ING Groep NV, the biggest Dutch financial-services company, has asked for final bids for its private banking operations and is seeking about US$1.8 billion, two people familiar with the matter said.

The Amsterdam-based bank has selected companies to enter final bidding as early as next week, one of the people said. ING expects its Asian private banking operations to contribute about 70 percent of the proceeds, the person said.

ING, which received a 10 billion euros (US$14.3 billion) lifeline in October from the Netherlands, is seeking to raise as much as 8 billion euros selling assets to boost capital. The sale of private banking assets in Asia, home to the world’s two fastest-growing major economies, may attract buyers seeking to expand their wealth management operations in the region.

“Private banking is a fast growing sector in Asia and could attract interest from those who want to expand in the region, especially in China,” said Yoon Charng-bae, a banking analyst at Seoul-based Hyundai Securities Co. “It remains to be seen whether ING’s assets themselves could garner much interest, given its relatively small presence in Asia.”

China’s number of so-called high net worth individuals, or those with at least US$1 million of assets to invest, surpassed that of the UK last year to become the world’s fourth-highest, the 2009 World Wealth Report by Cap Gemini SA and Merrill Lynch Wealth Management shows.

ING and its adviser JPMorgan Chase & Co declined to comment.

ING’s attempts to sell the operations may be helped by the 59 percent rally in the MSCI World Index from a March 9 low.

“We’ve seen a nice rally, so it’s probably more attractive to sell the business now,” said Benoit Petrarque, an analyst at Kepler Capital Markets in Amsterdam who has a “buy” rating on ING shares. “It’s not bad timing to sell in September.”

ING’s second-quarter profit fell 96 percent, more than analysts estimated, as it set aside money for risky loans and reduced the value of its real-estate holdings.

Chief executive officer Jan Hommen, who took over in January, said earlier this month that the company would cut 8,219 jobs, more than previously planned, and reduce costs.

The firm raised 1.4 billion euros in February by selling its 70 percent stake in ING Canada Inc, that country’s largest property and casualty insurer. The company agreed to sell its annuity and mortgage businesses in Chile to Corp Group Vida Chile SA last month. Corpvida will pay about US$350 million for the assets, Santiago-based newspaper Diario Financiero said.

ING’s Asian private banking division has offices in Singapore, Hong Kong and the Philippines, its Web site shows.

Assets under management declined to 11.4 billion euros in the first quarter of this year from 13.1 billion euros a year earlier.

SECURITY: As China is ‘reshaping’ Hong Kong’s population, Taiwan must raise the eligibility threshold for applications from Hong Kongers, Chiu Chui-cheng said When Hong Kong and Macau citizens apply for residency in Taiwan, it would be under a new category that includes a “national security observation period,” Mainland Affairs Council (MAC) Minister Chiu Chui-cheng (邱垂正) said yesterday. President William Lai (賴清德) on March 13 announced 17 strategies to counter China’s aggression toward Taiwan, including incorporating national security considerations into the review process for residency applications from Hong Kong and Macau citizens. The situation in Hong Kong is constantly changing, Chiu said to media yesterday on the sidelines of the Taipei Technology Run hosted by the Taipei Neihu Technology Park Development Association. With

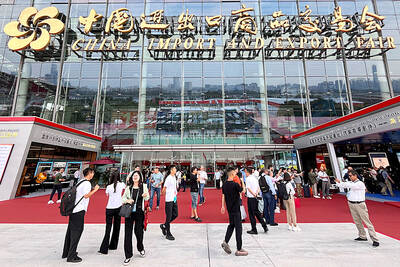

CARROT AND STICK: While unrelenting in its military threats, China attracted nearly 40,000 Taiwanese to over 400 business events last year Nearly 40,000 Taiwanese last year joined industry events in China, such as conferences and trade fairs, supported by the Chinese government, a study showed yesterday, as Beijing ramps up a charm offensive toward Taipei alongside military pressure. China has long taken a carrot-and-stick approach to Taiwan, threatening it with the prospect of military action while reaching out to those it believes are amenable to Beijing’s point of view. Taiwanese security officials are wary of what they see as Beijing’s influence campaigns to sway public opinion after Taipei and Beijing gradually resumed travel links halted by the COVID-19 pandemic, but the scale of

A US Marine Corps regiment equipped with Naval Strike Missiles (NSM) is set to participate in the upcoming Balikatan 25 exercise in the Luzon Strait, marking the system’s first-ever deployment in the Philippines. US and Philippine officials have separately confirmed that the Navy Marine Expeditionary Ship Interdiction System (NMESIS) — the mobile launch platform for the Naval Strike Missile — would take part in the joint exercise. The missiles are being deployed to “a strategic first island chain chokepoint” in the waters between Taiwan proper and the Philippines, US-based Naval News reported. “The Luzon Strait and Bashi Channel represent a critical access

Pope Francis is be laid to rest on Saturday after lying in state for three days in St Peter’s Basilica, where the faithful are expected to flock to pay their respects to history’s first Latin American pontiff. The cardinals met yesterday in the Vatican’s synod hall to chart the next steps before a conclave begins to choose Francis’ successor, as condolences poured in from around the world. According to current norms, the conclave must begin between May 5 and 10. The cardinals set the funeral for Saturday at 10am in St Peter’s Square, to be celebrated by the dean of the College