Islamic finance must strengthen regulation, boost its professional staff and diversify as it takes on a bigger global role in the aftermath of the worldwide financial crisis, experts said.

Financial products compliant with Islamic Shariah law are likely to gain in popularity as investors seek safer havens after the ruin caused by toxic derivatives sold globally by mainstream Western banks, they said.

However, experts warn that Islamic financial institutions must be on their guard against falling into the same unbridled excesses that jolted Wall Street and snowballed into a global economic downturn.

“Islamic finance is not immune from such pitfalls. Hence we must be careful to avoid this error in the Islamic financial industry,” said Muhammad Sulaiman Al-Jasser, governor of the Saudi Arabian Monetary Agency.

“Islamic financial institutions are continuing to invest time and effort to improve corporate governance and risk management and I expect that they will continue to avoid mistakes made in designing over-complicated securities,” he said.

He and other experts were speaking at a recent meeting of the Islamic Financial Services Board held in Singapore, which is aiming to be a key player in Islamic finance.

INTEREST

Islamic banking has been left relatively unscathed by the global financial crisis, largely because of rules forbidding engagement in the kind of risky business that sank mainstream institutions like Lehman Brothers.

Islamic Shariah law bars the payment and collection of interest, which is seen as a form of gambling.

RISK-SHARING

Islamic finance also operates on the principle of risk-sharing between the issuing bank and the buyer of a financial product, making it a less risky alternative to some conventional banking instruments.

Al-Jasser and other speakers told the Singapore conference that Islamic finance was likely to gather momentum in the aftermath of the downturn.

“It is my belief that Islamic finance has moved on to a new stage in the last few years. In the past, it was an individual decision based on faith, now it is competing on its own very strong merits in the global marketplace,” he said.

Islamic finance is now established in 47 countries with more than 600 institutions managing “balance-sheet assets” worth over US$630 billion, with another US$200 billion to US$300 billion managed as investment funds, he said.

Heng Swee Keat (王瑞傑), managing director of the Monetary Authority of Singapore, said more Asian countries were using Islamic finance to fund infrastructure projects.

‘SUKUK’

Issuance of Islamic bonds, called sukuk, in Asian currencies totaled US$64.3 billion last year, down 1.5 percent from 2007 when it expanded by 50 percent over the year before, Moody’s Investor Service said this month.

But the industry has much room for growth as Islamic finance represents only 1 percent of the total assets held by the global financial markets, experts said.

Ahmad Mohamed Ali, president of the Islamic Development Bank, urged the industry to offer a wider range of financial services, noting that commercial banking accounts for more than 70 percent of Shariah-compliant assets.

“There is a need for major investment banks that provide a different model of investment banking, a model that is able to have positive impact on economic growth without compromising stability and resilience,” he told the meeting.

“We also need varieties of venture capital institutions, small and medium financing institutions specialized in financing, leasing, etc,” he said.

As global regulatory bodies revise financial regulations to prevent future financial crises, Islamic regulatory and accounting standards must also improve, Ahmad said.

While the previous approach focused on regulating individual Islamic financial institutions, regulatory bodies should now adopt a comprehensive strategy to address both macro and micro-economic issues.

Muliaman Hadad, deputy governor of the Bank of Indonesia, said one of the key challenges was producing much-needed professional staff to deal with Shariah-compliant financial products.

EDUCATION

Indonesia, the world’s most populous Muslim nation, will also launch an education campaign across the country to help people — including bankers, bureaucrats, students and religious leaders — understand Islamic finance better.

Tunc Tahsin Uyanic, a sector manager for the World Bank in the East Asia and Pacific region, offered the bank’s assistance in personnel training, education, policy direction, development of new financial instruments and regulation.

INVESTIGATION: The case is the latest instance of a DPP figure being implicated in an espionage network accused of allegedly leaking information to Chinese intelligence Democratic Progressive Party (DPP) member Ho Jen-chieh (何仁傑) was detained and held incommunicado yesterday on suspicion of spying for China during his tenure as assistant to then-minister of foreign affairs Joseph Wu (吳釗燮). The Taipei District Prosecutors’ Office said Ho was implicated during its investigation into alleged spying activities by former Presidential Office consultant Wu Shang-yu (吳尚雨). Prosecutors said there is reason to believe Ho breached the National Security Act (國家安全法) by leaking classified Ministry of Foreign Affairs information to Chinese intelligence. Following interrogation, prosecutors petitioned the Taipei District Court to detain Ho, citing concerns over potential collusion or tampering of evidence. The

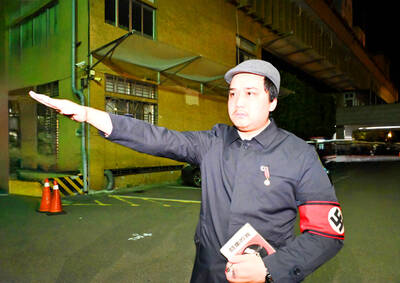

‘FORM OF PROTEST’: The German Institute Taipei said it was ‘shocked’ to see Nazi symbolism used in connection with political aims as it condemned the incident Sung Chien-liang (宋建樑), who led efforts to recall Democratic Progressive Party (DPP) Legislator Lee Kun-cheng (李坤城), was released on bail of NT$80,000 yesterday amid an outcry over a Nazi armband he wore to questioning the night before. Sung arrived at the New Taipei City District Prosecutors’ Office for questioning in a recall petition forgery case on Tuesday night wearing a red armband bearing a swastika, carrying a copy of Adolf Hitler’s Mein Kampf and giving a Nazi salute. Sung left the building at 1:15am without the armband and apparently covering the book with a coat. This is a serious international scandal and Chinese

Seventy percent of middle and elementary schools now conduct English classes entirely in English, the Ministry of Education said, as it encourages schools nationwide to adopt this practice Minister of Education (MOE) Cheng Ying-yao (鄭英耀) is scheduled to present a report on the government’s bilingual education policy to the Legislative Yuan’s Education and Culture Committee today. The report would outline strategies aimed at expanding access to education, reducing regional disparities and improving talent cultivation. Implementation of bilingual education policies has varied across local governments, occasionally drawing public criticism. For example, some schools have required teachers of non-English subjects to pass English proficiency

TRADE: The premier pledged safeguards on ‘Made in Taiwan’ labeling, anti-dumping measures and stricter export controls to strengthen its position in trade talks Products labeled “made in Taiwan” must be genuinely made in Taiwan, Premier Cho Jung-tai (卓榮泰) said yesterday, vowing to enforce strict safeguards against “origin laundering” and initiate anti-dumping investigations to prevent China dumping its products in Taiwan. Cho made the remarks in a discussion session with representatives from industries in Kaohsiung. In response to the US government’s recent announcement of “reciprocal” tariffs on its trading partners, President William Lai (賴清德) and Cho last week began a series of consultations with industry leaders nationwide to gather feedback and address concerns. Taiwanese and US officials held a videoconference on Friday evening to discuss the