Asian stocks advanced for the seventh time in eight weeks, sending a regional index to the highest level in four months, as production and earnings figures lifted confidence that the region’s economies have started to recover.

Canon Inc, the world’s largest seller of digital cameras, gained 8.1 percent after cost cuts helped the company boost its profit forecast and Japan’s production levels increased for the first time in six months. Li & Fung Ltd (利豐), the biggest supplier of toys and clothes to Wal-Mart Stores Inc, added 10 percent ahead of a report that Chinese manufacturing increased for a fifth month. Lion Nathan Ltd soared 41 percent after receiving a takeover offer.

The MSCI Asia-Pacific Index added 1.6 percent this week to 90.91, a level not seen since Jan. 7. Asian markets have rallied 29 percent since the MSCI benchmark dropped to an almost six-year low on March 9.

“All the things are in place for the bear market to have ended,” Anthony Bolton, London-based president of investments at Fidelity International, which oversees US$157.3 billion, told Bloomberg Television in Hong Kong. “We’re going to see a slow economic upturn, but that’s enough for the stock market. If you wait for things to get better, you’ll miss the rally.”

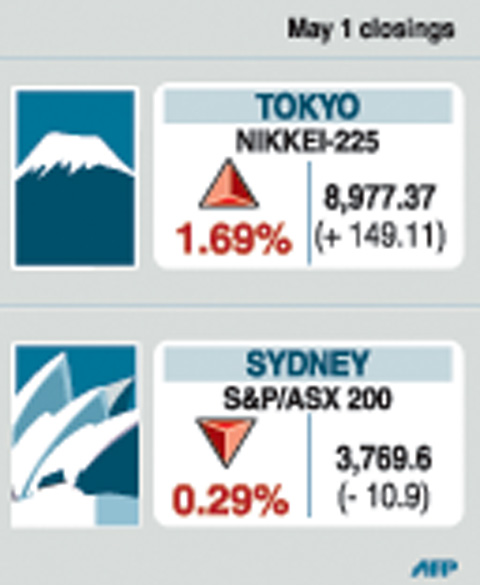

Japan’s Nikkei 225 Stock Average surged 3.1 percent to 8,977.37. Indonesia’s Jakarta Composite Index posted the region’s largest gain with an 8.3 percent advance after companies including PT Bank Rakyat Indonesia, the country’s No. 2 financial services provider, reported rising profits.

Markets shrugged off the outbreak of swine flu, and the bankruptcy of Chrysler LLC on Thursday also failed to derail market gains.

MSCI’s Asian index plunged by a record 43 percent last year as the credit crunch tipped the world’s largest economies into recession, forcing companies to idle factories and lay off workers.

Taiwan’s TAIEX index posted its steepest gain since 1991 on Thursday as the government allowed Chinese investments for the first time since a civil war ended six decades ago.

In the week to Thursday, the weighted index rose 111.80 points, or 1.90 percent, to 5,992.57 as Thursday’s rally made up losses earlier in the week on swine flu fears.

Average daily turnover stood at NT$128.28 billion (US$3.86 billion), compared with NT$130.81 billion a week earlier.

The market was closed on Friday for the Labor Day holiday.

Far EasTone Telecommunications Co (遠傳電信), Taiwan’s third-largest phone company, surged by 7.6 percent to NT$37.65 after China Mobile Ltd (中國移動) offered to buy a 12 percent stake for NT$17.77 billion (US$529 million).

Taiwanese share prices are expected to extend their gains next week on hopes over improving relations with China, dealers said on Thursday.

Buying next week may focus on large-cap electronic and financial stocks to help push the market past the psychological 6,000-point level and challenge 6,200 points, dealers said.

However, profit taking may emerge in the second half of the week as an outbreak of swine flu remains a concern to the already weak global economy, they said.

‘CROWN JEWEL’: Washington ‘can delay and deter’ Chinese President Xi Jinping’s plans for Taiwan, but it is ‘a very delicate situation there,’ the secretary of state said US President Donald Trump is opposed to any change to Taiwan’s “status quo” by force or extortion and would maintain that policy, US Secretary of State Marco Rubio told the Hugh Hewitt Show host on Wednesday. The US’ policy is to maintain Taiwan’s “status quo” and to oppose any changes in the situation by force or extortion, Rubio said. Hewitt asked Rubio about the significance of Trump earlier this month speaking with Taiwan Semiconductor Manufacturing Co (台積電) chairman C.C. Wei (魏哲家) at the White House, a meeting that Hewitt described as a “big deal.” Asked whether the meeting was an indication of the

‘RELATIVELY STRONG LANGUAGE’: An expert said the state department has not softened its language on China and was ‘probably a little more Taiwan supportive’ China’s latest drills near Taiwan on Monday were “brazen and irresponsible threats,” a US Department of State spokesperson said on Tuesday, while reiterating Washington’s decades-long support of Taipei. “China cannot credibly claim to be a ‘force for stability in a turbulent world’ while issuing brazen and irresponsible threats toward Taiwan,” the unnamed spokesperson said in an e-mailed response to media queries. Washington’s enduring commitment to Taiwan will continue as it has for 45 years and the US “will continue to support Taiwan in the face of China’s military, economic, informational and diplomatic pressure campaign,” the e-mail said. “Alongside our international partners, we firmly

KAOHSIUNG CEREMONY: The contract chipmaker is planning to build 5 fabs in the southern city to gradually expand its 2-nanometer chip capacity Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the world’s biggest contract chipmaker, yesterday confirmed that it plans to hold a ceremony on March 31 to unveil a capacity expansion plan for its most advanced 2-nanometer chips in Kaohsiung, demonstrating its commitment to further investment at home. The ceremony is to be hosted by TSMC cochief operating officer Y.P. Chyn (秦永沛). It did not disclose whether Premier Cho Jung-tai (卓榮泰) and high-ranking government officials would attend the ceremony. More details are to be released next week, it said. The chipmaker’s latest move came after its announcement earlier this month of an additional US$100 billion

Authorities yesterday elaborated on the rules governing Employment Gold Cards after a US cardholder was barred from entering Taiwan for six years after working without a permit during a 2023 visit. American YouTuber LeLe Farley was barred after already being approved for an Employment Gold Card, he said in a video published on his channel on Saturday. Farley, who has more than 420,000 subscribers on his YouTube channel, was approved for his Gold Card last month, but was told at a check-in counter at the Los Angeles International Airport that he could not enter Taiwan. That was because he previously participated in two