European stocks fell for the first week in more than a month as investors speculated share prices have outpaced the outlook for economic growth and companies from Aegon NV to Nestle SA posted lower earnings.

Aegon, the Dutch owner of US insurer Transamerica Corp, slumped 12 percent, while Nestle, the world’s biggest food company, sank 4.4 percent. Volkswagen AG plummeted 24 percent after saying it will pay about 3.3 billion euros (US$4.7 billion) for a stake in Porsche SE’s automotive unit.

Europe’s Dow Jones STOXX 600 Index lost 0.8 percent to 228.77 in the past week, snapping four weeks of gains. A 45 percent rebound since March 9 has left the regional measure valued at 39.9 times the profits of its companies, the most expensive since September 2003, weekly data compiled by Bloomberg show.

“In the short term you have to be cautious, equities are no longer very cheap,” said Manfred Hofer, head of equity analysis at LGT Capital Management in Pfaeffikon, Switzerland, which oversees about US$73 billion. “Companies have been able to post profits because of cost cutting. We now need to see economic data confirm an upturn, then it’s possible that profits and revenues will increase.”

The euro region’s economy contracted 0.1 percent in the second quarter as Germany and France unexpectedly returned to growth, suggesting Europe’s worst recession since World War II is coming to an end. Economists had estimated gross domestic product declined 0.5 percent in the three months through June, the median of 32 forecasts in a Bloomberg survey showed.

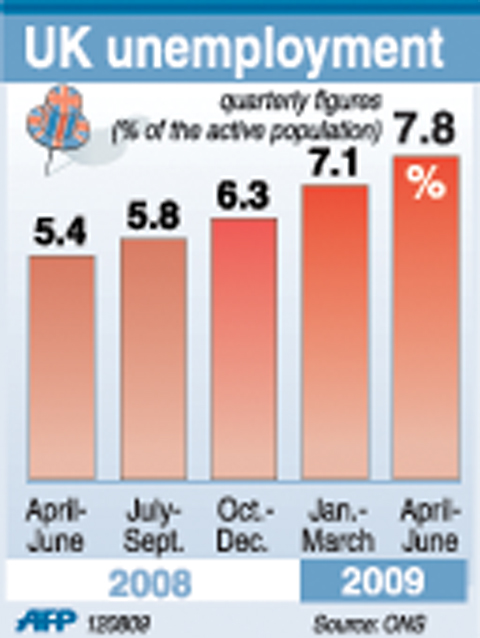

Bank of England Governor Mervyn King said that while recent economic reports are “encouraging,” growth won’t resume on an annual basis until 2010 while banks restrict access to credit.

National benchmark indexes declined in 10 of the 18 western European markets. The UK’s FTSE 100 lost 0.4 percent, and France’s CAC 40 decreased 0.7 percent. Germany’s DAX dropped 2.8 percent as Daimler AG slid.

Aegon tumbled 12 percent. The Dutch insurer posted a fourth straight quarterly loss on writedowns and the sale of a unit and said it will sell 1 billion euros of shares to help repay state aid. The second-quarter net loss was 161 million euros, wider than analysts’ estimates, and compared with a profit of 276 million euros a year earlier.

CLASH OF WORDS: While China’s foreign minister insisted the US play a constructive role with China, Rubio stressed Washington’s commitment to its allies in the region The Ministry of Foreign Affairs (MOFA) yesterday affirmed and welcomed US Secretary of State Marco Rubio statements expressing the US’ “serious concern over China’s coercive actions against Taiwan” and aggressive behavior in the South China Sea, in a telephone call with his Chinese counterpart. The ministry in a news release yesterday also said that the Chinese Ministry of Foreign Affairs had stated many fallacies about Taiwan in the call. “We solemnly emphasize again that our country and the People’s Republic of China are not subordinate to each other, and it has been an objective fact for a long time, as well as

‘CHARM OFFENSIVE’: Beijing has been sending senior Chinese officials to Okinawa as part of efforts to influence public opinion against the US, the ‘Telegraph’ reported Beijing is believed to be sowing divisions in Japan’s Okinawa Prefecture to better facilitate an invasion of Taiwan, British newspaper the Telegraph reported on Saturday. Less than 750km from Taiwan, Okinawa hosts nearly 30,000 US troops who would likely “play a pivotal role should Beijing order the invasion of Taiwan,” it wrote. To prevent US intervention in an invasion, China is carrying out a “silent invasion” of Okinawa by stoking the flames of discontent among locals toward the US presence in the prefecture, it said. Beijing is also allegedly funding separatists in the region, including Chosuke Yara, the head of the Ryukyu Independence

‘VERY SHALLOW’: The center of Saturday’s quake in Tainan’s Dongshan District hit at a depth of 7.7km, while yesterday’s in Nansai was at a depth of 8.1km, the CWA said Two magnitude 5.7 earthquakes that struck on Saturday night and yesterday morning were aftershocks triggered by a magnitude 6.4 quake on Tuesday last week, a seismologist said, adding that the epicenters of the aftershocks are moving westward. Saturday and yesterday’s earthquakes occurred as people were preparing for the Lunar New Year holiday this week. As of 10am yesterday, the Central Weather Administration (CWA) recorded 110 aftershocks from last week’s main earthquake, including six magnitude 5 to 6 quakes and 32 magnitude 4 to 5 tremors. Seventy-one of the earthquakes were smaller than magnitude 4. Thirty-one of the aftershocks were felt nationwide, while 79

GOLDEN OPPORTUNITY: Taiwan must capitalize on the shock waves DeepSeek has sent through US markets to show it is a tech partner of Washington, a researcher said China’s reported breakthrough in artificial intelligence (AI) would prompt the US to seek a stronger alliance with Taiwan and Japan to secure its technological superiority, a Taiwanese researcher said yesterday. The launch of low-cost AI model DeepSeek (深度求索) on Monday sent US tech stocks tumbling, with chipmaker Nvidia Corp losing 16 percent of its value and the NASDAQ falling 612.46 points, or 3.07 percent, to close at 19,341.84 points. On the same day, the Philadelphia Stock Exchange Semiconductor Sector index dropped 488.7 points, or 9.15 percent, to close at 4,853.24 points. The launch of the Chinese chatbot proves that a competitor can