Asian stocks fell for the third time in five weeks as the US unemployment rate reached a 26-year high, sparking concern a global recovery may falter, while a stronger yen dragged down Japanese exporters of autos and electronics.

Toyota Motor Corp, a carmaker that gets about 37 percent of revenue in North America, and Canon Inc, a camera maker that does 28 percent of its business in the Americas, dropped more than 4 percent in Tokyo after the US employment report. BHP Billiton Ltd, the world’s largest mining company, declined 3.3 percent in Sydney after copper fell. Seven & I Holdings Co, the world’s largest operator of convenience stores, slumped 6.6 percent in Tokyo after cutting its full-year profit forecast.

“The economic data has caught up to where the market was,” said Stephen Halmarick, Sydney-based head of investment-markets research at Colonial First State, which holds about US$115 billion. “For the equity market to really move on again, you need the next stage to take place, which is a more sustained recovery and better profitability.”

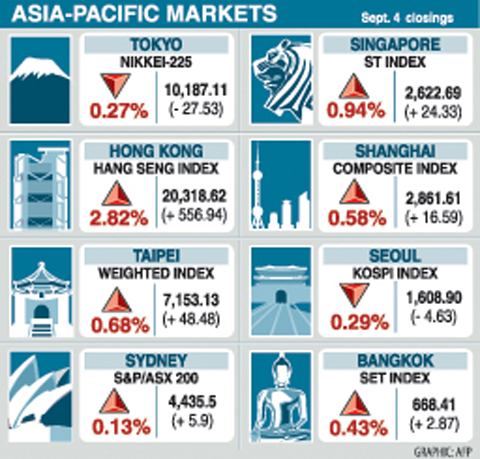

The MSCI Asia-Pacific Index fell 1.0 percent to 112.81 in the past five days, its sixth week of alternating between gains and losses. The gauge has surged 60 percent from a more than five-year low on March 9 on speculation the global economy was recovering. That’s swollen the average price of stocks in the index to 1.5 times book value, close to a 12-month high.

TOKYO

The Nikkei 225 Stock Average declined 3.3 percent this week in Tokyo to its lowest since July on concern a stronger yen will hurt the value of overseas sales at Japanese companies when repatriated into their home currency. The yen rose to a seven-week high against the dollar and the euro this week.

“People are cautious against being too optimistic about the economic recovery,” said Charles Lee, a trader with Eugene Investment & Futures Co in Seoul.

SHANGHAI

China’s Shanghai Composite Index closed little changed this week after recovering most of a 6.7 percent drop on Aug. 31 amid concern the government will tighten monetary policy to avert asset bubbles.

TAIPEI

Taiwanese share prices are expected to gain in the week ahead on hopes that high-tech firms will report improving sales data for last month on a recovery in global demand, dealers said on Friday.

Investors here are also upbeat about the performance of Wall Street, which appears to be stabilizing after recent corrections, they said.

The TAIEX is expected to challenge 7,300 points next week on institutional buying, while it may see support at around 6,900 points, dealers said.

For the week to Friday, the weighted index rose 343.27 points, or 5.04 percent, to 7,153.13 after a 2.33 percent increase a week earlier. Average turnover stood at NT$125.83 billion (US$3.82 billion), compared with NT$89.32 billion a week ago.

“Judging from the expanded turnover, I think many investors are willing to trade. It is positive,” Concord Securities Co (康和證券) analyst Allen Lin said.

“Optimism towards electronic firms’ sales may add momentum to the market,” Lin said.

Lin said foreign institutional investors may continue to buy as they have just begun to rebuild their portfolios after recent adjustments.

Taiwan International Securities (金鼎證券) analyst Arch Shih (施博元) said he expected financials to continue a rebound following recent selling amid fears the signing of a memorandum of understanding to boost cross strait banking would be delayed.

CRITICAL MOVE: TSMC’s plan to invest another US$100 billion in US chipmaking would boost Taiwan’s competitive edge in the global market, the premier said The government would ensure that the most advanced chipmaking technology stays in Taiwan while assisting Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) in investing overseas, the Presidential Office said yesterday. The statement follows a joint announcement by the world’s largest contract chipmaker and US President Donald Trump on Monday that TSMC would invest an additional US$100 billion over the next four years to expand its semiconductor manufacturing operations in the US, which would include construction of three new chip fabrication plants, two advanced packaging facilities, and a research and development center. The government knew about the deal in advance and would assist, Presidential

‘DANGEROUS GAME’: Legislative Yuan budget cuts have already become a point of discussion for Democrats and Republicans in Washington, Elbridge Colby said Taiwan’s fall to China “would be a disaster for American interests” and Taipei must raise defense spending to deter Beijing, US President Donald Trump’s pick to lead Pentagon policy, Elbridge Colby, said on Tuesday during his US Senate confirmation hearing. The nominee for US undersecretary of defense for policy told the Armed Services Committee that Washington needs to motivate Taiwan to avoid a conflict with China and that he is “profoundly disturbed” about its perceived reluctance to raise defense spending closer to 10 percent of GDP. Colby, a China hawk who also served in the Pentagon in Trump’s first team,

SEPARATE: The MAC rebutted Beijing’s claim that Taiwan is China’s province, asserting that UN Resolution 2758 neither mentions Taiwan nor grants the PRC authority over it The “status quo” of democratic Taiwan and autocratic China not belonging to each other has long been recognized by the international community, the Mainland Affairs Council (MAC) said yesterday in its rebuttal of Beijing’s claim that Taiwan can only be represented in the UN as “Taiwan, Province of China.” Chinese Minister of Foreign Affairs Wang Yi (王毅) yesterday at a news conference of the third session at the 14th National People’s Congress said that Taiwan can only be referred to as “Taiwan, Province of China” at the UN. Taiwan is an inseparable part of Chinese territory, which is not only history but

INVESTMENT WATCH: The US activity would not affect the firm’s investment in Taiwan, where 11 production lines would likely be completed this year, C.C. Wei said Investments by Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) in the US should not be a cause for concern, but rather seen as the moment that the company and Taiwan stepped into the global spotlight, President William Lai (賴清德) told a news conference at the Presidential Office in Taipei yesterday alongside TSMC chairman and chief executive officer C.C. Wei (魏哲家). Wei and US President Donald Trump in Washington on Monday announced plans to invest US$100 billion in the US to build three advanced foundries, two packaging plants, and a research and development center, after Trump threatened to slap tariffs on chips made