As caution creeps back into Wall Street, investors have pulled back to consolidate recent hefty gains amid questions about whether stocks have hit their peak for this year.

Losses in the past week came after a historic rally of some 50 percent for the broad market, but also amid jitters about the “September effect,” reflecting a historical trend of a weak period and last year’s market calamity in September.

Going into the US Labor Day holiday weekend, the blue-chip Dow Jones Industrial Average fell 1.18 percent for the week to end at 9.441.27.

The technology-heavy NASDAQ composite dipped 0.49 percent to 2,018.78 and the broad-market Standard & Poor’s 500 index pulled back 1.22 percent to 1,016.40.

With the broad market still up around 50 percent from lows in early March, some analysts argue that stocks have risen too far too fast over the past six months.

David Rosenberg, chief economist and strategist at Gluskin Sheff & Associates, said the market appears to be entering a new phase, having shifted its view from a contracting economy to one that is growing again.

“For months, the equity market had this uncanny ability to rally on any good news, as the psychology took hold that less-negative data was a positive,” Rosenberg said.

“But having gone from pricing in a drop of 2.5 percent in real GDP at the lows to a rise of 4.0 percent now, it looks like Mr Market is becoming a little more discerning in terms of interpreting the economic data,” he said.

Doug Kass at Seabreeze Partners recently argued that stocks had hit their highs for the year in late August, saying that the bull market was “in complacency,” as “optimism and a boisterous enthusiasm reigns.”

But others contend that the market, which remains more than 30 percent below peaks of 2007, can resume its upward track after a pause to consolidate.

Fred Dickson, chief market strategist at DA Davidson & Co, said he expects the S&P index to gain another 5 percent this year amid an improving economy.

“Over the next three months we are looking for the stock market to experience a series of minor rallies followed by short, shallow dips as investors continue to look for even slight pullbacks to raise equity exposure,” he said.

The market struggled to interpret the past week’s biggest economic news, showing a loss of 216,000 jobs as the US unemployment rate hit a fresh 26-year high of 9.7 percent.

While this was better than expected and showed some healing in the economy, it failed to inspire confidence in a strong economic rebound.

“All indications are that US real GDP growth will turn positive again during the third quarter of this year, but the recession lives on in the labor market,” Meny Grauman at CIBC World Markets said.

Brian Wesbury at First Trust Portfolios said the data suggests the economy is quickly gaining momentum after a brutal recession.

Dean Maki at Barclays Capital also sees an economy that will surprise to the upside.

“The economic data continue to reinforce our forecast of a solid recovery, pointing to robust growth in manufacturing output, housing, and real exports, and we expect these forces to propel a substantial rebound in growth over the next year,” he said.

Bonds were mixed for the week. The yield on the 10-year Treasury bonds fell to 3.442 percent Friday from 3.451 percent a week earlier and that on the 30-year bond rose to 4.273 percent from 4.208 percent. Bond yields and prices move in opposite directions.

The economic calendar is light in the holiday-shortened week opening on Tuesday. The market will receive the Federal Reserve Beige Book survey on the US economy and data on the US trade balance.

ENDEAVOR MANTA: The ship is programmed to automatically return to its designated home port and would self-destruct if seized by another party The Endeavor Manta, Taiwan’s first military-specification uncrewed surface vehicle (USV) tailor-made to operate in the Taiwan Strait in a bid to bolster the nation’s asymmetric combat capabilities made its first appearance at Kaohsiung’s Singda Harbor yesterday. Taking inspiration from Ukraine’s navy, which is using USVs to force Russia’s Black Sea fleet to take shelter within its own ports, CSBC Taiwan (台灣國際造船) established a research and development unit on USVs last year, CSBC chairman Huang Cheng-hung (黃正弘) said. With the exception of the satellite guidance system and the outboard motors — which were purchased from foreign companies that were not affiliated with Chinese-funded

PERMIT REVOKED: The influencer at a news conference said the National Immigration Agency was infringing on human rights and persecuting Chinese spouses Chinese influencer “Yaya in Taiwan” (亞亞在台灣) yesterday evening voluntarily left Taiwan, despite saying yesterday morning that she had “no intention” of leaving after her residence permit was revoked over her comments on Taiwan being “unified” with China by military force. The Ministry of the Interior yesterday had said that it could forcibly deport the influencer at midnight, but was considering taking a more flexible approach and beginning procedures this morning. The influencer, whose given name is Liu Zhenya (劉振亞), departed on a 8:45pm flight from Taipei International Airport (Songshan airport) to Fuzhou, China. Liu held a news conference at the airport at 7pm,

GRIDLOCK: The National Fire Agency’s Special Search and Rescue team is on standby to travel to the countries to help out with the rescue effort A powerful earthquake rocked Myanmar and neighboring Thailand yesterday, killing at least three people in Bangkok and burying dozens when a high-rise building under construction collapsed. Footage shared on social media from Myanmar’s second-largest city showed widespread destruction, raising fears that many were trapped under the rubble or killed. The magnitude 7.7 earthquake, with an epicenter near Mandalay in Myanmar, struck at midday and was followed by a strong magnitude 6.4 aftershock. The extent of death, injury and destruction — especially in Myanmar, which is embroiled in a civil war and where information is tightly controlled at the best of times —

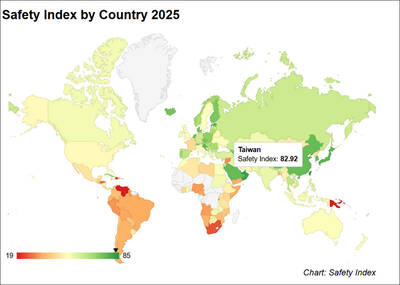

Taiwan was ranked the fourth-safest country in the world with a score of 82.9, trailing only Andorra, the United Arab Emirates and Qatar in Numbeo’s Safety Index by Country report. Taiwan’s score improved by 0.1 points compared with last year’s mid-year report, which had Taiwan fourth with a score of 82.8. However, both scores were lower than in last year’s first review, when Taiwan scored 83.3, and are a long way from when Taiwan was named the second-safest country in the world in 2021, scoring 84.8. Taiwan ranked higher than Singapore in ninth with a score of 77.4 and Japan in 10th with