After taking a breather from a stunning three-month run, Wall Street turns its attention in the coming week to the US Federal Reserve for signs that could revive the rally.

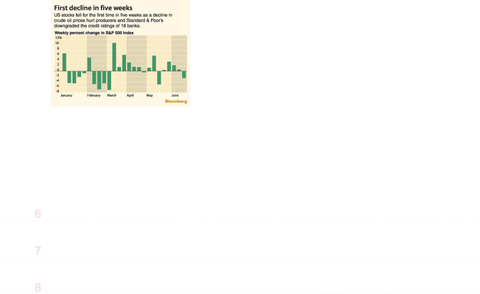

In the week to Friday, the blue-chip Dow Jones Industrial Average slumped 2.95 percent to 8,539.73, ending a four-week winning streak.

The technology-heavy NASDAQ lost 1.69 percent for the week to 1,827.47, while the broad-market Standard & Poor’s 500 index shed 2.64 percent to 921.23.

Despite the pullback in the past week, the market’s snapback of some 40 percent from lows in March suggests Wall Street believes the danger of an economic depression has passed, but the shape of recovery remains unclear.

As a result, the Federal Reserve’s two-day policy meeting takes on new importance, with the central bank’s comments likely to offer clues on timing and strength of an economic recovery.

Gregory Drahuschak at Janney Montgomery Scott said the market would scrutinize the statement on Wednesday from the Federal Open Market Committee.

“Rates are not likely to be changed but we suspect there could be some language in the policy statement suggesting that the Fed is contemplating pulling back on some of its stimulus,” he said.

“There is increasing evidence that the recession is ending and that a return to positive growth is imminent,” said Dean Maki, economist at Barclays Capital. “Given this backdrop, the Fed is likely to sound more upbeat on growth prospects than its April statement.”

But Maki said the Fed “will likely want to balance this upbeat view with some rhetoric emphasizing headwinds still facing the economy, and it will likely aim to convince investors that tightening is not imminent.”

The market is now struggling to get a handle on whether the economy will see a strong “V-shaped” recovery or a more sluggish one.

“We believe the stock market is now trying to figure out what the economic recovery will be like and how much growth we will see in 2010,” said Al Goldman at Wells Fargo Advisors.

Goldman said a strong economic recovery was “unlikely” amid a soft labor market and weak consumer spending.

But he argues that the rally has not yet run out steam.

“We believe the market will be higher by year-end because of a still-positive risk/reward ratio for stocks and prospects for a decent but modest economic recovery next year,” he said.

Fred Dickson, chief market strategist at DA Davidson & Co, said the market needed a pullback after the hefty gains but sees this as “short and shallow” but added the market may be bracing for quarterly earnings reports starting in July.

“Our biggest near-term worry is that second quarter earnings news may disappoint anxious investors,” he said.

Economist Benjamin Tal at CIBC World Markets argues that the stock market may have rallied too far and needs to digest the gains of the past three months.

“The stock market is probably ahead of itself,” he said.

“All indicators and common sense suggest that this recovery will be muted. After all, the US housing market is yet to find its footing, consumers are in a bad mood and deleveraging is king. Savings, not consumption, will be the new ‘in,’” Tal said.

“But the signals from stocks, commodities and bond markets suggest that while the next several quarters will be lackluster, the medium-term outlook could be brighter than many currently suspect,” he added.

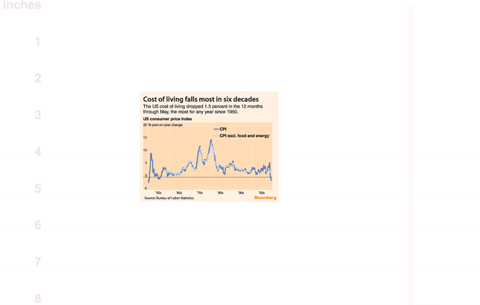

Bonds were mixed over the week as some fears about inflation and rate hikes eased.

The yield on the 10-year Treasury bond was marginally higher at 3.789 percent from 3.788 percent a week earlier while that on the 30-year bond declined to 4.522 percent from 4.633 percent. Bond yields and prices move in opposite directions.

AIR SUPPORT: The Ministry of National Defense thanked the US for the delivery, adding that it was an indicator of the White House’s commitment to the Taiwan Relations Act Deputy Minister of National Defense Po Horng-huei (柏鴻輝) and Representative to the US Alexander Yui on Friday attended a delivery ceremony for the first of Taiwan’s long-awaited 66 F-16C/D Block 70 jets at a Lockheed Martin Corp factory in Greenville, South Carolina. “We are so proud to be the global home of the F-16 and to support Taiwan’s air defense capabilities,” US Representative William Timmons wrote on X, alongside a photograph of Taiwanese and US officials at the event. The F-16C/D Block 70 jets Taiwan ordered have the same capabilities as aircraft that had been upgraded to F-16Vs. The batch of Lockheed Martin

GRIDLOCK: The National Fire Agency’s Special Search and Rescue team is on standby to travel to the countries to help out with the rescue effort A powerful earthquake rocked Myanmar and neighboring Thailand yesterday, killing at least three people in Bangkok and burying dozens when a high-rise building under construction collapsed. Footage shared on social media from Myanmar’s second-largest city showed widespread destruction, raising fears that many were trapped under the rubble or killed. The magnitude 7.7 earthquake, with an epicenter near Mandalay in Myanmar, struck at midday and was followed by a strong magnitude 6.4 aftershock. The extent of death, injury and destruction — especially in Myanmar, which is embroiled in a civil war and where information is tightly controlled at the best of times —

China's military today said it began joint army, navy and rocket force exercises around Taiwan to "serve as a stern warning and powerful deterrent against Taiwanese independence," calling President William Lai (賴清德) a "parasite." The exercises come after Lai called Beijing a "foreign hostile force" last month. More than 10 Chinese military ships approached close to Taiwan's 24 nautical mile (44.4km) contiguous zone this morning and Taiwan sent its own warships to respond, two senior Taiwanese officials said. Taiwan has not yet detected any live fire by the Chinese military so far, one of the officials said. The drills took place after US Secretary

THUGGISH BEHAVIOR: Encouraging people to report independence supporters is another intimidation tactic that threatens cross-strait peace, the state department said China setting up an online system for reporting “Taiwanese independence” advocates is an “irresponsible and reprehensible” act, a US government spokesperson said on Friday. “China’s call for private individuals to report on alleged ‘persecution or suppression’ by supposed ‘Taiwan independence henchmen and accomplices’ is irresponsible and reprehensible,” an unnamed US Department of State spokesperson told the Central News Agency in an e-mail. The move is part of Beijing’s “intimidation campaign” against Taiwan and its supporters, and is “threatening free speech around the world, destabilizing the Indo-Pacific region, and deliberately eroding the cross-strait status quo,” the spokesperson said. The Chinese Communist Party’s “threats