Asian stocks rose last week, led by energy and raw-materials producers, after oil and metal prices rallied, and on speculation governments will step up measures to bolster the global economy.

CNOOC Ltd (中國海洋石油) rallied 14 percent and BHP Billiton Ltd, the world’s largest mining company, gained 6 percent as metals and oil climbed. Satyam Computer Services Ltd, an Indian software company, rallied 30.6 percent as the company’s chairman moved to restore investor confidence and as the Economic Times of India said Hewlett-Packard Co may buy a stake.

“There’s a bit of cautious optimism the new year might bring something better,” said Shane Oliver, head of investment strategy at AMP Capital Investors, which holds US$61 billion in Sydney. “Mining stocks were pushed down this year as investors realized the world was going to be dragged into some sort of recession. Growth should pick up through the second half of 2009.”

The MSCI Asia-Pacific Index advanced 3.1 percent to 90.12 this week. Measures of energy and raw-materials stocks had the biggest gains among the broader index’s 10 industry groups. The energy and materials gauges lost more than half their value last year, the MSCI Asia-Pacific’s worst performers, on concern the global economy sliding into recession would hurt commodity demand.

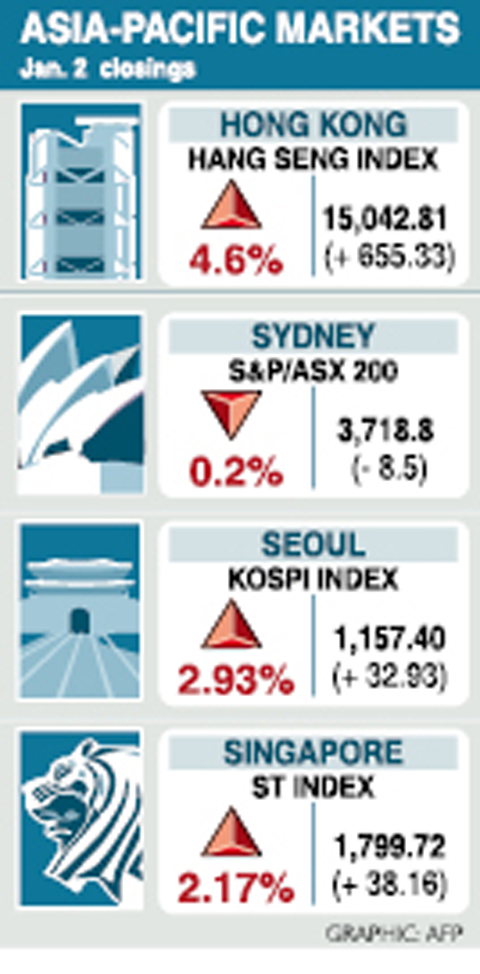

Japan was shut for the last three days of the week for the new year, with most markets closed on Thursday. Hong Kong’s Hang Seng Index climbed 4.6 percent on Friday for the best start to a year since at least 1970.

The Asian benchmark index lost 43 percent last year, the worst year in its two-decade history, as the collapse of the US housing market caused losses at financial institutions worldwide to swell to more than US$1 trillion.

Stock markets worldwide lost US$30 trillion in value last year, with only three of 89 major equity indexes tracked by Bloomberg posting gains. MSCI’s Asian gauge trades at about 13 times estimated profit, down more than one-fifth from a year ago.

Growth in the global economy will slow to 2.2 percent this year from last year’s 3.7 percent, the IMF said on Nov. 6. The IMF said a growth rate of 3 percent or less is “equivalent to a global recession.”

An index of Australian manufacturing contracted for a seventh month last month, an industry report released in Canberra on Friday showed. Singapore’s economy may shrink more than previously forecast this year, the government said.

The global slowdown has prompted governments worldwide including the US and Japan to slash interest rates and announce stimulus packages. South Korean President Lee Myung-bak pledged on Friday to keep devising measures to counter the slowdown.

Fubon Financial Holding Co (富邦金控), Taiwan’s No. 2 financial services company, surged 7.7 percent to NT$23.90. ProMOS Technologies Inc (茂德科技), Taiwan’s most unprofitable memory-chip maker, soared 16 percent to NT$2.43.

The government plans to spend NT$200 billion (US$6.1 billion) to help key industries through the global crisis, Premier Liu Chao-shiuan (劉兆玄) said on Tuesday.

Tokyo, Taipei, Shanghai, Bangkok, Manila, Jakarta and New Zealand were closed on Friday for public holidays and will reopen tomorrow.

Other regional markets:

KUALA LUMPUR: Malaysian shares rose 2 percent. The Kuala Lumpur Composite Index rose 17.61 points to close at 894.36. Advancing stocks outnumbered declines 392 to 139.

MUMBAI: Indian shares closed 0.55 percent higher. The benchmark 30-share SENSEX index closed 54.76 points higher at 9,958.22.

A Chinese freighter that allegedly snapped an undersea cable linking Taiwan proper to Penghu County is suspected of being owned by a Chinese state-run company and had docked at the ports of Kaohsiung and Keelung for three months using different names. On Tuesday last week, the Togo-flagged freighter Hong Tai 58 (宏泰58號) and its Chinese crew were detained after the Taipei-Penghu No. 3 submarine cable was severed. When the Coast Guard Administration (CGA) first attempted to detain the ship on grounds of possible sabotage, its crew said the ship’s name was Hong Tai 168, although the Automatic Identification System (AIS)

An Akizuki-class destroyer last month made the first-ever solo transit of a Japan Maritime Self-Defense Force ship through the Taiwan Strait, Japanese government officials with knowledge of the matter said yesterday. The JS Akizuki carried out a north-to-south transit through the Taiwan Strait on Feb. 5 as it sailed to the South China Sea to participate in a joint exercise with US, Australian and Philippine forces that day. The Japanese destroyer JS Sazanami in September last year made the Japan Maritime Self-Defense Force’s first-ever transit through the Taiwan Strait, but it was joined by vessels from New Zealand and Australia,

SECURITY: The purpose for giving Hong Kong and Macau residents more lenient paths to permanent residency no longer applies due to China’s policies, a source said The government is considering removing an optional path to citizenship for residents from Hong Kong and Macau, and lengthening the terms for permanent residence eligibility, a source said yesterday. In a bid to prevent the Chinese Communist Party (CCP) from infiltrating Taiwan through immigration from Hong Kong and Macau, the government could amend immigration laws for residents of the territories who currently receive preferential treatment, an official familiar with the matter speaking on condition of anonymity said. The move was part of “national security-related legislative reform,” they added. Under the amendments, arrivals from the Chinese territories would have to reside in Taiwan for

CRITICAL MOVE: TSMC’s plan to invest another US$100 billion in US chipmaking would boost Taiwan’s competitive edge in the global market, the premier said The government would ensure that the most advanced chipmaking technology stays in Taiwan while assisting Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) in investing overseas, the Presidential Office said yesterday. The statement follows a joint announcement by the world’s largest contract chipmaker and US President Donald Trump on Monday that TSMC would invest an additional US$100 billion over the next four years to expand its semiconductor manufacturing operations in the US, which would include construction of three new chip fabrication plants, two advanced packaging facilities, and a research and development center. The government knew about the deal in advance and would assist, Presidential