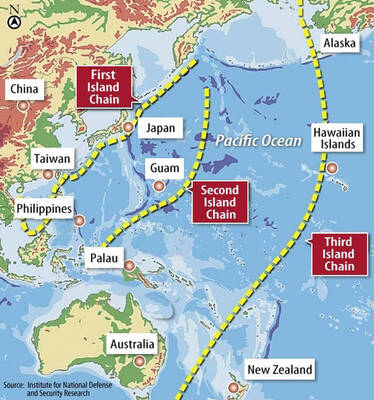

The US government has signed defense cooperation agreements with Japan and the Philippines to boost the deterrence capabilities of countries in the first island chain, a report by the National Security Bureau (NSB) showed. The main countries on the first island chain include the two nations and Taiwan. The bureau is to present the report at a meeting of the legislature’s Foreign Affairs and National Defense Committee tomorrow. The US military has deployed Typhon missile systems to Japan’s Yamaguchi Prefecture and Zambales province in the Philippines during their joint military exercises. It has also installed NMESIS anti-ship systems in Japan’s Okinawa

‘WIN-WIN’: The Philippines, and central and eastern European countries are important potential drone cooperation partners, Minister of Foreign Affairs Lin Chia-lung said Minister of Foreign Affairs Lin Chia-lung (林佳龍) in an interview published yesterday confirmed that there are joint ventures between Taiwan and Poland in the drone industry. Lin made the remark in an exclusive interview with the Chinese-language Liberty Times (the Taipei Times’ sister paper). The government-backed Taiwan Excellence Drone International Business Opportunities Alliance and the Polish Chamber of Unmanned Systems on Wednesday last week signed a memorandum of understanding in Poland to develop a “non-China” supply chain for drones and work together on key technologies. Asked if Taiwan prioritized Poland among central and eastern European countries in drone collaboration, Lin

The Chien Feng IV (勁蜂, Mighty Hornet) loitering munition is on track to enter flight tests next month in connection with potential adoption by Taiwanese and US armed forces, a government source said yesterday. The kamikaze drone, which boasts a range of 1,000km, debuted at the Taipei Aerospace and Defense Technology Exhibition in September, the official said on condition of anonymity. The Chungshan Institute of Science and Technology and US-based Kratos Defense jointly developed the platform by leveraging the engine and airframe of the latter’s MQM-178 Firejet target drone, they said. The uncrewed aerial vehicle is designed to utilize an artificial intelligence computer

Renewed border fighting between Thailand and Cambodia showed no signs of abating yesterday, leaving hundreds of thousands of displaced people in both countries living in strained conditions as more flooded into temporary shelters. Reporters on the Thai side of the border heard sounds of outgoing, indirect fire yesterday. About 400,000 people have been evacuated from affected areas in Thailand and about 700 schools closed while fighting was ongoing in four border provinces, said Thai Rear Admiral Surasant Kongsiri, a spokesman for the military. Cambodia evacuated more than 127,000 villagers and closed hundreds of schools, the Thai Ministry of Defense said. Thailand’s military announced that