Asian stocks climbed for a sixth week, the longest streak of gains in more than two years, on increasing confidence the worst of the global recession is over.

China Cosco Holdings Co, the world’s largest operator of dry-bulk ships, surged 21 percent on rising Chinese exports and shipping rates. PT Bumi Resources, Asia’s largest exporter of power-station coal, jumped 21 percent in Jakarta as elections strengthened the hold Indonesia’s president has over parliament. JFE Holdings Inc, Japan’s No. 2 steelmaker, soared 22 percent on speculation it won’t make large price cuts and as the government unveiled a record stimulus package.

“We’re probably seeing a bottoming out in the economy,” said Arjuna Mahendran, Singapore-based chief investment strategist for Asia at HSBC Private Bank, which oversees US$494 billion in assets. “The second quarter will be good for stocks as corporate earnings should bounce.”

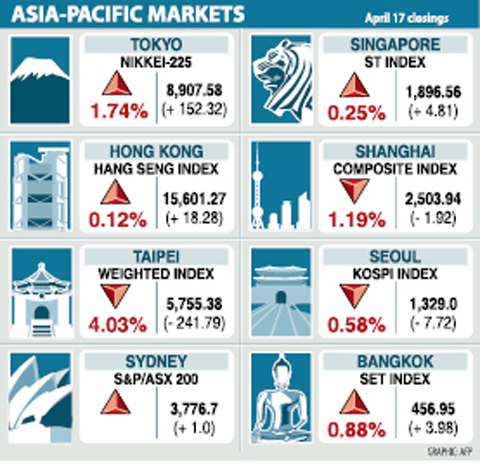

The MSCI Asia-Pacific Index rose 2 percent this week to 89.69, completing the longest stretch of gains since December 2006. Asian markets have rallied 27 percent since the MSCI benchmark dropped to a six-year low on March 9.

Japan’s Nikkei 225 Stock Average lost 0.6 percent. South Korea’s KOSPI index dropped 0.5 percent as brokerages cut recommendations on financial companies. Thailand’s SET Index gained 0.6 percent in a week shortened by new year holidays. The Thai government called a state of emergency following clashes between security forces and protesters in Bangkok.

MSCI’s Asian index plunged by a record 43 percent last year as the credit crunch tipped the world’s largest economies into recession, forcing companies to cut jobs amid slumping profits.

The gauge has rallied 27 percent from a five-year low reached on March 9 amid signs government measures to ease the financial crisis are working. Earnings estimates for companies included in the MSCI benchmark started to rise this month after a year of falling predictions, data compiled by Bloomberg showed.

China’s exports rose 39 percent last month from a month earlier, the customs bureau said on April 10, when Hong Kong markets were shut for a holiday. The Baltic Dry Index, a measure of shipping costs for commodities, jumped 13.8 percent this week. The gauge had slumped as much as 94 percent from a peak in May last year.

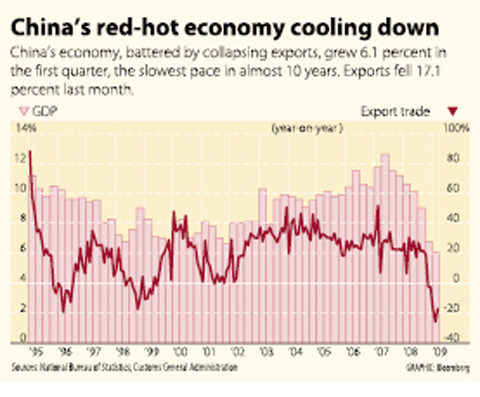

China posted a 6.1 percent annualized growth rate for the first quarter, the slowest rate of expansion in nearly a decade. That may mark the bottom for the world’s third-largest economy as a 4 trillion yuan (US$585 billion) stimulus package cushions the effects of the global recession.

Taiwanese share prices are expected to fall further in the week ahead following steep losses on Friday, with the market having failed to push above the key 6,000 point mark this week, dealers said.

Friday’s decline prompted many investors to be wary of stiff technical resistance ahead of 6,000 points, with the market having gained more than 30 percent since the beginning of last month, they said. Analysts said market sentiment toward the bellwether electronic sector is likely to turn cautious as high-tech heavyweights start to release their first quarter results next week.

However, companies with close business ties to China may attract interest, as they are expected to outperform the broader market, they added.

In the week to Friday, the TAIEX fell 26.58 points, or 0.50 percent, to 5,755.38 after a 4.56 percent increase a week earlier. Average daily turnover stood at NT$168.57 billion (US$4.99 billion), compared with NT$144.05 billion a week ago.

Other markets on Friday:

JAKARTA: Up 0.6 percent. The Jakarta Composite index rose 9.7 points to 1,634.79. The index has risen 24.59 percent over the past month.

MANILA: Up 1.42 percent. The composite index rose 29.47 points to 2,094.13. “Expectations of bad financial figures aren’t coming through,” Eagle Equities president Joseph Roxas said.

WELLINGTON: Up 1.81 percent. The NZX-50 gained 48.13 points to 2,711.29. The focus was on leading stocks and signs of fresh money entering the market, dealers said.

MUMBAI: Up 0.69 percent. The 30-share SENSEX rose 75.69 points to 11,023.09. Stocks shed most intraday gains as investors chose to unwind positions ahead of the weekend, dealers said.

AT RISK: The council reiterated that people should seriously consider the necessity of visiting China, after Beijing passed 22 guidelines to punish ‘die-hard’ separatists The Mainland Affairs Council (MAC) has since Jan. 1 last year received 65 petitions regarding Taiwanese who were interrogated or detained in China, MAC Minister Chiu Chui-cheng (邱垂正) said yesterday. Fifty-two either went missing or had their personal freedoms restricted, with some put in criminal detention, while 13 were interrogated and temporarily detained, he said in a radio interview. On June 21 last year, China announced 22 guidelines to punish “die-hard Taiwanese independence separatists,” allowing Chinese courts to try people in absentia. The guidelines are uncivilized and inhumane, allowing Beijing to seize assets and issue the death penalty, with no regard for potential

STILL COMMITTED: The US opposes any forced change to the ‘status quo’ in the Strait, but also does not seek conflict, US Secretary of State Marco Rubio said US President Donald Trump’s administration released US$5.3 billion in previously frozen foreign aid, including US$870 million in security exemptions for programs in Taiwan, a list of exemptions reviewed by Reuters showed. Trump ordered a 90-day pause on foreign aid shortly after taking office on Jan. 20, halting funding for everything from programs that fight starvation and deadly diseases to providing shelters for millions of displaced people across the globe. US Secretary of State Marco Rubio, who has said that all foreign assistance must align with Trump’s “America First” priorities, issued waivers late last month on military aid to Israel and Egypt, the

‘UNITED FRONT’ FRONTS: Barring contact with Huaqiao and Jinan universities is needed to stop China targeting Taiwanese students, the education minister said Taiwan has blacklisted two Chinese universities from conducting academic exchange programs in the nation after reports that the institutes are arms of Beijing’s United Front Work Department, Minister of Education Cheng Ying-yao (鄭英耀) said in an exclusive interview with the Chinese-language Liberty Times (the Taipei Times’ sister paper) published yesterday. China’s Huaqiao University in Xiamen and Quanzhou, as well as Jinan University in Guangzhou, which have 600 and 1,500 Taiwanese on their rolls respectively, are under direct control of the Chinese government’s political warfare branch, Cheng said, citing reports by national security officials. A comprehensive ban on Taiwanese institutions collaborating or

France’s nuclear-powered aircraft carrier and accompanying warships were in the Philippines yesterday after holding combat drills with Philippine forces in the disputed South China Sea in a show of firepower that would likely antagonize China. The Charles de Gaulle on Friday docked at Subic Bay, a former US naval base northwest of Manila, for a break after more than two months of deployment in the Indo-Pacific region. The French carrier engaged with security allies for contingency readiness and to promote regional security, including with Philippine forces, navy ships and fighter jets. They held anti-submarine warfare drills and aerial combat training on Friday in