Asian stocks fell for the second time in three weeks as concern that China will rein in lending sent the nation’s equities briefly into a bear market and as metal prices retreated.

The Shanghai Composite Index fell as much as 20 percent from its high for this year reached on Aug. 4 as a slump in new lending last month fueled concern growth may decelerate. Rio Tinto Group, the world’s third-largest mining company, lost 6.1 percent in Sydney for the week as earnings missed estimates and prices for metals including copper and nickel fell. Honda Motor Co, Japan’s No. 2 automaker, tumbled 5.3 percent as the US announced the end of the “cash for clunkers” subsidy program.

A plunge in new bank loans in China last month, disappointing earnings and concern Beijing will seek to damp property speculation has sapped confidence, driving down the Shanghai Composite briefly on Friday by the 20 percent threshold that signals a bear market.

The MSCI Asia-Pacific Index lost 3.2 percent this week to 110.61, slipping from the highest level for the year last Friday. The benchmark has rallied: 57 percent since dropping to the lowest in almost six years on March 9.

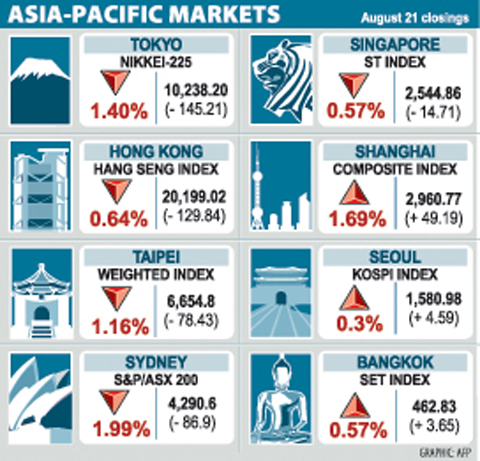

Japan’s Nikkei 225 Stock Average fell 3.4 percent to 10,238.20 as investors questioned the sustainability of a recovery even as data showed the economy expanded for the first time in more than a year last quarter.

Taiwan’s TAIEX index this week fell 5.9 percent, the region’s worst performance, on concern a possible Cabinet reshuffle next month will delay the signing of a financial agreement with China.

Taiwanese share prices are expected to face a correction next week after the market tumbled in the past week amid a lack of positive clues from corporate earnings reports, dealers said.

For the week to Friday, the weighted index fell 414.71 points, or 5.87 percent, to 6,654.80 after a rise of 2.92 percent the previous week. Average daily turnover came in at NT$92.95 billion (US$2.82 billion) compared with the previous week’s NT$111.04 billion.

“The continued shrinking of trading volume signalled that investors were reluctant to build up positions,” Allen Lin of Concord Securities Co (康和證券) said.

The market is also expected to react to political upheaval as President Ma Ying-jeou (馬英九) faces his worst criticism since coming to office over his handling of Typhoon Morakot and it aftermath.

Three senior Cabinet officials have already tendered their resignations to shoulder responsibility for the government’s response to the tragedy.

“Certainly politics would be a key factor that may drag down the market in the week ahead as investors fear it may ‘engulf’ the Ma administration and lead to political instability,” Chen Yu-yu (陳育娛) of Capital Securities Corp (群益證券) said.

Lin said that since the market fell below the 20-day moving average, it was expected to continue to dive to a range of 6,300-6,400 in the week ahead.

ALL-IN-ONE: A company in Tainan and another in New Taipei City offer tours to China during which Taiwanese can apply for a Chinese ID card, the source said The National Immigration Agency and national security authorities have identified at least five companies that help Taiwanese apply for Chinese identification cards while traveling in China, a source said yesterday. The issue has garnered attention in the past few months after YouTuber “Pa Chiung” (八炯) said that there are companies in Taiwan that help Taiwanese apply for Chinese documents. Minister of the Interior Liu Shyh-fang (劉世芳) last week said that three to five public relations firms in southern and northern Taiwan have allegedly assisted Taiwanese in applying for Chinese ID cards and were under investigation for potential contraventions of the Act Governing

‘INVESTMENT’: Rubio and Arevalo said they discussed the value of democracy, and Rubio thanked the president for Guatemala’s strong diplomatic relationship with Taiwan Guatemalan President Bernardo Arevalo met with US Secretary of State Marco Rubio in Guatemala City on Wednesday where they signed a deal for Guatemala to accept migrants deported from the US, while Rubio commended Guatemala for its support for Taiwan and said the US would do all it can to facilitate greater Taiwanese investment in Guatemala. Under the migrant agreement announced by Arevalo, the deportees would be returned to their home countries at US expense. It is the second deportation deal that Rubio has reached during a Central America trip that has been focused mainly on immigration. Arevalo said his

‘SOVEREIGN AI’: As of Nov. 19 last year, Taiwan was globally ranked No. 11 for having computing power of 103 petaflops. The governments wants to achieve 1,200 by 2029 The government would intensify efforts to bolster its “Sovereign Artificial Intelligence [AI]” program by setting a goal of elevating the nation’s collective computing power in the public and private sectors to 1,200 peta floating points per second (petaflops) by 2029, the Executive Yuan said yesterday. The goal was set to fulfill President William Lai’s (賴清德) vision of turning Taiwan into an “AI island.” Sovereign AI refers to a nation’s capabilities to produce AI using its own infrastructure, data, workforce and business networks. One petaflop allows 1 trillion calculations per second. As of Nov. 19 last year, Taiwan was globally ranked No. 11 for

STAY WARM: Sixty-three nontraumatic incidents of OHCA were reported on Feb. 1, the most for a single day this year, the National Fire Agency said A total of 415 cases of out-of-hospital cardiac arrest (OHCA) occurred this month as of Saturday, data from the National Fire Agency showed as doctors advised people to stay warm amid cold weather, particularly people with cardiovascular disease. The Central Weather Administration yesterday issued a low temperature warning nationwide except for Penghu County, anticipating sustained lows of 10°C or a dip to below 6°C in Nantou, Yilan, Hualien and Taitung counties, as well as areas north of Yunlin County. The coldest temperature recorded in flat areas of Taiwan proper yesterday morning was 6.4°C in New Taipei City’s Shiding District (石碇). Sixty-three nontraumatic OHCA