Asian stocks fell in the past week, the second weekly decline in three, as government data showed job markets are worsening, stoking concern the global economy will recover soon.

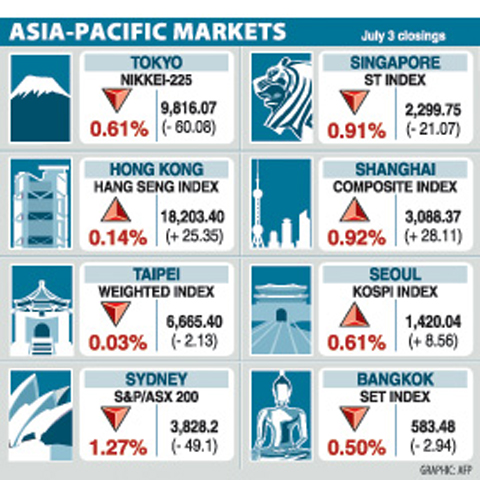

The MSCI Asia-Pacific Index lost 0.8 percent in the week, retreating from last week’s 2.2 percent climb. That pared the measure’s record 28 percent in the three months ended June 30 on optimism the global economy is stabilizing.

“We are running out of data points that can boost sentiment, so there’s not much hope for further gains,” said Tomomi Yamashita, a fund manager at Shinkin Asset Management Co in Tokyo, which oversees about US$5.5 billion. “Stocks are not at reasonable levels when you consider the facts.”

The Asian stock benchmark, which plunged by a record last year as the global economy slipped into recession, has now climbed 47 percent since reaching a more than five-year low on March 9. Stocks on the gauge now trade at 23.5 times estimated earnings, compared with 15 times at the market trough in March and 15.2 for the US’ Standard & Poor’s 500 Index.

The Bank of Japan’s Tankan survey of manufacturer sentiment rebounded less than estimated, the central bank said on Wednesday, while government data showed Japan’s unemployment rate reached a five-year high in May.

Taiwanese share prices are expected to encounter pressure as the market moves closer to the nearest technical resistance at about 6,700 points, dealers said on Friday.

Investors are likely to keep alert as the bellwether electronic sector will release sales results for last month by the end of next week for a clear indication of global demand, they said.

After a Wall Street dive on Thursday, market sentiment has turned cautious about the global economy with the US reporting a higher jobless rate for last month, they added.

While profit taking may continue to impact the market ahead of 6,700 points next week, the bourse is expected to see technical support at around 6,350, dealers said.

For the week to Friday, the weighted index rose 3.12 percent to 6,665,40 after a 3.37 percent fall a week earlier.

Average daily turnover stood at NT$107.42 billion (US$3.27 billion), compared with NT$99.87 billion a week ago.

“Amid global economic woes, investors remain eager to look into how the world’s high tech product demand is,” Mega Securities (兆豐證券) analyst Alex Huang (黃國偉) said.

“The June sales data will serve as an important indicator to the outlook of the electronic sector which is the backbone of Taiwan’s exports,” Huang said.

Capital Securities (群益證券) analyst Chen Yu-yu (陳育娛) agreed, saying high tech stocks may face relatively high pressure ahead of 6,700.

“With daily turnover at low, the market is unlikely to break out of a consolidation mode. It is time for investors to adjust their electronics portfolios,” Chen said.

‘DANGEROUS GAME’: Legislative Yuan budget cuts have already become a point of discussion for Democrats and Republicans in Washington, Elbridge Colby said Taiwan’s fall to China “would be a disaster for American interests” and Taipei must raise defense spending to deter Beijing, US President Donald Trump’s pick to lead Pentagon policy, Elbridge Colby, said on Tuesday during his US Senate confirmation hearing. The nominee for US undersecretary of defense for policy told the Armed Services Committee that Washington needs to motivate Taiwan to avoid a conflict with China and that he is “profoundly disturbed” about its perceived reluctance to raise defense spending closer to 10 percent of GDP. Colby, a China hawk who also served in the Pentagon in Trump’s first team,

SEPARATE: The MAC rebutted Beijing’s claim that Taiwan is China’s province, asserting that UN Resolution 2758 neither mentions Taiwan nor grants the PRC authority over it The “status quo” of democratic Taiwan and autocratic China not belonging to each other has long been recognized by the international community, the Mainland Affairs Council (MAC) said yesterday in its rebuttal of Beijing’s claim that Taiwan can only be represented in the UN as “Taiwan, Province of China.” Chinese Minister of Foreign Affairs Wang Yi (王毅) yesterday at a news conference of the third session at the 14th National People’s Congress said that Taiwan can only be referred to as “Taiwan, Province of China” at the UN. Taiwan is an inseparable part of Chinese territory, which is not only history but

CROSSED A LINE: While entertainers working in China have made pro-China statements before, this time it seriously affected the nation’s security and interests, a source said The Mainland Affairs Council (MAC) late on Saturday night condemned the comments of Taiwanese entertainers who reposted Chinese statements denigrating Taiwan’s sovereignty. The nation’s cross-strait affairs authority issued the statement after several Taiwanese entertainers, including Patty Hou (侯佩岑), Ouyang Nana (歐陽娜娜) and Michelle Chen (陳妍希), on Friday and Saturday shared on their respective Sina Weibo (微博) accounts a post by state broadcaster China Central Television. The post showed an image of a map of Taiwan along with the five stars of the Chinese flag, and the message: “Taiwan is never a country. It never was and never will be.” The post followed remarks

INVESTMENT WATCH: The US activity would not affect the firm’s investment in Taiwan, where 11 production lines would likely be completed this year, C.C. Wei said Investments by Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) in the US should not be a cause for concern, but rather seen as the moment that the company and Taiwan stepped into the global spotlight, President William Lai (賴清德) told a news conference at the Presidential Office in Taipei yesterday alongside TSMC chairman and chief executive officer C.C. Wei (魏哲家). Wei and US President Donald Trump in Washington on Monday announced plans to invest US$100 billion in the US to build three advanced foundries, two packaging plants, and a research and development center, after Trump threatened to slap tariffs on chips made