The Wall Street resurgence of the past weeks has pundits pondering: Has a new bull market begun after 17 months of horrific losses? Or is this just another heartbreaking “bear market” rally?

Bulls and bears both claim evidence in their favor after three consecutive weekly gains for the main US indexes.

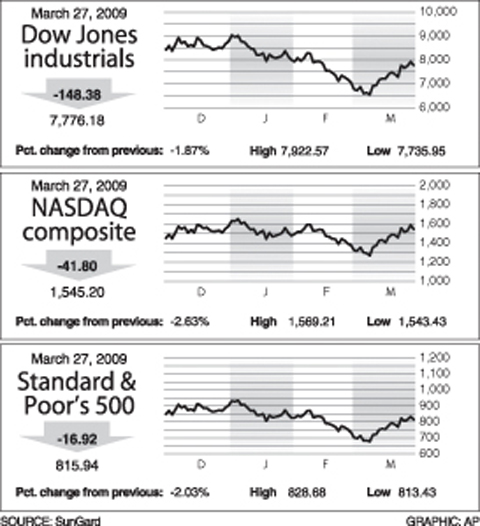

Over the week to Friday, the Dow Jones Industrial Average lifted 6.84 percent to 7,776.18 and the Standard & Poor’s 500 index rallied 6.17 percent to 815.94.

The technology-heavy NASDAQ posted a weekly gain of 6.03 percent to end on Friday at 1,545.20.

The major indexes have rallied at least 20 percent from lows hit early this month, giving rise to claims that the bear is dead and a new bull market has arrived.

Robert Brusca at FAO Economics called the 20 percent jump “a technical signal to kill the bear market.”

Even with hefty gains, the Dow index of blue chips and broad-market S&P 500 index remain down more than 40 percent from all-time highs hit in October 2007. Hence, the bear is still alive, by these measures.

Bob Dickey at RBC Wealth Management said it is too soon to call a new bull market despite the snapback.

“In olden times, these moves may have qualified as a new bull market, but in this day of much higher volatility, it will take more of a gain to reverse the bear trend, which, according to our measures, would take a move above 8,500 on the Dow to become official,” he said.

“That would mean waiting for a move of over 30 percent from the lows in order to create more bullish confidence,” he said.

Still, he said the horrendous selloffs may have led to “major market lows” early this month, “which makes us lean heavily in favor of a more meaningful uptrend than the bounce we have had so far.”

In the coming week, the market must grapple with grim economic realities: US auto sales this month are expected to show more hefty declines and Friday’s payrolls report is likely to reflect staggering new job losses, making it harder to sustain a recovery.

But many analysts say there are hopeful signs that the US economy may be stabilizing after a long and deep recession, which could mean the stock market will find its footing as well.

“Despite the doom and gloom outlook by some economists and the pessimistic feel on Main Street, recent economic data has shown signs of improvement,” said Kathy Lien at Global Forex Trading, citing upturns in consumer spending and several indicators on manufacturing.

“Although this is partially due to the overly pessimistic forecasts, the data also suggests that the economy could be stabilizing,” she said.

Larry Kantor at Barclays Capital said markets were ready to look forward to rosier times.

“We believe that the latest rally will have stronger legs, and thus marks an inflection point,” he said.

Kantor said the aggressive efforts by policymakers around the world and a massive decline in inventories sets the stage for better economic output.

“Reflecting all of this, we are now recommending that investors become more aggressive and take risk across a broader range of assets,” he said.

AIR SUPPORT: The Ministry of National Defense thanked the US for the delivery, adding that it was an indicator of the White House’s commitment to the Taiwan Relations Act Deputy Minister of National Defense Po Horng-huei (柏鴻輝) and Representative to the US Alexander Yui on Friday attended a delivery ceremony for the first of Taiwan’s long-awaited 66 F-16C/D Block 70 jets at a Lockheed Martin Corp factory in Greenville, South Carolina. “We are so proud to be the global home of the F-16 and to support Taiwan’s air defense capabilities,” US Representative William Timmons wrote on X, alongside a photograph of Taiwanese and US officials at the event. The F-16C/D Block 70 jets Taiwan ordered have the same capabilities as aircraft that had been upgraded to F-16Vs. The batch of Lockheed Martin

GRIDLOCK: The National Fire Agency’s Special Search and Rescue team is on standby to travel to the countries to help out with the rescue effort A powerful earthquake rocked Myanmar and neighboring Thailand yesterday, killing at least three people in Bangkok and burying dozens when a high-rise building under construction collapsed. Footage shared on social media from Myanmar’s second-largest city showed widespread destruction, raising fears that many were trapped under the rubble or killed. The magnitude 7.7 earthquake, with an epicenter near Mandalay in Myanmar, struck at midday and was followed by a strong magnitude 6.4 aftershock. The extent of death, injury and destruction — especially in Myanmar, which is embroiled in a civil war and where information is tightly controlled at the best of times —

China's military today said it began joint army, navy and rocket force exercises around Taiwan to "serve as a stern warning and powerful deterrent against Taiwanese independence," calling President William Lai (賴清德) a "parasite." The exercises come after Lai called Beijing a "foreign hostile force" last month. More than 10 Chinese military ships approached close to Taiwan's 24 nautical mile (44.4km) contiguous zone this morning and Taiwan sent its own warships to respond, two senior Taiwanese officials said. Taiwan has not yet detected any live fire by the Chinese military so far, one of the officials said. The drills took place after US Secretary

THUGGISH BEHAVIOR: Encouraging people to report independence supporters is another intimidation tactic that threatens cross-strait peace, the state department said China setting up an online system for reporting “Taiwanese independence” advocates is an “irresponsible and reprehensible” act, a US government spokesperson said on Friday. “China’s call for private individuals to report on alleged ‘persecution or suppression’ by supposed ‘Taiwan independence henchmen and accomplices’ is irresponsible and reprehensible,” an unnamed US Department of State spokesperson told the Central News Agency in an e-mail. The move is part of Beijing’s “intimidation campaign” against Taiwan and its supporters, and is “threatening free speech around the world, destabilizing the Indo-Pacific region, and deliberately eroding the cross-strait status quo,” the spokesperson said. The Chinese Communist Party’s “threats