Amid a heady rally in anticipation of an economic rebound, Wall Street faces a gut check in the coming week with data on the US employment market expected to show still-grim conditions.

The US equity market has risen sharply for three consecutive weeks in a surprising rebound fueled in large part by upbeat corporate results and encouraging economic data, bringing the indexes to highs for this year.

Yet debate persists on whether this is a bear market rally or the beginning of a recovery for the market and the economy.

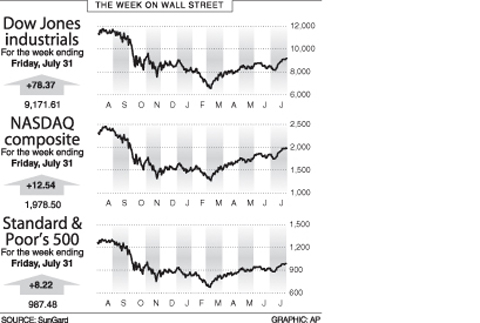

The Dow Jones Industrial Average rose 0.86 percent in the week to Friday to 9,171.61, capping a three-week gain for blue-chips of 12.5 percent and ending last month with a stunning 8.6 percent advance.

The broad-market Standard & Poor’s 500 index added 0.84 percent to 987.48 and the tech-dominated NASDAQ increased 0.64 percent to 1,978.50.

Over the first seven months of the year, the S&P is up 9.3 percent and the NASDAQ has rallied 25.4 percent, while the Dow is up a more modest 4.5 percent.

Analysts say investors are sensing better times ahead, and are putting cash back to work in the stock market.

“The stock market was deeply depressed back in March, and thus the preconditions for a rally were very much in place,” Al Goldman at Wells Fargo Advisors said.

“The economic news started to be ‘less bad’ — a nice change — but the big reason for the market rally has been corporate earnings. Second-quarter earnings have come in well ahead of projections, which increased confidence that our economy was close to the end of the recession. And lately some economic data improved from ‘less bad’ to ‘much better,’” Goldman said.

US President Barack Obama said recently he saw “the beginning of the end” of the recession, with job losses easing and many other indicators improving. A number of analysts agree.

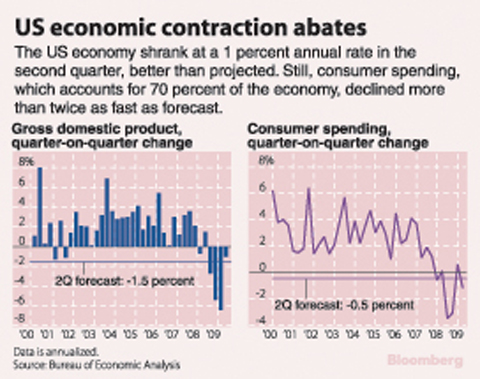

The latest report on GDP showed a 1.0 percent annualized drop in economic activity in the second quarter. It was a fourth consecutive decline but far better than the 6.4 percent drop in the first quarter and indicated momentum may be turning.

In addition to employment figures, the coming week features data on personal income and spending and a survey of the manufacturing sector by the Institute of Supply Management.

Bonds firmed in the past week. The yield on the 10-year Treasury note eased to 3.601 percent from 3.670 percent a week earlier and that on the 30-year bond fell to 4.311 percent from 4.555 percent.

A Chinese freighter that allegedly snapped an undersea cable linking Taiwan proper to Penghu County is suspected of being owned by a Chinese state-run company and had docked at the ports of Kaohsiung and Keelung for three months using different names. On Tuesday last week, the Togo-flagged freighter Hong Tai 58 (宏泰58號) and its Chinese crew were detained after the Taipei-Penghu No. 3 submarine cable was severed. When the Coast Guard Administration (CGA) first attempted to detain the ship on grounds of possible sabotage, its crew said the ship’s name was Hong Tai 168, although the Automatic Identification System (AIS)

An Akizuki-class destroyer last month made the first-ever solo transit of a Japan Maritime Self-Defense Force ship through the Taiwan Strait, Japanese government officials with knowledge of the matter said yesterday. The JS Akizuki carried out a north-to-south transit through the Taiwan Strait on Feb. 5 as it sailed to the South China Sea to participate in a joint exercise with US, Australian and Philippine forces that day. The Japanese destroyer JS Sazanami in September last year made the Japan Maritime Self-Defense Force’s first-ever transit through the Taiwan Strait, but it was joined by vessels from New Zealand and Australia,

SECURITY: The purpose for giving Hong Kong and Macau residents more lenient paths to permanent residency no longer applies due to China’s policies, a source said The government is considering removing an optional path to citizenship for residents from Hong Kong and Macau, and lengthening the terms for permanent residence eligibility, a source said yesterday. In a bid to prevent the Chinese Communist Party (CCP) from infiltrating Taiwan through immigration from Hong Kong and Macau, the government could amend immigration laws for residents of the territories who currently receive preferential treatment, an official familiar with the matter speaking on condition of anonymity said. The move was part of “national security-related legislative reform,” they added. Under the amendments, arrivals from the Chinese territories would have to reside in Taiwan for

CRITICAL MOVE: TSMC’s plan to invest another US$100 billion in US chipmaking would boost Taiwan’s competitive edge in the global market, the premier said The government would ensure that the most advanced chipmaking technology stays in Taiwan while assisting Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) in investing overseas, the Presidential Office said yesterday. The statement follows a joint announcement by the world’s largest contract chipmaker and US President Donald Trump on Monday that TSMC would invest an additional US$100 billion over the next four years to expand its semiconductor manufacturing operations in the US, which would include construction of three new chip fabrication plants, two advanced packaging facilities, and a research and development center. The government knew about the deal in advance and would assist, Presidential