Battered US stocks enter the New Year next week on expectations of a gradual market recovery as US president-elect Barack Obama moves to drag the world’s biggest economy out of recession.

The US stock market has risen about 20 percent from its climactic lows reached on Nov. 21 and “chances that we saw the bottom of the bear have increased because of the massive easing done by the Federal Reserve since then,” said Alfred Goldman, chief market strategist at Wachovia Securities.

The Fed had vowed to do whatever it takes to help the economy and the credit markets, as it slashed interest rates to virtually zero two weeks ago to jumpstart the economy from the worst slump since the Great Depression.

Goldman said stock valuation levels were “very attractive” and “the risk of a depression is extremely unlikely,” forecasting the recession may end next summer.

“We do know that 2009 will bring a new slate of ideas from a very popular president-elect,” he said ahead of Obama’s inauguration on Jan. 20 and the prospect of a massive stimulus package by his new administration.

Amid the current gloom of job and spending cuts as well as a credit squeeze, “the seeds are being sown for a modest recovery that we are forecasting to begin in mid-2009,” said Stephen Auth of Federated Investors.

“The prospect for eventual better times has led us to raise slightly the risk profile of our model stock-bond portfolio to capitalize on opportunities that arise in the months after the economy bottoms,” he said.

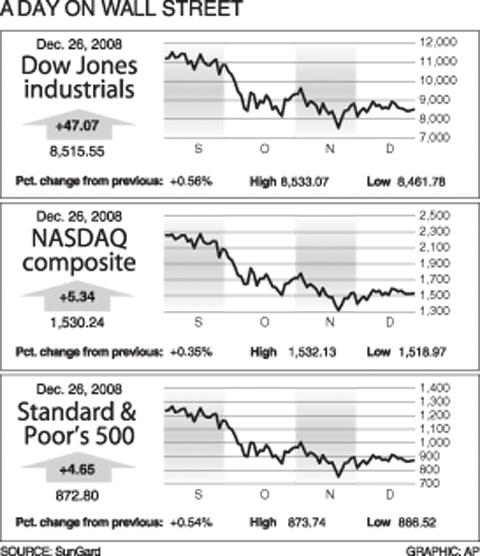

In the week to Friday, the Dow Jones Industrial Average, Wall Street’s benchmark index, fell 0.74 percent to 8,515.55 following a 0.59 percent drop the previous week.

The tech-studded NASDAQ shed 2.17 percent to 1,530.24 while the broad-market Standard and Poor’s 500 was down 1.69 percent to 872.80.

The stock decline stemmed from weak data on the ailing housing sector, and concerns over the fate of struggling automakers as well as plunging corporate earnings and retail sales as well as deteriorating US commercial property values.

“The underpinnings of the markets continue to improve, but it is still too early to say that the worst is finally over,” said Paul Nolte, director of investments at Hinsdale Associates.

“Our best guess at this point is that we rally a bit early in the New Year as investors wish 2008 good riddance,” he said.

However, he cautioned that once the likelihood of a still weak economy persisted into the second quarter, the market could visit old lows during the first half to eight months of the year.

“We are expecting that the second half of the year is not only good for the market ... and the economy should also begin to improve,” he said. The bond market, which had greatly benefited from the financial and economic uncertainty, fell the past week.

The 10-year Treasury bond yield rose to 2.137 percent from 2.131 percent the previous week and that on the 30-year Treasury bond was up to 2.613 percent from 2.562 percent.

Bond yields and prices move in opposite directions.

A Chinese freighter that allegedly snapped an undersea cable linking Taiwan proper to Penghu County is suspected of being owned by a Chinese state-run company and had docked at the ports of Kaohsiung and Keelung for three months using different names. On Tuesday last week, the Togo-flagged freighter Hong Tai 58 (宏泰58號) and its Chinese crew were detained after the Taipei-Penghu No. 3 submarine cable was severed. When the Coast Guard Administration (CGA) first attempted to detain the ship on grounds of possible sabotage, its crew said the ship’s name was Hong Tai 168, although the Automatic Identification System (AIS)

An Akizuki-class destroyer last month made the first-ever solo transit of a Japan Maritime Self-Defense Force ship through the Taiwan Strait, Japanese government officials with knowledge of the matter said yesterday. The JS Akizuki carried out a north-to-south transit through the Taiwan Strait on Feb. 5 as it sailed to the South China Sea to participate in a joint exercise with US, Australian and Philippine forces that day. The Japanese destroyer JS Sazanami in September last year made the Japan Maritime Self-Defense Force’s first-ever transit through the Taiwan Strait, but it was joined by vessels from New Zealand and Australia,

SECURITY: The purpose for giving Hong Kong and Macau residents more lenient paths to permanent residency no longer applies due to China’s policies, a source said The government is considering removing an optional path to citizenship for residents from Hong Kong and Macau, and lengthening the terms for permanent residence eligibility, a source said yesterday. In a bid to prevent the Chinese Communist Party (CCP) from infiltrating Taiwan through immigration from Hong Kong and Macau, the government could amend immigration laws for residents of the territories who currently receive preferential treatment, an official familiar with the matter speaking on condition of anonymity said. The move was part of “national security-related legislative reform,” they added. Under the amendments, arrivals from the Chinese territories would have to reside in Taiwan for

COORDINATION, ASSURANCE: Separately, representatives reintroduced a bill that asks the state department to review guidelines on how the US engages with Taiwan US senators on Tuesday introduced the Taiwan travel and tourism coordination act, which they said would bolster bilateral travel and cooperation. The bill, proposed by US senators Marsha Blackburn and Brian Schatz, seeks to establish “robust security screenings for those traveling to the US from Asia, open new markets for American industry, and strengthen the economic partnership between the US and Taiwan,” they said in a statement. “Travel and tourism play a crucial role in a nation’s economic security,” but Taiwan faces “pressure and coercion from the Chinese Communist Party [CCP]” in this sector, the statement said. As Taiwan is a “vital trading