With confidence rising of a recovery from recession, Wall Street faces historically its worst month of the year with memories still fresh from last September’s financial market debacle.

The market streaks to a new month up some 50 percent from lows hit in March, but with investors beginning to turn cautious.

Some analysts say that even if the economy is on the mend from its brutal recession, the market will need to consolidate to avoid getting overextended.

Others point out that further gains will only bring the market back to its levels a year ago before the financial panic deepened in the wake of the collapse of Lehman Brothers and rescue of AIG and others.

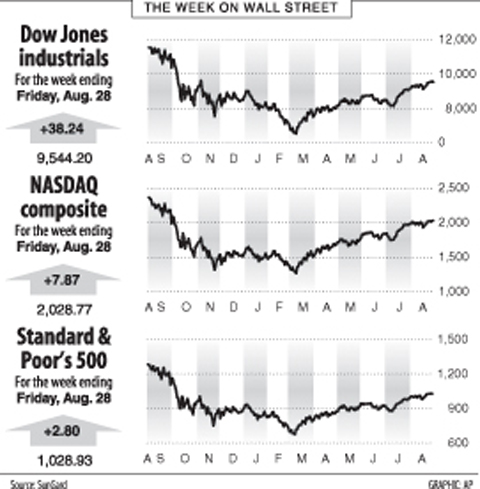

In the week to Friday, the Dow Jones Industrial Average managed a 0.4 percent gain to end at 9,544.20, near its highs for the year.

The technology-rich NASDAQ composite advanced 0.39 percent to 2,028.77 while the broad-market Standard & Poor’s 500 index edged up 0.27 percent to 1,028.93.

The stock market remains in a twilight zone that provides ammunition for both bulls and bears.

The broad S&P index is up more than 50 percent from March 9 lows — which would qualify as a roaring bull market — but is still off some 34 percent from record highs in 2007, with recovery still elusive from a horrific bear market.

Some jitters are approaching meanwhile about the September effect.

This is the market’s worst month, with an average loss of around 1 percent. Last year’s financial market blowup and the failure of Lehman Brothers and a freeze-up in credit dragged the S&P down by 9.2 percent for the month.

“The curse of the month of September, the weakest month of the year, is likely to bring in some selling before we even enter the month,” said Al Goldman, strategist at Wells Fargo Advisors.

“Also, there is no clear evidence that the market has totally worked off its five-month, 50 percent rally. Fortunately, these are only very short-term problems. Much more important are the improving fundamentals and a reasonable [valuation] ratio,” he said.

Andy Brooks, head of equity trading at T Rowe Price, said the market’s resilience is a good sign.

“The period of consolidation and holding these levels ought to be fairly bullish,” he said. “We’ve had a furious rally and we should be prepared for some retrenchment but the tone of the market is much improved.”

Some market watchers say the snapback from recession could be stronger than has been anticipated, which would help boost corporate profits and the stock market.

“In the US, all signs except for consumer spending are pointing to a strong recovery,” said Christian Broda, economist at Barclays Capital.

He said the rebound is showing up in manufacturing for big-ticket durable goods and the housing market and that the rest of the economy should eventually pick up too.

A test will come in Friday’s report on employment for this month. Analysts expect the data to show a loss of 225,000 jobs, which would continue an improving trend but still fall short of job growth. The jobless rate is expected to creep up to 9.5 percent, matching a 26-year high.

Over the past week, investors drew encouragement from news that Fed Chairman Ben Bernanke would be reappointed to a second term, and from data showing the second-quarter contraction in the economy was unrevised at 1 percent, appearing to set the stage for a rebound in the second half of this year.

Bonds firmed as the stock rally faded. The yield on the 10-year Treasury bonds eased to 3.451 percent from 3.556 a week earlier and that on the 30-year bond dropped to 4.208 percent from 4.359. Bond yields and prices move in opposite directions.

The coming week features a manufacturing supply managers survey from the Institute of Supply Management, data on factory orders and monthly auto sales reports.

ALL-IN-ONE: A company in Tainan and another in New Taipei City offer tours to China during which Taiwanese can apply for a Chinese ID card, the source said The National Immigration Agency and national security authorities have identified at least five companies that help Taiwanese apply for Chinese identification cards while traveling in China, a source said yesterday. The issue has garnered attention in the past few months after YouTuber “Pa Chiung” (八炯) said that there are companies in Taiwan that help Taiwanese apply for Chinese documents. Minister of the Interior Liu Shyh-fang (劉世芳) last week said that three to five public relations firms in southern and northern Taiwan have allegedly assisted Taiwanese in applying for Chinese ID cards and were under investigation for potential contraventions of the Act Governing

‘INVESTMENT’: Rubio and Arevalo said they discussed the value of democracy, and Rubio thanked the president for Guatemala’s strong diplomatic relationship with Taiwan Guatemalan President Bernardo Arevalo met with US Secretary of State Marco Rubio in Guatemala City on Wednesday where they signed a deal for Guatemala to accept migrants deported from the US, while Rubio commended Guatemala for its support for Taiwan and said the US would do all it can to facilitate greater Taiwanese investment in Guatemala. Under the migrant agreement announced by Arevalo, the deportees would be returned to their home countries at US expense. It is the second deportation deal that Rubio has reached during a Central America trip that has been focused mainly on immigration. Arevalo said his

‘SOVEREIGN AI’: As of Nov. 19 last year, Taiwan was globally ranked No. 11 for having computing power of 103 petaflops. The governments wants to achieve 1,200 by 2029 The government would intensify efforts to bolster its “Sovereign Artificial Intelligence [AI]” program by setting a goal of elevating the nation’s collective computing power in the public and private sectors to 1,200 peta floating points per second (petaflops) by 2029, the Executive Yuan said yesterday. The goal was set to fulfill President William Lai’s (賴清德) vision of turning Taiwan into an “AI island.” Sovereign AI refers to a nation’s capabilities to produce AI using its own infrastructure, data, workforce and business networks. One petaflop allows 1 trillion calculations per second. As of Nov. 19 last year, Taiwan was globally ranked No. 11 for

STAY WARM: Sixty-three nontraumatic incidents of OHCA were reported on Feb. 1, the most for a single day this year, the National Fire Agency said A total of 415 cases of out-of-hospital cardiac arrest (OHCA) occurred this month as of Saturday, data from the National Fire Agency showed as doctors advised people to stay warm amid cold weather, particularly people with cardiovascular disease. The Central Weather Administration yesterday issued a low temperature warning nationwide except for Penghu County, anticipating sustained lows of 10°C or a dip to below 6°C in Nantou, Yilan, Hualien and Taitung counties, as well as areas north of Yunlin County. The coldest temperature recorded in flat areas of Taiwan proper yesterday morning was 6.4°C in New Taipei City’s Shiding District (石碇). Sixty-three nontraumatic OHCA