Wall Street’s rally could persist next week as investors’ conviction grows that the US economy is on track for a recovery. But retailers’ results, CPI and other consumer data could cast a pall if shoppers fail to show signs of life.

The focus will also be on the US Federal Reserve, which will release a statement on Wednesday afternoon at the end of its two-day interest rate-setting meeting. The central bank is expected to hold rates near zero. So investors will look for signals of an exit strategy from its efforts to prop up the financial system.

The US government’s retail sales data for last month as well as quarterly scorecards from major retailers, including Wal-Mart Stores Inc, J.C. Penney and Macy’s, will give a snapshot of the industry and how consumer spending is faring in the recession. So far, consumers have tightened their belts and shopped mostly for just the bare necessities as worries about job security take precedence.

Encouraging US manufacturing and employment data this week pushed all three major stock indexes to nine and 10-month highs. Analysts said the enthusiasm from the better-than-expected reports should carry over into next week.

The broad Standard & Poor’s 500 is up 49.4 percent from the 12-year closing low of early March after vaulting above the key 1,000 level this week.

On Friday, the Dow and the S&P 500 ended at closing highs for this year. Earlier this week, on Tuesday, the NASDAQ popped back above the 2,000 mark to end at 2,011.31 — its closing high for this year.

For the year, the S&P 500 is up 11.9 percent. The Dow Jones industrial average is up 6.8 percent and the NASDAQ Composite Index up 26.8 percent this year.

“All the fundamentals for recovery are now aligned,” said Steve Hagenbuckle, managing principal of TerraCap Partners, based in New York. He expects stocks to climb next week.

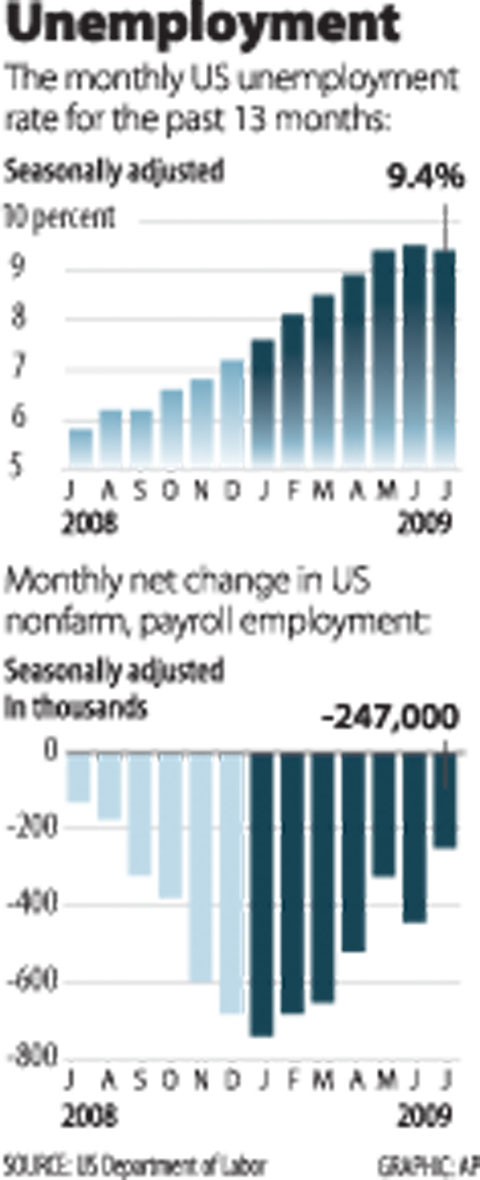

The non-farm payrolls report on Friday, in particular, boosted confidence after it showed the economy shed far fewer jobs than expected last month. While the job losses were still hefty — 247,000 jobs disappeared last month — the data provided the clearest signal yet that the economy was turning around.

Although this week’s data offered more evidence that some of the pillars of the economy are stabilizing at a better-than-expected rate, the recovery will still be a long process.

Analysts said the next point of focus for economic stabilization will be the consumer, whose spending accounts for about two-thirds of the US economy.

“We’re seeing the turning point right now,” said Kurt Karl, head of economic research and consulting for North America at Swiss Re in New York. “That should feed through to the consumer psyche and that will get things rolling, but it doesn’t look like a very fast-moving ball at this point.”

Wal-Mart, the discount king that’s also the largest retailer in terms of revenue, will be the biggest retailer reporting quarterly results next week. Investors will be keen to see if Wal-Mart benefits from shoppers looking for cheaper products. About about 140 million people walk through the doors of its 4,000 US stores each week.

Other data on tap in the week ahead include the international trade deficit for June on Wednesday, weekly initial jobless claims on Thursday, and the Fed’s report on Friday on industrial production and capacity utilization for last month.

Taiwanese actress Barbie Hsu (徐熙媛) has died of pneumonia at the age of 48 while on a trip to Japan, where she contracted influenza during the Lunar New Year holiday, her sister confirmed today through an agent. "Our whole family came to Japan for a trip, and my dearest and most kindhearted sister Barbie Hsu died of influenza-induced pneumonia and unfortunately left us," Hsu's sister and talk show hostess Dee Hsu (徐熙娣) said. "I was grateful to be her sister in this life and that we got to care for and spend time with each other. I will always be grateful to

UNITED: The premier said Trump’s tariff comments provided a great opportunity for the private and public sectors to come together to maintain the nation’s chip advantage The government is considering ways to assist the nation’s semiconductor industry or hosting collaborative projects with the private sector after US President Donald Trump threatened to impose a 100 percent tariff on chips exported to the US, Premier Cho Jung-tai (卓榮泰) said yesterday. Trump on Monday told Republican members of the US Congress about plans to impose sweeping tariffs on semiconductors, steel, aluminum, copper and pharmaceuticals “in the very near future.” “It’s time for the United States to return to the system that made us richer and more powerful than ever before,” Trump said at the Republican Issues Conference in Miami, Florida. “They

GOLDEN OPPORTUNITY: Taiwan must capitalize on the shock waves DeepSeek has sent through US markets to show it is a tech partner of Washington, a researcher said China’s reported breakthrough in artificial intelligence (AI) would prompt the US to seek a stronger alliance with Taiwan and Japan to secure its technological superiority, a Taiwanese researcher said yesterday. The launch of low-cost AI model DeepSeek (深度求索) on Monday sent US tech stocks tumbling, with chipmaker Nvidia Corp losing 16 percent of its value and the NASDAQ falling 612.46 points, or 3.07 percent, to close at 19,341.84 points. On the same day, the Philadelphia Stock Exchange Semiconductor Sector index dropped 488.7 points, or 9.15 percent, to close at 4,853.24 points. The launch of the Chinese chatbot proves that a competitor can

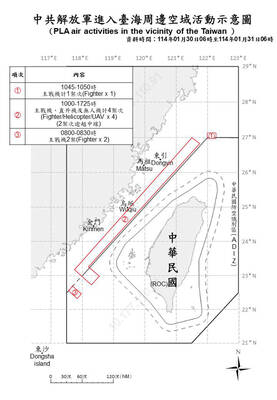

TAIWAN DEFENSE: The initiative would involve integrating various systems in a fast-paced manner through the use of common software to obstruct a Chinese invasion The first tranche of the US Navy’s “Replicator” initiative aimed at obstructing a Chinese invasion of Taiwan would be ready by August, a US Naval Institute (USNI) News report on Tuesday said. The initiative is part of a larger defense strategy for Taiwan, and would involve launching thousands of uncrewed submarines, surface vessels and aerial vehicles around Taiwan to buy the nation and its partners time to assemble a response. The plan was first made public by the Washington Post in June last year, when it cited comments by US Indo-Pacific Commander Admiral Samuel Paparo on the sidelines of the Shangri-La Dialogue