The presidents of two regional Federal Reserve (Fed) banks voiced confidence the US economy would show signs of recovery by year’s end, responding to an unprecedented monetary stimulus and a US$787 billion fiscal package.

“Resumption of growth should not be too far off,” Minneapolis Fed President Gary Stern said yesterday in a speech, while Richmond Fed President Jeffrey Lacker cited several “favorable signs” for the economy, including stabilization in retail sales and continued improvements in wages and salaries.

Recent gains in home sales and residential construction also suggest that the rate of decline in GDP may be easing after a 6.3 percent annual pace of contraction in the fourth quarter, the worst performance since 1982.

Both Lacker and Stern noted uncertainty over the precise timing of a recovery. The economy has yet to show a decisive reaction to a reduction of the Fed’s benchmark interest rate to as low as 0 percent and emergency credit programs that have expanded the central bank’s balance sheet to US$2.07 trillion.

“It bears emphasizing that uncertainty about the economy is particularly acute right now,” Lacker said in a speech in Charleston, South Carolina. “While there are indications consistent with the emergence of positive momentum by the end of the year, we are likely to see quite negative economic reports in the meantime.”

The number of people collecting US unemployment benefits rose to a record 5.56 million as of March 14, indicating more Americans were spending longer periods out of work, the US Labor Department said yesterday. Initial claims topped 600,000 for an eighth straight time.

“The economy is in the midst of a serious recession that seems likely to persist at least though mid-year,” Stern said in a speech to the Economic Club of Minnesota in Minneapolis. “Once under way, the pace of expansion is likely to be subdued for some time.”

An increase in consumer spending may indicate that the economy is likely to stabilize by the end of the year, Lacker said.

“Prominent forecasters expect the economy to bottom out at some point later this year and then gradually regain forward momentum and I think that is a reasonable expectation,” he said.

Increased retail spending through last month “may be a sign that consumers are responding” to “less adverse longer-run income prospects,” Lacker said.

The Federal Open Market Committee on March 18 authorized the purchase of US$300 billion of long-term Treasuries and announced a plan to more than double purchases of mortgage debt to US$1.45 trillion in an attempt to reduce home-loan rates. Chairman Ben Bernanke is trying to prevent the credit contraction from deepening what may be the worst recession in 70 years.

Policymakers “have responded aggressively and, in some instances, with unprecedented action,” Stern said.

While it’s unclear whether “further steps will be required to restore stability,” Stern said he was “guardedly optimistic that many pieces are now in place to contribute to improvement in financial market conditions and in business activity.”

AIR SUPPORT: The Ministry of National Defense thanked the US for the delivery, adding that it was an indicator of the White House’s commitment to the Taiwan Relations Act Deputy Minister of National Defense Po Horng-huei (柏鴻輝) and Representative to the US Alexander Yui on Friday attended a delivery ceremony for the first of Taiwan’s long-awaited 66 F-16C/D Block 70 jets at a Lockheed Martin Corp factory in Greenville, South Carolina. “We are so proud to be the global home of the F-16 and to support Taiwan’s air defense capabilities,” US Representative William Timmons wrote on X, alongside a photograph of Taiwanese and US officials at the event. The F-16C/D Block 70 jets Taiwan ordered have the same capabilities as aircraft that had been upgraded to F-16Vs. The batch of Lockheed Martin

GRIDLOCK: The National Fire Agency’s Special Search and Rescue team is on standby to travel to the countries to help out with the rescue effort A powerful earthquake rocked Myanmar and neighboring Thailand yesterday, killing at least three people in Bangkok and burying dozens when a high-rise building under construction collapsed. Footage shared on social media from Myanmar’s second-largest city showed widespread destruction, raising fears that many were trapped under the rubble or killed. The magnitude 7.7 earthquake, with an epicenter near Mandalay in Myanmar, struck at midday and was followed by a strong magnitude 6.4 aftershock. The extent of death, injury and destruction — especially in Myanmar, which is embroiled in a civil war and where information is tightly controlled at the best of times —

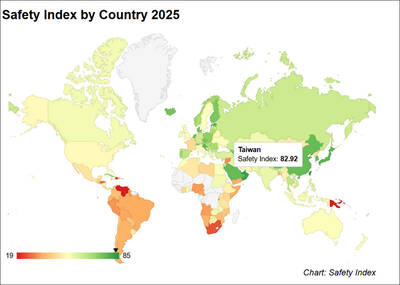

Taiwan was ranked the fourth-safest country in the world with a score of 82.9, trailing only Andorra, the United Arab Emirates and Qatar in Numbeo’s Safety Index by Country report. Taiwan’s score improved by 0.1 points compared with last year’s mid-year report, which had Taiwan fourth with a score of 82.8. However, both scores were lower than in last year’s first review, when Taiwan scored 83.3, and are a long way from when Taiwan was named the second-safest country in the world in 2021, scoring 84.8. Taiwan ranked higher than Singapore in ninth with a score of 77.4 and Japan in 10th with

SECURITY RISK: If there is a conflict between China and Taiwan, ‘there would likely be significant consequences to global economic and security interests,’ it said China remains the top military and cyber threat to the US and continues to make progress on capabilities to seize Taiwan, a report by US intelligence agencies said on Tuesday. The report provides an overview of the “collective insights” of top US intelligence agencies about the security threats to the US posed by foreign nations and criminal organizations. In its Annual Threat Assessment, the agencies divided threats facing the US into two broad categories, “nonstate transnational criminals and terrorists” and “major state actors,” with China, Russia, Iran and North Korea named. Of those countries, “China presents the most comprehensive and robust military threat