After putting together a remarkable four-week winning streak, Wall Street faces a new test of its rally in the coming week with the opening of earnings season.

Although the market has been lifted by optimism that the worst crisis since the Great Depression is easing, the news from corporate America may provide clues about whether and when recovery is coming, say analysts.

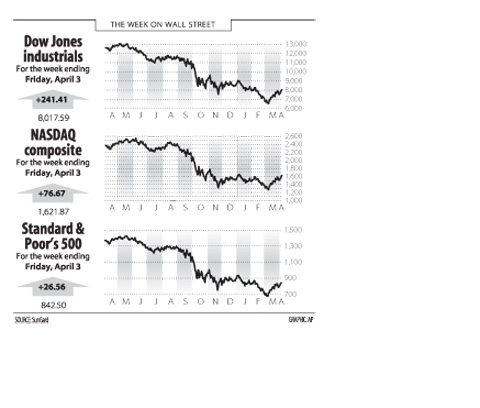

The Dow Jones Industrial Average climbed 3.1 percent in the week to Friday to close at 8,017.59, capping four sizzling weeks that added some 22 percent to the blue-chip index.

The Standard & Poor’s 500 index advanced 3.25 percent to 842.50, capping a 24 percent gain from lows hit on March 9.

The tech-heavy NASDAQ powered higher by 4.96 percent on the week to 1,621.87.

The market managed to shrug off weak economic news in the past few sessions, amid a growing consensus that the worst may be over.

“While the economic news continues to be awful, recent news, including the small incremental bump in auto sales, factory orders and [a purchasing manager survey on] manufacturing, are leading many investors to believe the end of the economic recession is finally coming into sight,” said Fred Dickson, chief market strategist at DA Davidson & Co.

“We are holding to our view that the rate of decline in the economy is beginning to slow, leading us to believe the economy has a good chance of bottoming out this summer,” he said.

Dickson said the rally has gained momentum as short sellers scramble to take profits and cover positions, and money managers with big cash positions “are becoming more nervous about missing the normal big early cycle move that traditionally leads an economic recovery.”

But he said a key test will be upcoming with first-quarter earnings reports that will begin to hit the tape over the next few days.

“That will be a real test to see if the current rally is just a technical rally within the overall context of an ongoing bear market or the first leg of a new bull market,” he said.

“Investors are very focused on what the economy will do in the second and third quarters,” Hugh Johnson at Johnson Illington Advisors said. “To get an idea of what the economy and earnings will do you have to look carefully at these earnings reports.”

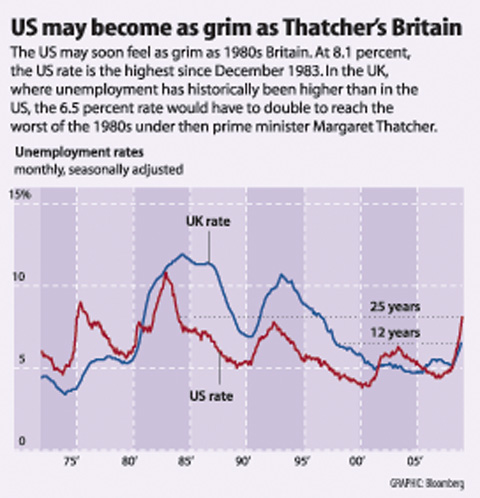

Analysts said the market took in stride Friday’s report showing a rise in the unemployment rate to 8.5 percent as 663,000 jobs were shed.

Douglas Porter, economist at BMO Capital Markets, said the view looking forward is not as bleak as in the rear-view mirror.

“Employment will be among the last major indicators to turn the corner,” he said.

“First, sales must revive, and then be sustained, then business will try to squeeze more out of remaining employees, then add hours to the workweek, and only then add to payrolls. So, even as jobs spiral lower, another broad array of indicators this week suggested that the howling recession winds may be easing a touch.”

Bonds fell sharply for the week on improved appetite for stocks. The yield on the 10-year US Treasury bond rose to 2.907 percent from 2.761 percent a week earlier and that on the 30-year bond increased to 3.721 percent from 3.618 percent. Bond yields and prices move in opposite directions.

CLASH OF WORDS: While China’s foreign minister insisted the US play a constructive role with China, Rubio stressed Washington’s commitment to its allies in the region The Ministry of Foreign Affairs (MOFA) yesterday affirmed and welcomed US Secretary of State Marco Rubio statements expressing the US’ “serious concern over China’s coercive actions against Taiwan” and aggressive behavior in the South China Sea, in a telephone call with his Chinese counterpart. The ministry in a news release yesterday also said that the Chinese Ministry of Foreign Affairs had stated many fallacies about Taiwan in the call. “We solemnly emphasize again that our country and the People’s Republic of China are not subordinate to each other, and it has been an objective fact for a long time, as well as

‘CHARM OFFENSIVE’: Beijing has been sending senior Chinese officials to Okinawa as part of efforts to influence public opinion against the US, the ‘Telegraph’ reported Beijing is believed to be sowing divisions in Japan’s Okinawa Prefecture to better facilitate an invasion of Taiwan, British newspaper the Telegraph reported on Saturday. Less than 750km from Taiwan, Okinawa hosts nearly 30,000 US troops who would likely “play a pivotal role should Beijing order the invasion of Taiwan,” it wrote. To prevent US intervention in an invasion, China is carrying out a “silent invasion” of Okinawa by stoking the flames of discontent among locals toward the US presence in the prefecture, it said. Beijing is also allegedly funding separatists in the region, including Chosuke Yara, the head of the Ryukyu Independence

‘VERY SHALLOW’: The center of Saturday’s quake in Tainan’s Dongshan District hit at a depth of 7.7km, while yesterday’s in Nansai was at a depth of 8.1km, the CWA said Two magnitude 5.7 earthquakes that struck on Saturday night and yesterday morning were aftershocks triggered by a magnitude 6.4 quake on Tuesday last week, a seismologist said, adding that the epicenters of the aftershocks are moving westward. Saturday and yesterday’s earthquakes occurred as people were preparing for the Lunar New Year holiday this week. As of 10am yesterday, the Central Weather Administration (CWA) recorded 110 aftershocks from last week’s main earthquake, including six magnitude 5 to 6 quakes and 32 magnitude 4 to 5 tremors. Seventy-one of the earthquakes were smaller than magnitude 4. Thirty-one of the aftershocks were felt nationwide, while 79

MARITIME SECURITY: Of the 52 vessels, 15 were rated a ‘threat’ for various reasons, including the amount of time they spent loitering near subsea cables, the CGA said Taiwan has identified 52 “suspicious” Chinese-owned ships flying flags of convenience that require close monitoring if detected near the nation, the Coast Guard Administration (CGA) said yesterday, as the nation seeks to protect its subsea telecoms cables. The stricter regime comes after a Cameroon-flagged vessel was briefly detained by the CGA earlier this month on suspicion of damaging an international cable northeast of Taiwan. The vessel is owned by a Hong Kong-registered company with a Chinese address given for its only listed director, the CGA said previously. Taiwan fears China could sever its communication links as part of an attempt