US stocks may have started the New Year with a bang, but experts see major headwinds for the market as the new administration of US president-elect Barack Obama moves rapidly to eject the economy from prolonged recession.

All three key stock indices shot up at least 6 percent in the week to Friday as investors banked on Obama, who takes over from US President George W. Bush on Jan. 20, to push ahead with a mammoth plan to stimulate growth in the world’s largest economy.

“Mr Obama’s stimulus plan will be a major focal point for the market in January,” Patrick O’Hare of Briefing.com said.

“No one knows for certain right now what it will end up looking like, but one thing is certain at this point: it will be big in terms of its cost,” he said.

Obama is scheduled to meet lawmakers tomorrow to finalize an infrastructure-based stimulus package that media reports say ranges from US$850 billion to US$1 trillion in a bid to pump prime the US economy, reeling from its worst crisis since the Great Depression.

Nigel Gault, chief economist at IHS Global Insight, cautioned that any stimulus plan based on spending to boost infrastructure would take time to revitalize the economy.

“But how quickly can the funds actually be spent?” he asked. “Infrastructure spending is a key part of the package, and it cannot be turned on and off like a faucet. We assume that the funds will take much longer than two years to spend out.”

But Gault said that combined with the Federal Reserve’s vigorous easing of interest rates, the stimulus package should help stabilize the economy in the second half of this year and promote some recovery during next year.

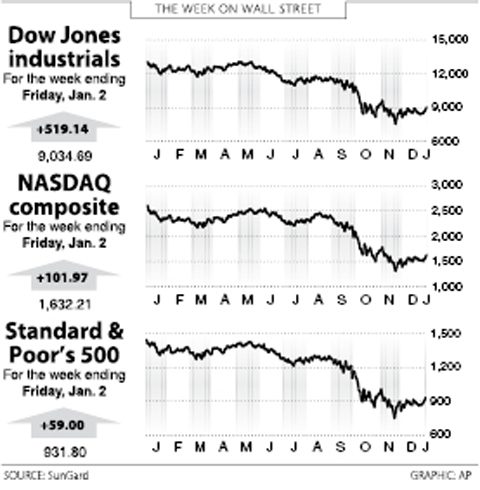

The Dow Jones Industrial Average surged a hefty 6.09 percent for the holiday-shortened week to finish Friday at 9,034.69, its highest close since Nov. 5.

The tech-studded NASDAQ leapt 6.66 percent to 1,632.21 and the broad-market Standard & Poor’s 500 index advanced 6.75 percent to 931.80 for the week.

Experts cautioned that the advances of the key indices came amid very low trading volume as many investors were still on holiday.

Only twice in the past seven sessions has trading volume on the New York Stock Exchange exceeded 1 billion shares.

Trading in the week ahead could be dictated by a series of new economic data to be released, including last month’s vehicle and retail sales figures and the widely watched employment report for the month, experts said. Economists expect that the US shed jobs for the 12th straight month last month while investors will closely watch to see if holiday retail sales were as poor as some retailers had suggested.

The number of companies to announce their quarterly earnings results will also start to pick up the coming week.

“Next week’s indicators will constitute yet another stark reminder of how forces in the economy reached maximum negative amplitude at the end of 2008,” analysts at Global Insight said in a report.

The bond market, which had greatly benefited from the financial and economic uncertainty, fell the past week.

The 10-year Treasury bond yield rose to 2.416 percent from 2.137 percent the previous week and that on the 30-year Treasury bond was up to 2.815 percent from 2.613 percent.

Bond yields and prices move in opposite directions.

SECURITY: As China is ‘reshaping’ Hong Kong’s population, Taiwan must raise the eligibility threshold for applications from Hong Kongers, Chiu Chui-cheng said When Hong Kong and Macau citizens apply for residency in Taiwan, it would be under a new category that includes a “national security observation period,” Mainland Affairs Council (MAC) Minister Chiu Chui-cheng (邱垂正) said yesterday. President William Lai (賴清德) on March 13 announced 17 strategies to counter China’s aggression toward Taiwan, including incorporating national security considerations into the review process for residency applications from Hong Kong and Macau citizens. The situation in Hong Kong is constantly changing, Chiu said to media yesterday on the sidelines of the Taipei Technology Run hosted by the Taipei Neihu Technology Park Development Association. With

CARROT AND STICK: While unrelenting in its military threats, China attracted nearly 40,000 Taiwanese to over 400 business events last year Nearly 40,000 Taiwanese last year joined industry events in China, such as conferences and trade fairs, supported by the Chinese government, a study showed yesterday, as Beijing ramps up a charm offensive toward Taipei alongside military pressure. China has long taken a carrot-and-stick approach to Taiwan, threatening it with the prospect of military action while reaching out to those it believes are amenable to Beijing’s point of view. Taiwanese security officials are wary of what they see as Beijing’s influence campaigns to sway public opinion after Taipei and Beijing gradually resumed travel links halted by the COVID-19 pandemic, but the scale of

A US Marine Corps regiment equipped with Naval Strike Missiles (NSM) is set to participate in the upcoming Balikatan 25 exercise in the Luzon Strait, marking the system’s first-ever deployment in the Philippines. US and Philippine officials have separately confirmed that the Navy Marine Expeditionary Ship Interdiction System (NMESIS) — the mobile launch platform for the Naval Strike Missile — would take part in the joint exercise. The missiles are being deployed to “a strategic first island chain chokepoint” in the waters between Taiwan proper and the Philippines, US-based Naval News reported. “The Luzon Strait and Bashi Channel represent a critical access

Pope Francis is be laid to rest on Saturday after lying in state for three days in St Peter’s Basilica, where the faithful are expected to flock to pay their respects to history’s first Latin American pontiff. The cardinals met yesterday in the Vatican’s synod hall to chart the next steps before a conclave begins to choose Francis’ successor, as condolences poured in from around the world. According to current norms, the conclave must begin between May 5 and 10. The cardinals set the funeral for Saturday at 10am in St Peter’s Square, to be celebrated by the dean of the College