The dollar ended mixed on Friday in volatile trading as the markets tried to assess the impact of a grim report showing more massive US job losses, suggesting a long road to economic recovery.

The euro rose to US$1.2652 at 10pm GMT after US$1.2538 late on Thursday in New York. The euro jumped to US$1.2738 just after the announcement of the US jobs figures.

The US dollar edged up to ¥98.27 after ¥98.03 on Thursday.

The US government said the US economy shed 651,000 jobs last month, in line with most forecasts but also underscoring the dire state of the economy as companies axe jobs to cope with an intensifying slump.

The US unemployment rate rose from 7.6 percent in January to 8.1 last month, the highest since December 1983.

Although traders said it was a calamitous report that could signal a delayed economic recovery, some said the market was reassured that it failed to live up to the so-called “whisper number” of 1 million job losses.

“A look at the intraday price action in both the equity and currency markets reveal that traders reacted positively and not negatively to the nonfarm payrolls report,” Kathy Lien at Global Forex Trading said.

Investors on Friday welcomed the Bank of England’s (BOE) announcement that it would become the first European central bank to use “quantitative easing” to boost the money supply.

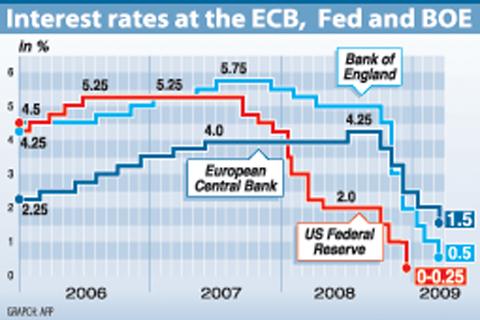

The BOE on Thursday cut its main rate by half a point to 0.50 percent, the lowest level in its 315-year history, and said it would pump £75 billion (US$106 billion) of newly created money into the financial system to combat a credit crunch.

The European Central Bank meanwhile slashed rates by 50 basis points to 1.5 percent and drastically revised its forecasts, predicting the eurozone economy will shrink 2.7 percent this year.

In late New York trading, the US dollar bought 1.1579 Swiss francs after SF1.1708 on Thursday.

The pound was at US$1.4076 from US$1.4113.

South Korea’s won and the Indian rupee led declines in Asian currencies this week on speculation investors will stay away from emerging-market assets as the global financial slump deepens.

The won posted its fifth weekly drop, approaching an 11-year low, on concern that global market turmoil will make it difficult for banks to raise funds needed to service overseas debt.

Malaysia’s ringgit slid for the fourth week as a government report showed exports tumbled the most in 15 years.

The won fell 1 percent this week to 1,550 per dollar at the 3pm local close, according to Seoul Money Brokerage Services Ltd. The currency touched 1,597, the lowest since 1998.

The rupee declined 1.1 percent to 51.7025 in Mumbai on Friday. The rupiah dropped 0.9 percent this week and traded at 12,090 in Jakarta, according to data compiled by Bloomberg.

The New Taiwan dollar gained 0.5 percent this week to NT$34.780 against the US currency, according to Taipei Forex Inc.

“Political risk declined in Taiwan, as it seems China is really intent on improving the relationship,” said Dariusz Kowalczyk, chief investment strategist at SJS Markets Ltd in Hong Kong. “There’s some relief in the currency market.”

The NT dollar could fall to NT$36 at the end of this month, Kowalczyk said.

The Philippine peso rebounded to 48.52 a dollar on Friday, after touching 49.26 on March 3 in Manila, the lowest level since Dec. 9, according to Tullett Prebon PLC.

Elsewhere, Malaysia’s ringgit ringgit dropped 0.4 percent this week to 3.7175 a dollar, the Thai baht traded at 36.07 versus 36.15 last week and Vietnam’s dong was little changed at 17,481.

The CIA has a message for Chinese government officials worried about their place in Chinese President Xi Jinping’s (習近平) government: Come work with us. The agency released two Mandarin-language videos on social media on Thursday inviting disgruntled officials to contact the CIA. The recruitment videos posted on YouTube and X racked up more than 5 million views combined in their first day. The outreach comes as CIA Director John Ratcliffe has vowed to boost the agency’s use of intelligence from human sources and its focus on China, which has recently targeted US officials with its own espionage operations. The videos are “aimed at

STEADFAST FRIEND: The bills encourage increased Taiwan-US engagement and address China’s distortion of UN Resolution 2758 to isolate Taiwan internationally The Presidential Office yesterday thanked the US House of Representatives for unanimously passing two Taiwan-related bills highlighting its solid support for Taiwan’s democracy and global participation, and for deepening bilateral relations. One of the bills, the Taiwan Assurance Implementation Act, requires the US Department of State to periodically review its guidelines for engagement with Taiwan, and report to the US Congress on the guidelines and plans to lift self-imposed limitations on US-Taiwan engagement. The other bill is the Taiwan International Solidarity Act, which clarifies that UN Resolution 2758 does not address the issue of the representation of Taiwan or its people in

DEFENDING DEMOCRACY: Taiwan shares the same values as those that fought in WWII, and nations must unite to halt the expansion of a new authoritarian bloc, Lai said The government yesterday held a commemoration ceremony for Victory in Europe (V-E) Day, joining the rest of the world for the first time to mark the anniversary of the end of World War II in Europe. Taiwan honoring V-E Day signifies “our growing connections with the international community,” President William Lai (賴清德) said at a reception in Taipei on the 80th anniversary of V-E Day. One of the major lessons of World War II is that “authoritarianism and aggression lead only to slaughter, tragedy and greater inequality,” Lai said. Even more importantly, the war also taught people that “those who cherish peace cannot

US Indo-Pacific Commander Admiral Samuel Paparo on Friday expressed concern over the rate at which China is diversifying its military exercises, the Financial Times (FT) reported on Saturday. “The rates of change on the depth and breadth of their exercises is the one non-linear effect that I’ve seen in the last year that wakes me up at night or keeps me up at night,” Paparo was quoted by FT as saying while attending the annual Sedona Forum at the McCain Institute in Arizona. Paparo also expressed concern over the speed with which China was expanding its military. While the US