European stocks gained for a second week, erasing this year’s loss, as companies from Vodafone Group PLC to Electrolux AB reported better-than-estimated results and governments stepped up measures to revive the global economy.

Vodafone, the largest mobile-phone company, rose 6.7 percent this week after sales beat analysts’ projections. Electrolux, the second-biggest appliance maker, climbed 16 percent on a smaller-than-expected loss. Infineon Technologies AG increased 17 percent as Europe’s second-largest maker of semiconductors said it would deepen cost cuts and lower investments to preserve cash. Xstrata PLC led mining shares higher as metals prices rallied.

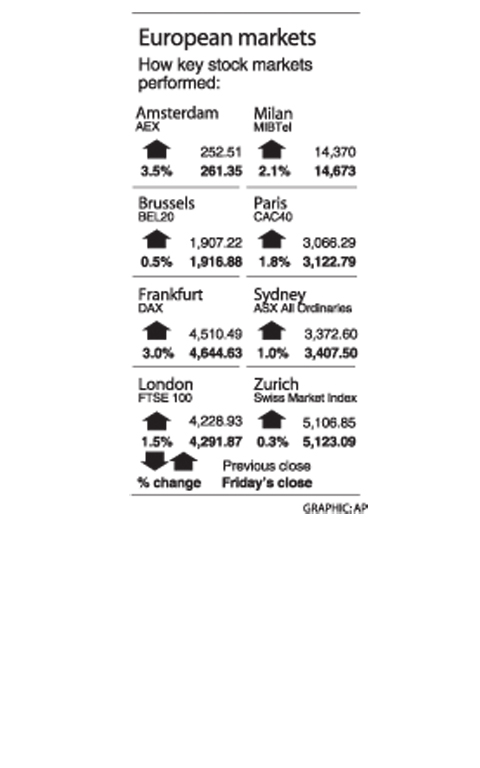

The Dow Jones STOXX 600 Index added 3.8 percent to 198.53, for a 0.1 percent gain this year.

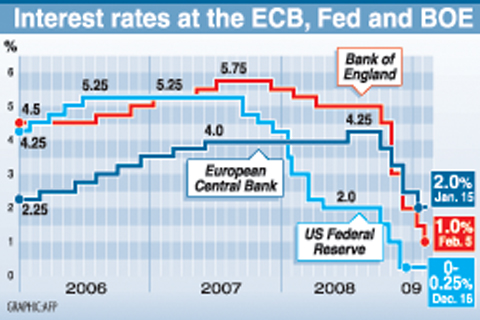

The measure has climbed 8.8 percent in the past two weeks amid speculation companies will weather the crisis that drove the US, Europe and Japan into simultaneous recessions and government measures and interest-rate cuts will revive the economy.

“Earnings from companies that depend on the economy have done better and that is reassuring,” said Bruno Ducros, a fund manager at Cardif Asset Management in Paris, which oversees about US$2.6 billion in stocks.

“It’s motivating the market. There are stimulus plans all over the world and that’s a very positive element,” he said.

National benchmark indexes increased in 15 of the 18 western European markets. Germany’s DAX Index rose 7.1 percent, while France’s CAC 40 advanced 5 percent. The UK’s FTSE 100 added 3.4 percent as Aviva PLC and BHP Billiton Ltd rallied.

Profits for companies in the index are expected to decline 1.6 percent this year following a 20 percent slump last year, according to data compiled by Bloomberg.

Governments around the world are fighting to revive a global economy burdened by more than US$1 trillion of losses and writedowns tied to the credit crisis.

China’s government started investing the second allocation of a 4 trillion-yuan (US$585 billion) economic stimulus package, the offical Xinhua news agency reported. Japan’s central bank said it will buy ¥1 trillion (US$10.9 billion) of shares held by financial institutions, while Australia announced A$42 billion (US$28 billion) in extra spending.

A Chinese freighter that allegedly snapped an undersea cable linking Taiwan proper to Penghu County is suspected of being owned by a Chinese state-run company and had docked at the ports of Kaohsiung and Keelung for three months using different names. On Tuesday last week, the Togo-flagged freighter Hong Tai 58 (宏泰58號) and its Chinese crew were detained after the Taipei-Penghu No. 3 submarine cable was severed. When the Coast Guard Administration (CGA) first attempted to detain the ship on grounds of possible sabotage, its crew said the ship’s name was Hong Tai 168, although the Automatic Identification System (AIS)

An Akizuki-class destroyer last month made the first-ever solo transit of a Japan Maritime Self-Defense Force ship through the Taiwan Strait, Japanese government officials with knowledge of the matter said yesterday. The JS Akizuki carried out a north-to-south transit through the Taiwan Strait on Feb. 5 as it sailed to the South China Sea to participate in a joint exercise with US, Australian and Philippine forces that day. The Japanese destroyer JS Sazanami in September last year made the Japan Maritime Self-Defense Force’s first-ever transit through the Taiwan Strait, but it was joined by vessels from New Zealand and Australia,

SECURITY: The purpose for giving Hong Kong and Macau residents more lenient paths to permanent residency no longer applies due to China’s policies, a source said The government is considering removing an optional path to citizenship for residents from Hong Kong and Macau, and lengthening the terms for permanent residence eligibility, a source said yesterday. In a bid to prevent the Chinese Communist Party (CCP) from infiltrating Taiwan through immigration from Hong Kong and Macau, the government could amend immigration laws for residents of the territories who currently receive preferential treatment, an official familiar with the matter speaking on condition of anonymity said. The move was part of “national security-related legislative reform,” they added. Under the amendments, arrivals from the Chinese territories would have to reside in Taiwan for

CRITICAL MOVE: TSMC’s plan to invest another US$100 billion in US chipmaking would boost Taiwan’s competitive edge in the global market, the premier said The government would ensure that the most advanced chipmaking technology stays in Taiwan while assisting Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) in investing overseas, the Presidential Office said yesterday. The statement follows a joint announcement by the world’s largest contract chipmaker and US President Donald Trump on Monday that TSMC would invest an additional US$100 billion over the next four years to expand its semiconductor manufacturing operations in the US, which would include construction of three new chip fabrication plants, two advanced packaging facilities, and a research and development center. The government knew about the deal in advance and would assist, Presidential