Asian stocks rose for a second week as optimism that government measures worldwide will ease the financial crisis offset cuts in earnings forecasts at Mizuho Financial Group Inc and Hitachi Ltd.

BHP Billiton Ltd and Kawasaki Kisen Kaisha Ltd led gains among mining and shipping companies after China cut some tariffs on raw material and component imports. Mitsubishi UFJ Financial Group Inc led banks lower as rival Mizuho, Japan’s second-largest lender, cut its earnings target. Hitachi, which makes electrical equipment, slumped 6.5 percent after forecasting the biggest loss by an Asian electronics maker.

“Fiscal and monetary stimulus policies have helped improve sentiment,” said Binay Chandgothia, who oversees about US$1.5 billion as chief investment officer at Principal Asset Management Co in Hong Kong. “These measures will benefit the economy, although there will be more earnings downgrades.”

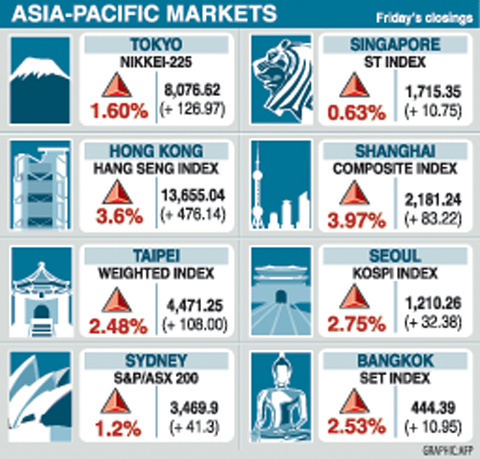

The MSCI Asia-Pacific Index rose 0.4 percent to 83.42 in the past five days, adding to the previous week’s 3.5 percent increase. The gauge is down 6.9 percent this year amid mounting signs the global recession has hurt corporate profits.

Toyota Motor Corp, the world’s largest automaker, on Friday widened its loss prediction on slowing demand in the US and in Japan. Mitsubishi UFJ cut its full-year profit forecast after the stock market closed on Friday.

The Nikkei 225 Stock Average added 1 percent last week, while Hong Kong’s Hang Seng index climbed 2.8 percent. China’s Shanghai Composite Index surged 9.6 percent.

Stocks have fallen this year amid mounting signs the financial crisis, which has caused more than US$1 trillion in credit-related losses, is hurting corporate earnings. With banks tightening lending, bankruptcies among Japan’s listed companies reached an annual postwar record last year, according to Tokyo Shoko Research Ltd.

Governments around the world are stepping up efforts to ease the crisis that the IMF predicts will cause global growth to almost grind to a halt this year.

Indonesia’s central bank this week lowered its benchmark interest rate for a third straight month. China’s government started investing a second allocation of a 4 trillion yuan (US$580 billion) economic stimulus package, the official Xinhua News Agency reported.

China’s State Council, or Cabinet, also this week said that components and raw materials that “really needed to be imported” will be exempted from import duties.

Taiwanese share prices are expected to encounter strong technical resistance before the market moves above 4,500 points in the week ahead, dealers said on Friday.

The bourse is likely to drop at the beginning of the week before regaining momentum in the second half owing to adequate liquidity as more institutional investors return to rebuild positions, they said.

Bellwether electronic shares may lead the gains on their attractive valuations after a sell-off ahead of the Lunar New Year holiday last month.

But the financial sector is likely to underperform the broader market on bad loan fears amid the economic meltdown, they added.

The market is expected to fall to between 4,200 and 4,300 points on technical factors early on but is likely to overcome the resistance to jump to around 4,550 later, dealers said.

In the week to Friday, the weighted index rose 223.28 points or 5.26 percent to 4,471.25 after a 2.71 percent fall the week before the Lunar New Year holiday.

Average daily turnover stood at NT$59.76 billion (US$1.77 billion), compared with NT$43.41 billion at the close of the previous trading week.

“The technical resistance ahead of 4,500 points is stiff. It is time for the market to pull back to some extent after a strong showing this week,” Taiwan International Securities (金鼎證券) analyst Arch Shih (施博元) said.

But, as many investors remain empty-handed after unloading their holdings before the holiday, the market will be filled with liquidity.

“They [investors] are still hunting bargains. Any technical downturn will provide them with good buying opportunities,” Shih said.

With trading turnover expanding, Shih said he expects large cap stocks, in particular electronics, to continue to be the favorites of institutional investors.

A Chinese freighter that allegedly snapped an undersea cable linking Taiwan proper to Penghu County is suspected of being owned by a Chinese state-run company and had docked at the ports of Kaohsiung and Keelung for three months using different names. On Tuesday last week, the Togo-flagged freighter Hong Tai 58 (宏泰58號) and its Chinese crew were detained after the Taipei-Penghu No. 3 submarine cable was severed. When the Coast Guard Administration (CGA) first attempted to detain the ship on grounds of possible sabotage, its crew said the ship’s name was Hong Tai 168, although the Automatic Identification System (AIS)

An Akizuki-class destroyer last month made the first-ever solo transit of a Japan Maritime Self-Defense Force ship through the Taiwan Strait, Japanese government officials with knowledge of the matter said yesterday. The JS Akizuki carried out a north-to-south transit through the Taiwan Strait on Feb. 5 as it sailed to the South China Sea to participate in a joint exercise with US, Australian and Philippine forces that day. The Japanese destroyer JS Sazanami in September last year made the Japan Maritime Self-Defense Force’s first-ever transit through the Taiwan Strait, but it was joined by vessels from New Zealand and Australia,

SECURITY: The purpose for giving Hong Kong and Macau residents more lenient paths to permanent residency no longer applies due to China’s policies, a source said The government is considering removing an optional path to citizenship for residents from Hong Kong and Macau, and lengthening the terms for permanent residence eligibility, a source said yesterday. In a bid to prevent the Chinese Communist Party (CCP) from infiltrating Taiwan through immigration from Hong Kong and Macau, the government could amend immigration laws for residents of the territories who currently receive preferential treatment, an official familiar with the matter speaking on condition of anonymity said. The move was part of “national security-related legislative reform,” they added. Under the amendments, arrivals from the Chinese territories would have to reside in Taiwan for

CRITICAL MOVE: TSMC’s plan to invest another US$100 billion in US chipmaking would boost Taiwan’s competitive edge in the global market, the premier said The government would ensure that the most advanced chipmaking technology stays in Taiwan while assisting Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) in investing overseas, the Presidential Office said yesterday. The statement follows a joint announcement by the world’s largest contract chipmaker and US President Donald Trump on Monday that TSMC would invest an additional US$100 billion over the next four years to expand its semiconductor manufacturing operations in the US, which would include construction of three new chip fabrication plants, two advanced packaging facilities, and a research and development center. The government knew about the deal in advance and would assist, Presidential