Wall Street’s stunning comeback from 12-year lows over the past week has sparked some hope for battered investors, but whether the rebound is genuine remains a topic of heated debate.

Some market watchers say a positive outlook from the battered banking sector and tentative signs of stability in some economic reports suggests the worst may be over for the economy and the stock market.

“Stocks have come a long way in a few days,” said Al Goldman, chief market strategist at Wachovia Securities. “The market has already discounted almost every conceivable problem. Thus, any additional evidence that the economy is close to bottoming will keep this market headed higher into year-end — we believe the economic storm is at its peak and will soon begin to moderate.”

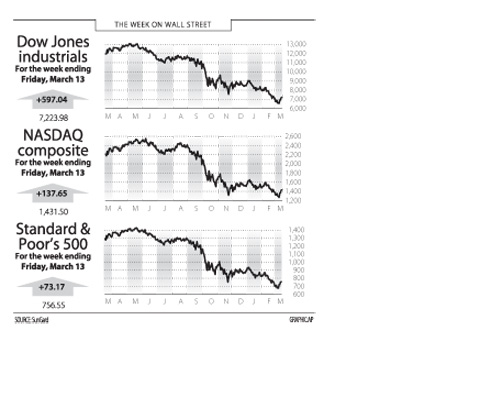

The Dow Jones Industrial Average of 30 blue-chips surged 9.0 percent on the week to end Friday at 7,223.98, roaring back from a 12-year low. The broad-market Standard & Poor’s 500 bounced back from a nearly 13-year low, rallying 10.7 percent in the week to 756.55.

The technology-heavy NASDAQ composite climbed 10.6 percent over the week to end at 1,431.50.

Despite the snapback, the Dow index is down 17.7 percent for this year, with the S&P off 16.2 percent and the NASDAQ 9.2 percent.

With a bear market still in force, many analysts say caution is warranted.

“For the time being, we continue to believe the stock market indices will remain volatile with sharp rallies being followed by corrections as market sentiment continues to be shaped by the daily economic, corporate and political news flow,” said Fred Dickson, strategist at DA Davidson & Co.

Dickson said until the market breaks out above the current trading range, “we will view the market action as a very welcome bear market short-covering rally rather than the beginning of the next long-term bull market.”

More pessimistic, economist Nouriel Roubini of New York University said there was a chance the global recession deepens into a depression, which would make the latest rebound another “sucker rally.”

“If a near depression were to take hold globally, a 40 to 50 percent further fall in US and global equities from current levels could not be ruled out,” Roubini said.

Kent Engelke, chief economic strategist at Capitol Securities Management, said he saw a possible upside surprise.

“Is this rally sustainable or is it just a dead cat bounce?” he said. “There is almost a 100 percent consensus that it is the latter and the lows will be revisited in short time, a pattern steep in precedence of the last 18 months.”

But he argued that “it has been my experience when everyone expects something to happen normally the inverse occurs.”

“I believe if the financials are indeed stabilizing and if there is a change in mark to market accounting, the odds are significant that we have experienced this cycle’s lows,” he added.

Sherry Cooper, chief economist at BMO Capital Markets, said two bits of news on the regulatory front have also brightened the mood.

She said officials and lawmakers seem to be moving toward easing the “mark-to-market” accounting rules that require banks to recognize losses quickly instead of holding them to await a recovery.

Bonds fell in the week. The yield on the 10-year US Treasury bond rose to 2.918 percent from 2.828 percent a week earlier and that on the 30-year bond increased to 3.671 percent from 3.503 percent. Bond yields and prices move in opposite directions.

The economic calendar in the coming week is light, with data due on housing starts and consumer prices. More significantly, the US Federal Reserve opens a two-day meeting on Tuesday expected to signal its intent next week to act even more aggressively in opening up credit markets to spark recovery from recession.

STILL COMMITTED: The US opposes any forced change to the ‘status quo’ in the Strait, but also does not seek conflict, US Secretary of State Marco Rubio said US President Donald Trump’s administration released US$5.3 billion in previously frozen foreign aid, including US$870 million in security exemptions for programs in Taiwan, a list of exemptions reviewed by Reuters showed. Trump ordered a 90-day pause on foreign aid shortly after taking office on Jan. 20, halting funding for everything from programs that fight starvation and deadly diseases to providing shelters for millions of displaced people across the globe. US Secretary of State Marco Rubio, who has said that all foreign assistance must align with Trump’s “America First” priorities, issued waivers late last month on military aid to Israel and Egypt, the

France’s nuclear-powered aircraft carrier and accompanying warships were in the Philippines yesterday after holding combat drills with Philippine forces in the disputed South China Sea in a show of firepower that would likely antagonize China. The Charles de Gaulle on Friday docked at Subic Bay, a former US naval base northwest of Manila, for a break after more than two months of deployment in the Indo-Pacific region. The French carrier engaged with security allies for contingency readiness and to promote regional security, including with Philippine forces, navy ships and fighter jets. They held anti-submarine warfare drills and aerial combat training on Friday in

COMBAT READINESS: The military is reviewing weaponry, personnel resources, and mobilization and recovery forces to adjust defense strategies, the defense minister said The military has released a photograph of Minister of National Defense Wellington Koo (顧立雄) appearing to sit beside a US general during the annual Han Kuang military exercises on Friday last week in a historic first. In the photo, Koo, who was presiding over the drills with high-level officers, appears to be sitting next to US Marine Corps Major General Jay Bargeron, the director of strategic planning and policy of the US Indo-Pacific Command, although only Bargeron’s name tag is visible in the seat as “J5 Maj General.” It is the first time the military has released a photo of an active

CHANGE OF MIND: The Chinese crew at first showed a willingness to cooperate, but later regretted that when the ship arrived at the port and refused to enter Togolese Republic-registered Chinese freighter Hong Tai (宏泰號) and its crew have been detained on suspicion of deliberately damaging a submarine cable connecting Taiwan proper and Penghu County, the Coast Guard Administration said in a statement yesterday. The case would be subject to a “national security-level investigation” by the Tainan District Prosecutors’ Office, it added. The administration said that it had been monitoring the ship since 7:10pm on Saturday when it appeared to be loitering in waters about 6 nautical miles (11km) northwest of Tainan’s Chiang Chun Fishing Port, adding that the ship’s location was about 0.5 nautical miles north of the No.