Crisis-stricken Royal Bank of Scotland took fresh help from the government on Monday and announced that its losses for last year could reach £28 billion (US$41.3 billion) — the biggest ever for a British corporation.

The government raised its stake in RBS from 58 percent to 70 percent in a deal which will save the company 600 million pounds a year in interest charges, but the agreement ignited fears in the market that the bank could soon be fully nationalized. RBS battered shares lost two-thirds of their value in on Monday’s trading.

“Isn’t this nationalization in all but name?” said Vincent Cable, a senior lawmaker from the Liberal Democrat party.

British Prime Minister Gordon Brown, who separately announced a new round of bailouts for Britain’s troubled banks, scolded RBS for what he called irresponsible risk-taking on mortgage-related securities in the US and the expensive takeover of Dutch bank ABN Amro.

The bank said it expected to mark down the value of past acquisitions including the ABN Amro deal by £15 billion to £20 billion, plus posting other losses up to £8 billion after a dismal fourth quarter.

The largest full-year loss previously reported by a British corporation was £15 billion, by Vodafone in 2006.

Royal Bank of Scotland shares, which traded at around £3 a year ago, finished the day down 67 percent at £0.116.

The bank said profits in retail and commercial business in Britain had been wiped out by losses in its global banking and markets division.

The bank said it had reached an agreement with the government, which took a 58 percent stake in the first round of bank bailouts, to convert £5 billion in preference shares held by the government to ordinary shares, saving RBS having to pay some £600 million a year in dividends.

“Yes, I am angry at the Royal Bank of Scotland and what happened,” Brown said at a news conference where he announced a new insurance program to cushion British banks’ exposure to bad assets.

“Almost all their losses are in the subprime markets in America and related to the acquisition of the bank ABN Amro. And these are irresponsible risks which were taken by a bank with people’s money in the United Kingdom,” Brown said.

In 2007 RBS led a consortium including Belgian-Dutch group Fortis and Spain’s Banco Santander in a takeover of ABN Amro at a cost of euro 70.5 billion.

In April, RBS launched a £12 billion rights issue to raise more capital from investors, the largest in British corporate history. Fred Goodwin, who directed the bank’s aggressive expansion, resigned in November last year when the government took a 58 percent stake in RBS in a first round of bailouts.

“The dislocation of credit markets and the global economic downturn continue to hit RBS hard, as with many other banks,” RBS chief executive Stephen Hester said.

“Significant uncertainties and risks inevitably remain. In this context, the support we are receiving from government benefits all our stakeholders and enables us to provide more customer support in return,” he added.

ACCOUNTABILITY: The incident, which occured at a Shin Kong Mitsukoshi Department Store in Taichung, was allegedly caused by a gas explosion on the 12th floor Shin Kong Group (新光集團) president Richard Wu (吳昕陽) yesterday said the company would take responsibility for an apparent gas explosion that resulted in four deaths and 26 injuries at Shin Kong Mitsukoshi Zhonggang Store in Taichung yesterday. The Taichung Fire Bureau at 11:33am yesterday received a report saying that people were injured after an explosion at the department store on Section 3 of Taiwan Boulevard in Taichung’s Situn District (西屯). It sent 56 ambulances and 136 paramedics to the site, with the people injured sent to Cheng Ching Hospital’s Chung Kang Branch, Wuri Lin Shin Hospital, Taichung Veterans General Hospital or Chung

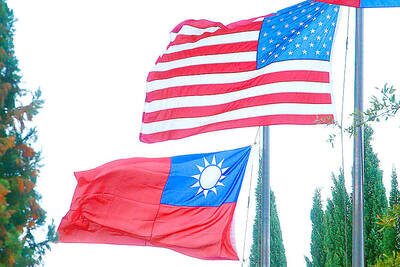

‘TAIWAN-FRIENDLY’: The last time the Web site fact sheet removed the lines on the US not supporting Taiwanese independence was during the Biden administration in 2022 The US Department of State has removed a statement on its Web site that it does not support Taiwanese independence, among changes that the Taiwanese government praised yesterday as supporting Taiwan. The Taiwan-US relations fact sheet, produced by the department’s Bureau of East Asian and Pacific Affairs, previously stated that the US opposes “any unilateral changes to the status quo from either side; we do not support Taiwan independence; and we expect cross-strait differences to be resolved by peaceful means.” In the updated version published on Thursday, the line stating that the US does not support Taiwanese independence had been removed. The updated

There is no need for one country to control the semiconductor industry, which is complex and needs a division of labor, Taiwan’s top technology official said yesterday after US President Donald Trump criticized the nation’s chip dominance. Trump repeated claims on Thursday that Taiwan had taken the industry and he wanted it back in the US, saying he aimed to restore US chip manufacturing. National Science and Technology Council Minister Wu Cheng-wen (吳誠文) did not name Trump in a Facebook post, but referred to President William Lai’s (賴清德) comments on Friday that Taiwan would be a reliable partner in the

‘CORRECT IDENTIFICATION’: Beginning in May, Taiwanese married to Japanese can register their home country as Taiwan in their spouse’s family record, ‘Nikkei Asia’ said The government yesterday thanked Japan for revising rules that would allow Taiwanese nationals married to Japanese citizens to list their home country as “Taiwan” in the official family record database. At present, Taiwanese have to select “China.” Minister of Foreign Affairs Lin Chia-lung (林佳龍) said the new rule, set to be implemented in May, would now “correctly” identify Taiwanese in Japan and help protect their rights, the Ministry of Foreign Affairs said in a statement. The statement was released after Nikkei Asia reported the new policy earlier yesterday. The name and nationality of a non-Japanese person marrying a Japanese national is added to the