Barclays is to pay tens of millions of pounds to its investment bankers who have made huge profits from trading in government debt, derivatives and foreign exchange.

Some of the biggest payouts are expected to go to former Lehman Brothers traders hired by the British bank after it took over Lehman’s US operations at a knockdown price in September. Some Lehman staff were granted guaranteed bonuses to ensure they stayed with Barclays rather than jump ship and sign up with rivals.

OUTRAGE EXPECTED

The bonuses are expected to cause outrage among Barclays UK employees, who are being balloted by the Unite trade union on strike action over the scrapping of the firm’s final-salary pension scheme. Barclays has cut hundreds of jobs since the financial crisis erupted in 2007.

Protests are also expected from Lehman creditors, who are fighting in the courts on both sides of the Atlantic for money that was owed by the US bank before it went bust. Barclays stepped in to buy Lehman’s US business for US$250 million, while its European arm was sold to Nomura.

The Barclays deal was viewed as a coup for the UK clearing bank led by chairman Marcus Agius and chief executive John Varley. The Lehman acquisition has allowed the British institution to become a major player in investment banking, competing for mandates along with giants of the industry such as Goldman Sachs and JP Morgan.

LION’S SHARE

Analysts say that Barclays Capital, the bank’s investment arm, has become so profitable that it could account for the lion’s share of the £3 billion (US$4.9 billion) of interim profit that the institution is expected to report in the first week of August.

BarCap’s income is expected to more than make up for write-offs that Barclays is forecast to make against its domestic and commercial lending books.

Brokers say that BarCap’s contribution to this year’s pre-tax profit should rise from 30 percent of the total last year to more than two-thirds.

Q2 PROFITS

Goldman and Morgan reported a surge in second-quarter profit last week, setting the stage for lavish bonuses at the end of the year.

The return of bonuses — Goldman’s remuneration bill will top US$20 billion — has caused a political outcry, as big payouts were deemed to have helped cause the credit crunch by encouraging excessive risk-taking and irresponsible lending.

Last week, opposition Liberal Democrat party Treasury spokesman Vince Cable said that it “shouldn’t be back to business as usual” for financial institutions. But investment banks have been able to take advantage of the explosion of activity in the bond markets, where governments are raising billions to cover increased expenditure.

The banks left standing after the financial turmoil are also benefiting from a reduction of competition following the collapse of firms such as Bear Stearns and Lehman last year.

HEDGING DEALS

Other profitable areas of activity are hedging deals, where financial institutions seek to profit by predicting the future price of currencies, equities or commodities such as oil.

Barclays has pleased investors by avoiding the need for a government bailout, unlike RBS and Lloyds. But it has been criticized on various fronts: shareholder activists have questioned the huge payouts to staff at its fund management arm, BGI, following the sale of the business to BlackRock for US$13.5 billion. Bob Diamond, BarCap chief and chairman of BGI, is in line for a payout of £22 million from the sale, while the arm’s chief executive, Blake Grossman, will collect about £55 million.

The ballot over strike action at Barclays will be held this summer. The scrapping of the final salary pension scheme — even for existing members — has been labeled “a betrayal” by the trade union Unite.

SECURITY: As China is ‘reshaping’ Hong Kong’s population, Taiwan must raise the eligibility threshold for applications from Hong Kongers, Chiu Chui-cheng said When Hong Kong and Macau citizens apply for residency in Taiwan, it would be under a new category that includes a “national security observation period,” Mainland Affairs Council (MAC) Minister Chiu Chui-cheng (邱垂正) said yesterday. President William Lai (賴清德) on March 13 announced 17 strategies to counter China’s aggression toward Taiwan, including incorporating national security considerations into the review process for residency applications from Hong Kong and Macau citizens. The situation in Hong Kong is constantly changing, Chiu said to media yesterday on the sidelines of the Taipei Technology Run hosted by the Taipei Neihu Technology Park Development Association. With

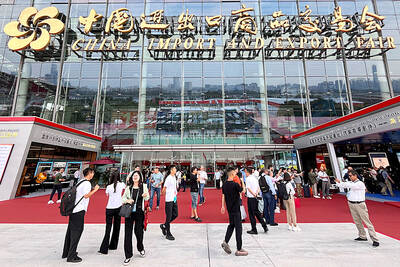

CARROT AND STICK: While unrelenting in its military threats, China attracted nearly 40,000 Taiwanese to over 400 business events last year Nearly 40,000 Taiwanese last year joined industry events in China, such as conferences and trade fairs, supported by the Chinese government, a study showed yesterday, as Beijing ramps up a charm offensive toward Taipei alongside military pressure. China has long taken a carrot-and-stick approach to Taiwan, threatening it with the prospect of military action while reaching out to those it believes are amenable to Beijing’s point of view. Taiwanese security officials are wary of what they see as Beijing’s influence campaigns to sway public opinion after Taipei and Beijing gradually resumed travel links halted by the COVID-19 pandemic, but the scale of

A US Marine Corps regiment equipped with Naval Strike Missiles (NSM) is set to participate in the upcoming Balikatan 25 exercise in the Luzon Strait, marking the system’s first-ever deployment in the Philippines. US and Philippine officials have separately confirmed that the Navy Marine Expeditionary Ship Interdiction System (NMESIS) — the mobile launch platform for the Naval Strike Missile — would take part in the joint exercise. The missiles are being deployed to “a strategic first island chain chokepoint” in the waters between Taiwan proper and the Philippines, US-based Naval News reported. “The Luzon Strait and Bashi Channel represent a critical access

Pope Francis is be laid to rest on Saturday after lying in state for three days in St Peter’s Basilica, where the faithful are expected to flock to pay their respects to history’s first Latin American pontiff. The cardinals met yesterday in the Vatican’s synod hall to chart the next steps before a conclave begins to choose Francis’ successor, as condolences poured in from around the world. According to current norms, the conclave must begin between May 5 and 10. The cardinals set the funeral for Saturday at 10am in St Peter’s Square, to be celebrated by the dean of the College