Wall Street’s hopes for a rapid recovery from recession, muddled by disappointing US labor market data, faces a new test in the coming week with the looming corporate earnings season.

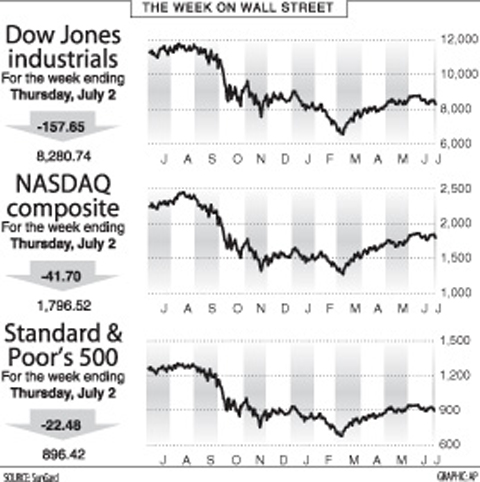

The market was hammered by news of steeper-than-expected US job losses in the past month, which dampened hopes of a quick recovery, putting the earnings season in the spotlight for investors. In the holiday-shortened week to Thursday, the Dow Jones Industrial Average slumped 1.87 percent to 8,280.74, a third consecutive loss for blue-chips.

The broad-market Standard & Poor’s 500 index slumped for a third week, losing 2.45 percent to 896.42, while the technology-heavy NASDAQ lost 2.27 percent over the four-day week to 1,796.52.

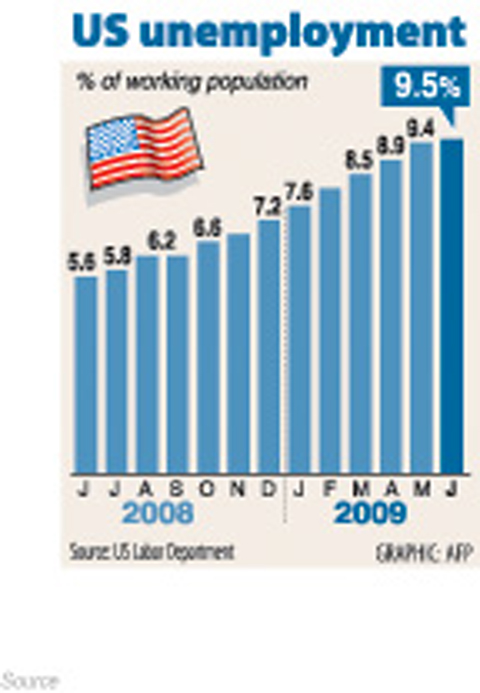

The market had been on a positive track for the week until Thursday’s shock data showed a disappointing 467,000 jobs lost last month — far worse than expected and a reversal of the improving trend from May.

The report dashed hopes that had been growing for an early recover to the recession that has gripped the world’s biggest economy since December 2007.

“For all the talk of an impending US economic recovery, June’s worse than expected nonfarm payroll report highlights that the current recession lives on,” said Meny Grauman, an economist at CIBC World Markets.

“The outlook for the US economy remains decidedly negative despite a slew of better than expected economic data. Not only are monthly payroll declines still in the triple digits, but earnings are growing very slowly, and hours worked are being cut back,” Grauman said.

Grauman said the weakness in the job market will hurt incomes, leading to sluggish spending and overall economic activity.

Others say a single report should not detract from what appears to be a stabilization in the economy, highlighted by improving trends in manufacturing and spending.

“We need to take stock for a minute and ask whether this was a reversal in the downward trend in payroll losses or just a hiccup in the process of stabilizing the job market,” Joel Naroff at Naroff Economic Advisors said.

“I have always argued that one month a trend does not make and that is the case with this data. But the employment reductions have to slow soon if the economy is to start to rebound,” Naroff said.

Philip Orlando at Federated Investors said the data “clearly was a step in the wrong direction for the recovery of both the economy in general and the employment market in particular.

“We continue to believe that January 2009 remains the trough of the current jobs cycle,” with a loss of 741,000 jobs, Orlando said. “We are also sticking to our controversial, out-of-consensus belief that the economy likely bottomed during the just-completed second quarter, and we are still forecasting a resumption of positive gross domestic product growth in the second half of calendar 2009. But today’s jobs report was undoubtedly a black eye for our forecast.”

Bonds ended the week mixed. The yield on the 10-year Treasury note fell to 3.495 percent from 3.506 percent a week earlier and that on the 30-year bond edged up to 4.317 percent from 4.303 percent. Bond yields and prices move in opposite directions.

The coming week sees the first of the blue-chips, Alcoa, reporting earnings on Tuesday, and a survey on the US services sector from the Institute of Supply Management.

ACCOUNTABILITY: The incident, which occured at a Shin Kong Mitsukoshi Department Store in Taichung, was allegedly caused by a gas explosion on the 12th floor Shin Kong Group (新光集團) president Richard Wu (吳昕陽) yesterday said the company would take responsibility for an apparent gas explosion that resulted in four deaths and 26 injuries at Shin Kong Mitsukoshi Zhonggang Store in Taichung yesterday. The Taichung Fire Bureau at 11:33am yesterday received a report saying that people were injured after an explosion at the department store on Section 3 of Taiwan Boulevard in Taichung’s Situn District (西屯). It sent 56 ambulances and 136 paramedics to the site, with the people injured sent to Cheng Ching Hospital’s Chung Kang Branch, Wuri Lin Shin Hospital, Taichung Veterans General Hospital or Chung

‘TAIWAN-FRIENDLY’: The last time the Web site fact sheet removed the lines on the US not supporting Taiwanese independence was during the Biden administration in 2022 The US Department of State has removed a statement on its Web site that it does not support Taiwanese independence, among changes that the Taiwanese government praised yesterday as supporting Taiwan. The Taiwan-US relations fact sheet, produced by the department’s Bureau of East Asian and Pacific Affairs, previously stated that the US opposes “any unilateral changes to the status quo from either side; we do not support Taiwan independence; and we expect cross-strait differences to be resolved by peaceful means.” In the updated version published on Thursday, the line stating that the US does not support Taiwanese independence had been removed. The updated

‘CORRECT IDENTIFICATION’: Beginning in May, Taiwanese married to Japanese can register their home country as Taiwan in their spouse’s family record, ‘Nikkei Asia’ said The government yesterday thanked Japan for revising rules that would allow Taiwanese nationals married to Japanese citizens to list their home country as “Taiwan” in the official family record database. At present, Taiwanese have to select “China.” Minister of Foreign Affairs Lin Chia-lung (林佳龍) said the new rule, set to be implemented in May, would now “correctly” identify Taiwanese in Japan and help protect their rights, the Ministry of Foreign Affairs said in a statement. The statement was released after Nikkei Asia reported the new policy earlier yesterday. The name and nationality of a non-Japanese person marrying a Japanese national is added to the

AT RISK: The council reiterated that people should seriously consider the necessity of visiting China, after Beijing passed 22 guidelines to punish ‘die-hard’ separatists The Mainland Affairs Council (MAC) has since Jan. 1 last year received 65 petitions regarding Taiwanese who were interrogated or detained in China, MAC Minister Chiu Chui-cheng (邱垂正) said yesterday. Fifty-two either went missing or had their personal freedoms restricted, with some put in criminal detention, while 13 were interrogated and temporarily detained, he said in a radio interview. On June 21 last year, China announced 22 guidelines to punish “die-hard Taiwanese independence separatists,” allowing Chinese courts to try people in absentia. The guidelines are uncivilized and inhumane, allowing Beijing to seize assets and issue the death penalty, with no regard for potential