With Wall Street enjoying its best rally in decades, debate is heating up on whether the market has gone too far, too fast or is ready for a second wind.

Bulls and bears continue to slug it out: some say the economy is gathering steam and will keep the market on track; others argue this is still a “sucker rally” not supported by economic fundamentals.

In the week to Friday, the Dow Jones Industrial Average of blue chips advanced 2.24 percent to 9,820.20, its highest level in 11 months.

The technology-heavy NASDAQ composite lifted 2.5 percent to 2,132.82 while the broad-market Standard & Poor’s 500 index vaulted 2.45 percent to 1,068.30.

The gains since lows in early March — 50 percent for the Dow, represent the best six-month rally for the blue-chip index since 1933, according to finance professor Mark Perry at the University of Michigan.

The other indexes have also soared over the past six months — 58 percent for the S&P and 68 percent for the NASDAQ — although all the indexes remain well below their all-time highs.

Bob Dickey at RBC Wealth Management said it is likely the market can return to levels before the collapse of Lehman Brothers and other events last year that led to a panic. That could push the Dow to about 11,000.

“A recent driver behind the market recovery could be the market performance itself, where after a more than 50 percent recovery, investors are being driven to invest the cash that has been woefully underperforming for the past six months,” he said.

“This trend can last some time with the volume growing and the move accelerating as the fear of missing out continues to spread. And now we’re starting to hear more rumblings that the end of the recession may be at hand, and as this feeling grows, it could result in even more of a rush to buy stocks,” he said.

Barry Ritholtz of the research firm Fusion IQ said his analysis suggests the rally has further to run.

“There’s nothing in the technicals that we look at that tell us we’re done,” Ritholtz said.

“Based on history, which is no guarantee, we could be in the sixth or seventh inning of this rally, which means there still could be a ways to go,” he said.

Mike Shedlock at SitkaPacific Capital Management counters that investors hoping for a rebound have taken the market too far.

The economic rebound, he argues, is largely fueled by government spending and may not be sustainable.

“The fractional banking system is still broken, and so is the consumer,” he said.

“Without either or both, every dollar the Federal Reserve attempts to print just replaces a dollar destroyed by bad debt,” he said.

“When the market realizes that the Fed can’t create inflation … it’ll see that the S&P 500 is really trading at 20 times earnings that are not growing.”

David Rosenberg at Gluskin Sheff & Associates is also skeptical about the rally.

“These rallies can often take you to heights that you can never imagine we would get to [but] they cannot be sustained without a durable organic economic expansion,” he said.

“The problem is that the global economy in general, and the US economy in particular, is operating on so much medication that it is difficult to conduct an appropriate examination of the patient at the current time,” he said.

In the coming week, investors will scrutinize the statement from US Federal Reserve, which holds a two-day meeting on Tuesday and on Wednesday. Although the Fed is unlikely to alter its near-zero interest rates, the document may offer clues about the central bank’s plans in the coming months.

“There remains a great deal of uncertainty surrounding the speed and shape of recovery,” said Pascal Gauthier, economist at TD Bank Financial. “Growth has no doubt resumed, but the long-term path of US real GDP has been near-permanently impaired by the financial crisis.”

In the coming week, the market also will react to reports on new and existing home sales, and orders for durable manufactured goods.

The strong move into stocks hurt the bond market. The yield on the 10-year treasury bond rose to 3.474 percent from 3.342 percent a week earlier and that on the 30-year bond increased to 4.231 percent from 4.175 percent.

Bond yields and prices move in opposite directions.

Also See: High stakes in the search for a fiscal exit strategy

ENDEAVOR MANTA: The ship is programmed to automatically return to its designated home port and would self-destruct if seized by another party The Endeavor Manta, Taiwan’s first military-specification uncrewed surface vehicle (USV) tailor-made to operate in the Taiwan Strait in a bid to bolster the nation’s asymmetric combat capabilities made its first appearance at Kaohsiung’s Singda Harbor yesterday. Taking inspiration from Ukraine’s navy, which is using USVs to force Russia’s Black Sea fleet to take shelter within its own ports, CSBC Taiwan (台灣國際造船) established a research and development unit on USVs last year, CSBC chairman Huang Cheng-hung (黃正弘) said. With the exception of the satellite guidance system and the outboard motors — which were purchased from foreign companies that were not affiliated with Chinese-funded

PERMIT REVOKED: The influencer at a news conference said the National Immigration Agency was infringing on human rights and persecuting Chinese spouses Chinese influencer “Yaya in Taiwan” (亞亞在台灣) yesterday evening voluntarily left Taiwan, despite saying yesterday morning that she had “no intention” of leaving after her residence permit was revoked over her comments on Taiwan being “unified” with China by military force. The Ministry of the Interior yesterday had said that it could forcibly deport the influencer at midnight, but was considering taking a more flexible approach and beginning procedures this morning. The influencer, whose given name is Liu Zhenya (劉振亞), departed on a 8:45pm flight from Taipei International Airport (Songshan airport) to Fuzhou, China. Liu held a news conference at the airport at 7pm,

GRIDLOCK: The National Fire Agency’s Special Search and Rescue team is on standby to travel to the countries to help out with the rescue effort A powerful earthquake rocked Myanmar and neighboring Thailand yesterday, killing at least three people in Bangkok and burying dozens when a high-rise building under construction collapsed. Footage shared on social media from Myanmar’s second-largest city showed widespread destruction, raising fears that many were trapped under the rubble or killed. The magnitude 7.7 earthquake, with an epicenter near Mandalay in Myanmar, struck at midday and was followed by a strong magnitude 6.4 aftershock. The extent of death, injury and destruction — especially in Myanmar, which is embroiled in a civil war and where information is tightly controlled at the best of times —

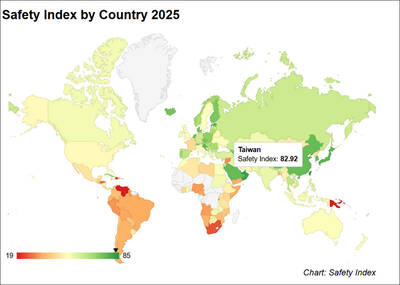

Taiwan was ranked the fourth-safest country in the world with a score of 82.9, trailing only Andorra, the United Arab Emirates and Qatar in Numbeo’s Safety Index by Country report. Taiwan’s score improved by 0.1 points compared with last year’s mid-year report, which had Taiwan fourth with a score of 82.8. However, both scores were lower than in last year’s first review, when Taiwan scored 83.3, and are a long way from when Taiwan was named the second-safest country in the world in 2021, scoring 84.8. Taiwan ranked higher than Singapore in ninth with a score of 77.4 and Japan in 10th with