Wall Street limped to the end of what appears to be a positive quarter in the past week amid doubts about whether the economy can rebound and the market can keep upward momentum in the second half of the year.

With the year’s midpoint coming up, a key for stocks in the holiday-shortened week ahead will be Thursday’s report on US unemployment and payrolls, which comes a day early with US markets closed for Friday’s Independence Day celebration.

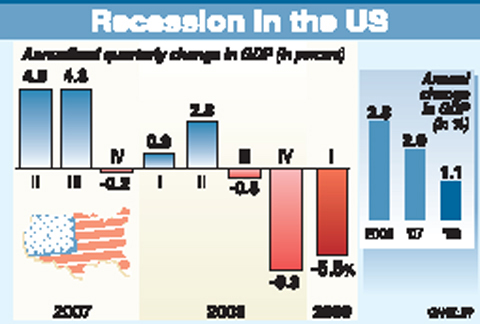

The report is seen as one of the best indicators of economic momentum and could provide clues about the timing and strength of a rebound from the worst recession in decades.

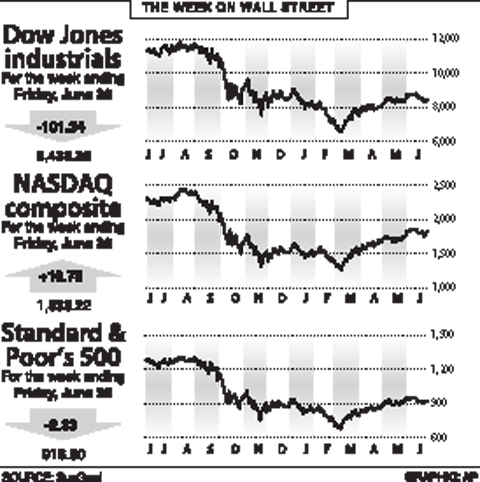

The blue-chip Dow Jones Industrial Average dropped 1.2 percent to 8,438.39 in the week to Friday, a second weekly drop after a four-week winning streak.

The technology-heavy NASDAQ rose 0.59 percent on the week to 1,838.22 while the broad-market Standard & Poor’s 500 index declined 0.25 percent to 918.90.

Many say that despite the lackluster week, the market is sensing that the US and global economies will soon come out of their deep slump, yet some of that has already been reflected in the 40 percent jump in the broad indexes since March.

Mark Luschini, chief investment strategist at Janney Montgomery Scott, said there was some trepidation about how far the rally can run, with the S&P index still up some 35 percent from its March lows.

“The dilemma amongst market participants at the moment relates to whether the weakness was merely the stock market taking a well-deserved breather or did it warn of something more sinister,” he said.

“On one hand, the rally germinated from improving news on the economic front and confidence returning to the financial markets ... On the other hand, the ‘green shoots’ metaphor is a tad worn at this juncture and the market’s budding skepticism is based on the need to realize actual good news rather than advancing on news that is just comparatively less bad,” Luschini said.

The US Federal Reserve calmed some nerves over the past week as it made no change in its near-zero interest rate policy and signaled it would keep its stimulus efforts on track without pulling back or expanding the effort.

The announced extension of key lending programs put into place to counter the credit crisis appeared to generate confidence.

“By extending its lending facilities into next year, the Federal Reserve sent a strong message to financial markets on Thursday that interest rates will remain unchanged for the foreseeable future,” Ryan Sweet at Moody’s Economy.com said.

Nariman Behravesh, chief economist at IHS Global Insight, said there was growing evidence the worldwide slump is ending.

“The light at the end of the tunnel is shining a little brighter,” he said. “The world economy will begin its recovery in the second half of 2009 as the global inventory correction winds down. The timing and speed of regional recoveries will vary, with Asia leading, the United States coincident, and much of Europe lagging behind.”

But analysts say Thursday’s payrolls report could be a key for the economy and the stock market.

Bonds rose as inflation fears ebbed. The yield on the 10-year Treasury bond dropped to 3.506 percent from 3.789 percent a week earlier and that on the 30-year bond declined to 4.303 percent from 4.522 percent. Bond yields and prices move in opposite directions.

The coming week also features data on monthly US auto sales, consumer confidence and a purchasing managers’ index on the manufacturing sector.

STILL COMMITTED: The US opposes any forced change to the ‘status quo’ in the Strait, but also does not seek conflict, US Secretary of State Marco Rubio said US President Donald Trump’s administration released US$5.3 billion in previously frozen foreign aid, including US$870 million in security exemptions for programs in Taiwan, a list of exemptions reviewed by Reuters showed. Trump ordered a 90-day pause on foreign aid shortly after taking office on Jan. 20, halting funding for everything from programs that fight starvation and deadly diseases to providing shelters for millions of displaced people across the globe. US Secretary of State Marco Rubio, who has said that all foreign assistance must align with Trump’s “America First” priorities, issued waivers late last month on military aid to Israel and Egypt, the

France’s nuclear-powered aircraft carrier and accompanying warships were in the Philippines yesterday after holding combat drills with Philippine forces in the disputed South China Sea in a show of firepower that would likely antagonize China. The Charles de Gaulle on Friday docked at Subic Bay, a former US naval base northwest of Manila, for a break after more than two months of deployment in the Indo-Pacific region. The French carrier engaged with security allies for contingency readiness and to promote regional security, including with Philippine forces, navy ships and fighter jets. They held anti-submarine warfare drills and aerial combat training on Friday in

COMBAT READINESS: The military is reviewing weaponry, personnel resources, and mobilization and recovery forces to adjust defense strategies, the defense minister said The military has released a photograph of Minister of National Defense Wellington Koo (顧立雄) appearing to sit beside a US general during the annual Han Kuang military exercises on Friday last week in a historic first. In the photo, Koo, who was presiding over the drills with high-level officers, appears to be sitting next to US Marine Corps Major General Jay Bargeron, the director of strategic planning and policy of the US Indo-Pacific Command, although only Bargeron’s name tag is visible in the seat as “J5 Maj General.” It is the first time the military has released a photo of an active

CHANGE OF MIND: The Chinese crew at first showed a willingness to cooperate, but later regretted that when the ship arrived at the port and refused to enter Togolese Republic-registered Chinese freighter Hong Tai (宏泰號) and its crew have been detained on suspicion of deliberately damaging a submarine cable connecting Taiwan proper and Penghu County, the Coast Guard Administration said in a statement yesterday. The case would be subject to a “national security-level investigation” by the Tainan District Prosecutors’ Office, it added. The administration said that it had been monitoring the ship since 7:10pm on Saturday when it appeared to be loitering in waters about 6 nautical miles (11km) northwest of Tainan’s Chiang Chun Fishing Port, adding that the ship’s location was about 0.5 nautical miles north of the No.