Asian stocks posted the biggest weekly decline since October as the weakening global economy assailed corporate profits.

Mitsubishi UFJ Financial Group Inc, Japan’s largest listed bank, plunged 9.1 percent after the nation’s economy contracted at the fastest pace since 1974. Woori Finance Holdings Co, controlling South Korea’s second-largest bank, slumped 17 percent after rising bad loans forced it to apply for state funds. Elpida Memory Inc, Japan’s largest memory chipmaker, tumbled 27 percent after Standard & Poor’s slashed the company’s debt rating, citing its liquidity risk.

“There’s no magic potion we can all drink and cure the ills that the global economy has at the moment,” said Tim Schroeder, who helps manage about US$2.6 billion at Pengana Capital Ltd in Melbourne. “The evidence shows any pickup is going to be muted, and that profitability is not going to recover meaningfully for some time.”

The MSCI Asia-Pacific Index plunged 7 percent this week to 76.03, the steepest slide since the period ending Oct. 24. The gauge has plunged 15 percent this year and is less than 2 percent from a six-year low.

Japan’s TOPIX Index dropped 3.3 percent as it tumbled to the lowest since January 1984. All of the region’s benchmark equity indexes slumped, except in Pakistan. South Korea led the region’s declines as financial and heavy industry companies sent the KOSPI Index to an 11 percent slide.

MSCI’s Asian index slumped by a record 43 percent last year as the credit crunch tipped the world’s largest economies into recession, forcing companies to cut jobs amid falling profits. Earnings estimates for companies in the gauge have been slashed 44 percent since the beginning of the year, bringing them to the lowest level since Bloomberg began compiling the data in 2005.

Taiwanese share prices are expected to remain volatile next week as an unstable Wall Street continues to haunt market sentiment, dealers said on Friday.

A weakening New Taiwan dollar has discouraged foreign institutional investors from buying assets, including stocks, on the local market, paving the way for a further downturn, they said.

The financial sector is likely to continue to underperform the broader market on concerns over more possible bank bad loans after the island’s economy contracted a record 8.36 percent in the fourth quarter of last year, they added.

The market could extend its downside to test 4,300 points next week, while any technical rebound may face strong resistance at the key 4,500 point level, dealers said.

For the week to Friday, the weighted index fell 153.56 points or 3.35 percent to 4,436.94 after a 2.67 percent increase the previous week.

Average daily turnover stood at NT$65.84 billion (US$1.89 billion), compared with NT$73.60 billion a week earlier.

“Wall Street has fallen to a six-year low. It seems that more negative news related to the global economy will come to further hurt market sentiment,” Taiwan International Securities (金鼎證券) analyst Arch Shih (施博元) said.

Shih said the reduced trading volume showed investors’ hesitation to hunt bargains after the week’s losses.

“If daily turnover continues to shrink and fall below NT$50 billion, the market is expected to enter the doldrums,” Shih said.

On Friday, turnover fell to NT$59.85 billion from Thursday’s NT$70.52 billion.

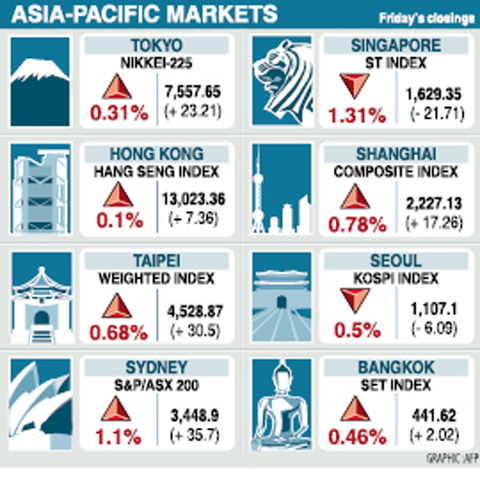

Other regional markets:

KUALA LUMPUR: Down 1.1 percent. The Kuala Lumpur Composite Index lost 9.88 points to 889.71.

BANGKOK: Down 1.57 percent. The Stock Exchange of Thailand composite index fell 6.95 points to 434.67 points. “The [market] sentiment was down as investors lost confidence in the global economy and solutions to the financial crisis in the US,” said Pichai Lertsupongkit, senior vice president at Thanachart Securities.

JAKARTA: Down 2 percent. The Jakarta Composite Index lost 26.75 points to 1,296.94.

MANILA: Down 1 percent. The composite index shed 18.36 points to 1,881.44. “Investors are selling because of the fear of what will happen in the US,” said April Lee-Tan, research head at CitisecOnline.com.

MUMBAI: Down 2.21 percent. The benchmark 30-share SENSEX index fell 199.42 points to 8,843.21 as foreign funds sold index heavyweights on the back of weak US index futures trends.

WELLINGTON: Down 1.54 percent. The benchmark NZX-50 index dropped 40.25 points to 2,576.68.

STILL COMMITTED: The US opposes any forced change to the ‘status quo’ in the Strait, but also does not seek conflict, US Secretary of State Marco Rubio said US President Donald Trump’s administration released US$5.3 billion in previously frozen foreign aid, including US$870 million in security exemptions for programs in Taiwan, a list of exemptions reviewed by Reuters showed. Trump ordered a 90-day pause on foreign aid shortly after taking office on Jan. 20, halting funding for everything from programs that fight starvation and deadly diseases to providing shelters for millions of displaced people across the globe. US Secretary of State Marco Rubio, who has said that all foreign assistance must align with Trump’s “America First” priorities, issued waivers late last month on military aid to Israel and Egypt, the

‘UNITED FRONT’ FRONTS: Barring contact with Huaqiao and Jinan universities is needed to stop China targeting Taiwanese students, the education minister said Taiwan has blacklisted two Chinese universities from conducting academic exchange programs in the nation after reports that the institutes are arms of Beijing’s United Front Work Department, Minister of Education Cheng Ying-yao (鄭英耀) said in an exclusive interview with the Chinese-language Liberty Times (the Taipei Times’ sister paper) published yesterday. China’s Huaqiao University in Xiamen and Quanzhou, as well as Jinan University in Guangzhou, which have 600 and 1,500 Taiwanese on their rolls respectively, are under direct control of the Chinese government’s political warfare branch, Cheng said, citing reports by national security officials. A comprehensive ban on Taiwanese institutions collaborating or

France’s nuclear-powered aircraft carrier and accompanying warships were in the Philippines yesterday after holding combat drills with Philippine forces in the disputed South China Sea in a show of firepower that would likely antagonize China. The Charles de Gaulle on Friday docked at Subic Bay, a former US naval base northwest of Manila, for a break after more than two months of deployment in the Indo-Pacific region. The French carrier engaged with security allies for contingency readiness and to promote regional security, including with Philippine forces, navy ships and fighter jets. They held anti-submarine warfare drills and aerial combat training on Friday in

COMBAT READINESS: The military is reviewing weaponry, personnel resources, and mobilization and recovery forces to adjust defense strategies, the defense minister said The military has released a photograph of Minister of National Defense Wellington Koo (顧立雄) appearing to sit beside a US general during the annual Han Kuang military exercises on Friday last week in a historic first. In the photo, Koo, who was presiding over the drills with high-level officers, appears to be sitting next to US Marine Corps Major General Jay Bargeron, the director of strategic planning and policy of the US Indo-Pacific Command, although only Bargeron’s name tag is visible in the seat as “J5 Maj General.” It is the first time the military has released a photo of an active