Asian stocks fell this week as investors sold shares trading at their most expensive valuations in five years on concerns that the economy and corporate profits will take longer than expected to recover.

Hitachi Ltd, Japan’s third-largest chipmaker, tumbled 17 percent after forecasting a loss. Rio Tinto Group, the world’s third-largest mining company, slumped 14 percent after London’s Telegraph newspaper reported the company may sell shares. China Construction Bank Ltd (中國建設銀行), the world’s No. 2 lender by market value, dropped 8.8 percent as Bank of America Corp sold a stake.

“All positive news has already been priced,” said Masaru Hamasaki, a senior strategist at Toyota Asset Management Co, which oversees the equivalent of US$3.3 billion. “We need solid evidence the economy is indeed recovering to go up any further.”

The MSCI Asia-Pacific Index fell 0.7 percent to 97.28 in the past five days, ending a two-week, 9.5 percent advance. Speculation the global economy is recovering sent the gauge to the highest since Oct. 7 on Monday. The average valuation of its companies is 33 times trailing earnings, the highest level since 2004, according to data compiled by Bloomberg.

Cautious sentiment is expected to affect Taiwanese shares next week after today’s pro-independence protests against the China-friendly Chinese Nationalist Party (KMT) government, dealers said on Friday. Worries linger over a possible prolonged standoff and even violence as the Democratic Progressive Party also plans an all-night sit-in protest in front of the Presidential Office, they said.

“Political conflicts are the last thing the stock market wants to have,” Grand Cathay Securities Corp (大華證券) analyst Mars Hsu said.

Investors are also keeping a close eye on first-quarter GDP data scheduled for release on May 21, and waiting for government comments on the economic outlook for the rest of the year, they added.

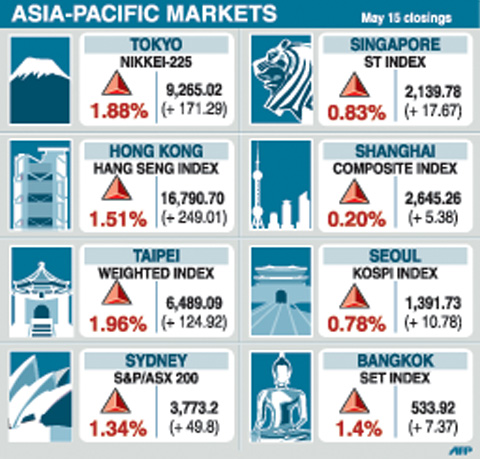

The market is expected to face stiff technical barriers as it moves closer to 6,500-6,600 points next week, while ample liquidity may lend some support to prices at around 6,300, dealers said. In the week to Friday, the weighted index fell 94.78 points, or 1.44 percent, to 6,489.09 after a 9.86 percent increase the previous week.

Average daily turnover stood at NT$170.52 billion (US$5.18 billion), compared with NT$211.87 billion a week ago.

Hsu said the market’s recent significant gains have paved the way for volatility in the short term.

“Many investors may use such political factors as an excuse to cut positions for profit,” Hsu said.

Other markets on Friday:

KUALA LUMPUR: Up 0.2 percent. The Kuala Lumpur Composite Index gained 2.22 points to 1,014.21.

BANGKOK: The SET gained 7.37 points, or 1.4 percent, to 533.92.

MANILA: Up 1.97 percent. The composite index rose 44.47 points to 2,308.70.

WELLINGTON: Up 0.53 percent. The NZX-50 index rose 14.78 points to 2,790.90.

MUMBAI: Up 2.53 percent. The 30-share SENSEX gained 300.51 points to 12,173.42.

SECURITY: As China is ‘reshaping’ Hong Kong’s population, Taiwan must raise the eligibility threshold for applications from Hong Kongers, Chiu Chui-cheng said When Hong Kong and Macau citizens apply for residency in Taiwan, it would be under a new category that includes a “national security observation period,” Mainland Affairs Council (MAC) Minister Chiu Chui-cheng (邱垂正) said yesterday. President William Lai (賴清德) on March 13 announced 17 strategies to counter China’s aggression toward Taiwan, including incorporating national security considerations into the review process for residency applications from Hong Kong and Macau citizens. The situation in Hong Kong is constantly changing, Chiu said to media yesterday on the sidelines of the Taipei Technology Run hosted by the Taipei Neihu Technology Park Development Association. With

CARROT AND STICK: While unrelenting in its military threats, China attracted nearly 40,000 Taiwanese to over 400 business events last year Nearly 40,000 Taiwanese last year joined industry events in China, such as conferences and trade fairs, supported by the Chinese government, a study showed yesterday, as Beijing ramps up a charm offensive toward Taipei alongside military pressure. China has long taken a carrot-and-stick approach to Taiwan, threatening it with the prospect of military action while reaching out to those it believes are amenable to Beijing’s point of view. Taiwanese security officials are wary of what they see as Beijing’s influence campaigns to sway public opinion after Taipei and Beijing gradually resumed travel links halted by the COVID-19 pandemic, but the scale of

A US Marine Corps regiment equipped with Naval Strike Missiles (NSM) is set to participate in the upcoming Balikatan 25 exercise in the Luzon Strait, marking the system’s first-ever deployment in the Philippines. US and Philippine officials have separately confirmed that the Navy Marine Expeditionary Ship Interdiction System (NMESIS) — the mobile launch platform for the Naval Strike Missile — would take part in the joint exercise. The missiles are being deployed to “a strategic first island chain chokepoint” in the waters between Taiwan proper and the Philippines, US-based Naval News reported. “The Luzon Strait and Bashi Channel represent a critical access

Pope Francis is be laid to rest on Saturday after lying in state for three days in St Peter’s Basilica, where the faithful are expected to flock to pay their respects to history’s first Latin American pontiff. The cardinals met yesterday in the Vatican’s synod hall to chart the next steps before a conclave begins to choose Francis’ successor, as condolences poured in from around the world. According to current norms, the conclave must begin between May 5 and 10. The cardinals set the funeral for Saturday at 10am in St Peter’s Square, to be celebrated by the dean of the College