US stocks managed to chalk up back-to-back weeks of gains for the first time in 10 months after the US Federal Reserve provided an unexpected boost to sentiment with an aggressive move to pump up liquidity.

But with investors locking in profits on Friday amid waning enthusiasm over the central bank’s decision to inject another US$1 trillion into the financial system to prop up the economy, analysts said the market was expected to remain cautious.

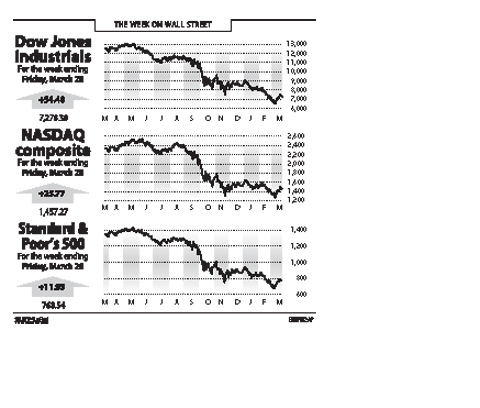

Over the week, the Dow Jones Industrial Average of 30 blue-chips added 0.75 percent to end at 7,278.38 — the first back-to-back weekly gains since May last year — despite two consecutive solid days of red ink on on Thursday and Friday.

The technology-heavy NASDAQ composite rose 1.8 percent to 1,457.27, while the broad-market Standard & Poor’s 500 Index was up 1.58 percent to 768.54 for the week.

“As the market has already experienced two periods of panic selling — late November and early March — we believe the downside risk is limited,” Wachovia Securities chief market strategist Al Goldman said amid increasing investor optimism about the global economy.

Investors are at their most optimistic about the global economy since December 2005, according to the Merrill Lynch Survey of Fund Managers for this month, although a prolonged banking crisis seems to be stopping them from putting cash into equities.

US share prices rose the past week after fresh data showed new US home construction and building permits saw a surprise jump last month from 50-year low levels in a positive sign for the moribund home market at the epicenter of the global financial crisis.

The market turned more buoyant after US Federal Reserve Chairman Ben Bernanke made a surprise announcement on Wednesday on buying up to US$300 billion in Treasury bonds and an additional US$850 billion in other debt in a bid to cut lending costs and fire up the sluggish economy.

But the enthusiasm died down by the end of the week as investors feared that the move carried a huge inflation risk as the more than US$1 trillion in new money might have to be paid for one way or the other, through taxes or higher inflation.

“One conclusion is that the Fed is simply printing money to provide liquidity. By definition this action is always inflationary,” Fred Dickson of DA Davidson & Co said. “What remains to be seen is how long it will take to show up in the prices consumers and businesses pay for goods.”

Although the market is not expecting any bombshells the coming week, it may have to contend with some weak economic numbers.

“We are expecting, however, another string of dismal economic reports,” IHS Global Insight economists said in a report.

They said all indicators pointed to another plunge in existing home sales for last month even if new home sales could stage a modest rebound from an all-time low in January.

A US economic contraction, at 6.2 percent the last quarter, could also be revised to show an even larger drop, the IHS Global Insight report said, forecasting 6.7 percent against an analysts consensus of 6.6 percent.

STILL COMMITTED: The US opposes any forced change to the ‘status quo’ in the Strait, but also does not seek conflict, US Secretary of State Marco Rubio said US President Donald Trump’s administration released US$5.3 billion in previously frozen foreign aid, including US$870 million in security exemptions for programs in Taiwan, a list of exemptions reviewed by Reuters showed. Trump ordered a 90-day pause on foreign aid shortly after taking office on Jan. 20, halting funding for everything from programs that fight starvation and deadly diseases to providing shelters for millions of displaced people across the globe. US Secretary of State Marco Rubio, who has said that all foreign assistance must align with Trump’s “America First” priorities, issued waivers late last month on military aid to Israel and Egypt, the

France’s nuclear-powered aircraft carrier and accompanying warships were in the Philippines yesterday after holding combat drills with Philippine forces in the disputed South China Sea in a show of firepower that would likely antagonize China. The Charles de Gaulle on Friday docked at Subic Bay, a former US naval base northwest of Manila, for a break after more than two months of deployment in the Indo-Pacific region. The French carrier engaged with security allies for contingency readiness and to promote regional security, including with Philippine forces, navy ships and fighter jets. They held anti-submarine warfare drills and aerial combat training on Friday in

COMBAT READINESS: The military is reviewing weaponry, personnel resources, and mobilization and recovery forces to adjust defense strategies, the defense minister said The military has released a photograph of Minister of National Defense Wellington Koo (顧立雄) appearing to sit beside a US general during the annual Han Kuang military exercises on Friday last week in a historic first. In the photo, Koo, who was presiding over the drills with high-level officers, appears to be sitting next to US Marine Corps Major General Jay Bargeron, the director of strategic planning and policy of the US Indo-Pacific Command, although only Bargeron’s name tag is visible in the seat as “J5 Maj General.” It is the first time the military has released a photo of an active

CHANGE OF MIND: The Chinese crew at first showed a willingness to cooperate, but later regretted that when the ship arrived at the port and refused to enter Togolese Republic-registered Chinese freighter Hong Tai (宏泰號) and its crew have been detained on suspicion of deliberately damaging a submarine cable connecting Taiwan proper and Penghu County, the Coast Guard Administration said in a statement yesterday. The case would be subject to a “national security-level investigation” by the Tainan District Prosecutors’ Office, it added. The administration said that it had been monitoring the ship since 7:10pm on Saturday when it appeared to be loitering in waters about 6 nautical miles (11km) northwest of Tainan’s Chiang Chun Fishing Port, adding that the ship’s location was about 0.5 nautical miles north of the No.