Asian stocks rose for a fourth week in five, driving the MSCI Asia-Pacific Index to the highest level in eight months, as US consumer confidence and Japanese production reports spurred hopes for a global economic recovery.

Toyota Motor Corp, which gets 31 percent of its revenue in North America, gained 6.7 percent in Tokyo. PetroChina Co, the nation’s biggest oil producer, advanced 6 percent as crude oil prices surged for a second week. Hang Lung Properties Ltd, Hong Kong’s fifth-biggest builder, surged 16 percent after Hong Kong’s government announced an additional stimulus package.

“Signs of a turnaround are coming through,” said Matt Riordan, who helps manage about US$3.1 billion at Paradice Investment Management in Sydney. “People who were initially dismissing this as a bear-market rally are concerned it might be sustainable.”

.jpg)

The MSCI Asia-Pacific Index gained 2.7 percent to 102.04, its highest level since Oct. 3. The gauge, which has rallied 45 percent from a five-year low on March 9, briefly pared gains this week after North Korea threatened a military strike in response to South Korea joining a program to seize weapons shipments.

South Korea’s KOSPI Index sank 0.6 percent as North Korea tested a nuclear device on May 25 and launched six short-range missiles in defiance of international condemnation.

“The North Korean missile test is providing investors a reality check,” said Roger Groebli, Singapore-based head of market analysis at LGT Capital Management, which oversees about US$20 billion. “Valuations in Asia are a little rich.”

Taiwanese share prices are expected to challenge the key 7,000-point level next week on continued inflows of foreign funds, dealers said.

Foreign institutional investors are likely to pick up financial heavyweights as their holdings remain relatively low and they need further short covering, they said.

However, as the bellwether electronic sector is scheduled to report sales data for this month, cautious sentiment toward high-tech stocks may cast a shadow over the broader market, the dealers added.

While the ample liquidity is expected to push the index through 7,000 or even higher next week, stiff technical resistance is likely to follow and drag it to around 6,600, they said.

In the holiday-shortened week to Wednesday, the weighted index rose 153.15 points, or 2.27 percent, to 6,890.44 after a 3.82 percent increase a week earlier.

Average daily turnover stood at NT$204.64 billion (US$6.28 billion), compared with NT$189.36 billion a week ago.

The market was closed on Thursday and Friday for the prolonged Dragon Boat Festival holiday.

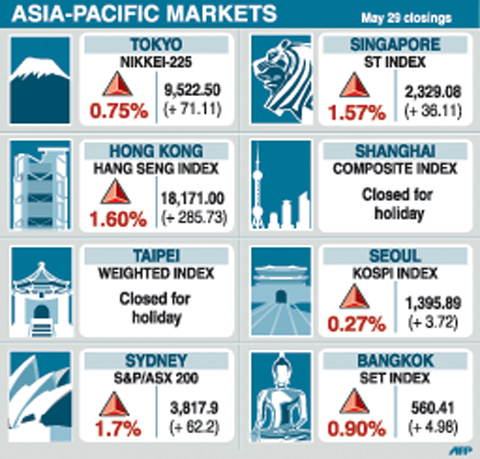

Other regional markets on Friday:

HONG KONG: Up 1.60 percent. The Hang Seng Index rose 285.73 points at 18,171.00, its highest close since early October. Dealers said profit-taking pressure was strong as the local benchmark index has risen 17 percent since the start of May.

SYDNEY: Up 1.7 percent. The S&P/ASX 200 rose 62.2 points to 3,817.9. The market was “remarkably strong” and buoyed by gains in Commonwealth Bank, ANZ and Westpac after a positive lead from Wall Street, Ord Minnett private client adviser Jon Hancock said.

SEOUL: UP 0.27 percent. The KOSPI ended up 3.72 points at 1,395.89. Foreign buying outweighed concerns over instability on the Korean peninsula.

KUALA LUMPUR: Up 0.28 percent. The Kuala Lumpur Composite Index added 2.87 points at 1,044.11.

MANILA: Up 1.48 percent. The composite index rose 34.94 points to 2,389.31.

MUMBAI: Up 2.3 percent. The 30-share SENSEX rose 329.24 points to 14,625.25, a near nine-month high. Sentiment was lifted after the government said the economy grew by a better-than-expected 6.7 percent in the past fiscal year, dealers said.

AIR SUPPORT: The Ministry of National Defense thanked the US for the delivery, adding that it was an indicator of the White House’s commitment to the Taiwan Relations Act Deputy Minister of National Defense Po Horng-huei (柏鴻輝) and Representative to the US Alexander Yui on Friday attended a delivery ceremony for the first of Taiwan’s long-awaited 66 F-16C/D Block 70 jets at a Lockheed Martin Corp factory in Greenville, South Carolina. “We are so proud to be the global home of the F-16 and to support Taiwan’s air defense capabilities,” US Representative William Timmons wrote on X, alongside a photograph of Taiwanese and US officials at the event. The F-16C/D Block 70 jets Taiwan ordered have the same capabilities as aircraft that had been upgraded to F-16Vs. The batch of Lockheed Martin

GRIDLOCK: The National Fire Agency’s Special Search and Rescue team is on standby to travel to the countries to help out with the rescue effort A powerful earthquake rocked Myanmar and neighboring Thailand yesterday, killing at least three people in Bangkok and burying dozens when a high-rise building under construction collapsed. Footage shared on social media from Myanmar’s second-largest city showed widespread destruction, raising fears that many were trapped under the rubble or killed. The magnitude 7.7 earthquake, with an epicenter near Mandalay in Myanmar, struck at midday and was followed by a strong magnitude 6.4 aftershock. The extent of death, injury and destruction — especially in Myanmar, which is embroiled in a civil war and where information is tightly controlled at the best of times —

China's military today said it began joint army, navy and rocket force exercises around Taiwan to "serve as a stern warning and powerful deterrent against Taiwanese independence," calling President William Lai (賴清德) a "parasite." The exercises come after Lai called Beijing a "foreign hostile force" last month. More than 10 Chinese military ships approached close to Taiwan's 24 nautical mile (44.4km) contiguous zone this morning and Taiwan sent its own warships to respond, two senior Taiwanese officials said. Taiwan has not yet detected any live fire by the Chinese military so far, one of the officials said. The drills took place after US Secretary

THUGGISH BEHAVIOR: Encouraging people to report independence supporters is another intimidation tactic that threatens cross-strait peace, the state department said China setting up an online system for reporting “Taiwanese independence” advocates is an “irresponsible and reprehensible” act, a US government spokesperson said on Friday. “China’s call for private individuals to report on alleged ‘persecution or suppression’ by supposed ‘Taiwan independence henchmen and accomplices’ is irresponsible and reprehensible,” an unnamed US Department of State spokesperson told the Central News Agency in an e-mail. The move is part of Beijing’s “intimidation campaign” against Taiwan and its supporters, and is “threatening free speech around the world, destabilizing the Indo-Pacific region, and deliberately eroding the cross-strait status quo,” the spokesperson said. The Chinese Communist Party’s “threats