Wall Street may take a breather in the upcoming week after an earnings-driven rally lifted the major US stock indexes to their highest levels in months.

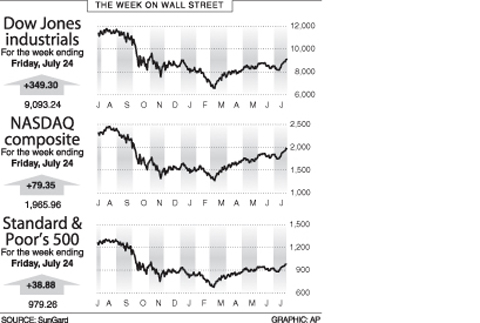

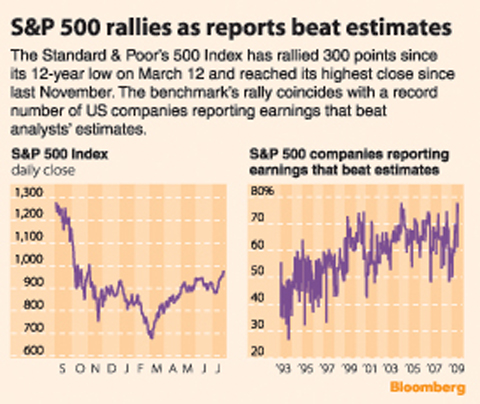

The blue-chip Dow Jones industrial average popped back above the 9,000 mark this week for the first time since January. And the Standard and Poor’s 500 Index ended Friday at 979.26 — up almost 45 percent from the 12-year closing low hit on March 9 — after a number of prominent companies’ earnings surpassed Wall Street’s expectations.

This week’s “market enjoyed the better-than-expected earnings, or I should say, less-bad-than-expected earnings, but we can play the game for only so long,” said Scott Marcouiller, senior equity market strategist at Wells Fargo Advisors in St Louis. “Stay cautious. We can’t put a cap on it [the rally] yet, but there will be a correction.”

The exuberance was interrupted on Friday as disappointing quarterly revenues from Microsoft Corp and Amazon.com hit their stocks and weighed on the NASDAQ, which fell on Friday and halted a 12-day run of gains.

In contrast, both the blue-chip Dow average and the S&P 500 ended Friday’s session at eight-month closing highs.

The earnings blitz will continue next week, with about a third of the S&P 500 companies expected to report results, including such high-profile names as Exxon Mobil Corp and Walt Disney Co. Both are also Dow components.

Wall Street and Main Street are likely to tune in when US Federal Reserve Chairman Ben Bernanke appears on PBS next week in a town hall-style forum called “Bernanke on the Record,” hosted by Jim Lehrer.

After being grilled repeatedly on Capitol Hill about the troubles continuing to roil the nation’s economy, Bernanke will talk about the Fed’s response to last year’s economic crisis and its role in economic recovery. The program, which will be recorded today at the Federal Reserve Bank of Kansas City, will be broadcast on The NewsHour with Jim Lehrer on PBS tomorrow, on Tuesday and Wednesday; a one-hour special will be aired on or after Wednesday, PBS said.

Investors will get the first look at second-quarter GDP growth on Friday. New home sales, consumer confidence and durable goods orders are among the major indicators on tap.

The week will start with new home sales for last month, due today. Economists polled by Reuters predict an annual pace of 350,000 units, up from May’s 342,000.

The Conference Board, a private research group, will release its consumer confidence index for this month on Tuesday. The forecast: 49.0 vs June’s 49.3, the Reuters poll showed.

The Conference Board’s consumer confidence index is expected to reflect concerns over job insecurity and falling home values. The Reuters/University of Michigan Surveys of Consumers showed on Friday that US consumer sentiment ebbed late this month to the lowest reading since April on growing pessimism about the long-term economic outlook. Its final consumer sentiment reading fell for this month to 66.0 from last month’s 70.8.

Durable goods orders, due on Wednesday, are forecast to have declined last month. But that may be skewed by bankruptcy filings affecting auto production. Initial jobless benefits claims, due on Thursday, are seen rising in the latest week.

The GDP data due on Friday could reinforce the perception that the worst US recession in decades will end in the year’s second half.

STILL COMMITTED: The US opposes any forced change to the ‘status quo’ in the Strait, but also does not seek conflict, US Secretary of State Marco Rubio said US President Donald Trump’s administration released US$5.3 billion in previously frozen foreign aid, including US$870 million in security exemptions for programs in Taiwan, a list of exemptions reviewed by Reuters showed. Trump ordered a 90-day pause on foreign aid shortly after taking office on Jan. 20, halting funding for everything from programs that fight starvation and deadly diseases to providing shelters for millions of displaced people across the globe. US Secretary of State Marco Rubio, who has said that all foreign assistance must align with Trump’s “America First” priorities, issued waivers late last month on military aid to Israel and Egypt, the

France’s nuclear-powered aircraft carrier and accompanying warships were in the Philippines yesterday after holding combat drills with Philippine forces in the disputed South China Sea in a show of firepower that would likely antagonize China. The Charles de Gaulle on Friday docked at Subic Bay, a former US naval base northwest of Manila, for a break after more than two months of deployment in the Indo-Pacific region. The French carrier engaged with security allies for contingency readiness and to promote regional security, including with Philippine forces, navy ships and fighter jets. They held anti-submarine warfare drills and aerial combat training on Friday in

COMBAT READINESS: The military is reviewing weaponry, personnel resources, and mobilization and recovery forces to adjust defense strategies, the defense minister said The military has released a photograph of Minister of National Defense Wellington Koo (顧立雄) appearing to sit beside a US general during the annual Han Kuang military exercises on Friday last week in a historic first. In the photo, Koo, who was presiding over the drills with high-level officers, appears to be sitting next to US Marine Corps Major General Jay Bargeron, the director of strategic planning and policy of the US Indo-Pacific Command, although only Bargeron’s name tag is visible in the seat as “J5 Maj General.” It is the first time the military has released a photo of an active

CHANGE OF MIND: The Chinese crew at first showed a willingness to cooperate, but later regretted that when the ship arrived at the port and refused to enter Togolese Republic-registered Chinese freighter Hong Tai (宏泰號) and its crew have been detained on suspicion of deliberately damaging a submarine cable connecting Taiwan proper and Penghu County, the Coast Guard Administration said in a statement yesterday. The case would be subject to a “national security-level investigation” by the Tainan District Prosecutors’ Office, it added. The administration said that it had been monitoring the ship since 7:10pm on Saturday when it appeared to be loitering in waters about 6 nautical miles (11km) northwest of Tainan’s Chiang Chun Fishing Port, adding that the ship’s location was about 0.5 nautical miles north of the No.