European stocks fell this past week, led by financial companies and commodity producers on concern corporate earnings may deteriorate further as the global economic slowdown deepens.

BNP Paribas SA tumbled 31 percent after saying losses at its investment bank since October more than wiped out the division’s profit this year.

Royal Bank of Scotland Group Plc lost 23 percent after disclosing investments with Bernard Madoff, the investment adviser who was arrested in a potential US$50 billion fraud. BG Group Plc and Xstrata Plc both sank more than 3 percent as crude oil plunged below US$36 a barrel and metal prices fell.

The Dow Jones Stoxx 600 Index retreated 0.9 percent this week to 196.43, bringing its decline this year to 46 percent as credit losses and writedowns at the world’s largest banks surpassed US$1 trillion and the US, Europe and Japan entered the first simultaneous recessions since World War II.

“The economic slowdown is reflected in the price of oil,” said Chicuong Dang, an analyst at KBL Richelieu Gestion in Paris, which has about US$5.6 billion under management. “It shows that the market context is very difficult. We have to expect further downgrades of ratings and profit warnings. There’s a lot of volatility to come.”

The Stoxx 600 dropped every day this week except on Tuesday.

The US Federal Reserve this week cut its benchmark interest rate to as low as zero for the first time and pledged to use “all available tools” to spur economic growth.

US president-elect Barack Obama may ask Congress to approve a stimulus plan of around $850 billion.

The European Central Bank also cut the rate it pays institutions to deposit money with it overnight in an effort to jolt banks into lending more to each other.

National benchmark indexes rose in 10 out of 18 western European markets. Germany’s DAX gained 0.7 percent. Britain’s FTSE 100 rose 0.2 percent and France’s CAC 40 added 0.4 percent.

The Dow Jones Europe Stoxx Banks Index fell 6.5 percent in the week, the sharpest retreat among 19 industry groups.

BNP, France’s largest bank, plunged 31 percent. The corporate and investment division had a 710 million euro (US$981 million) pretax loss in the first 11 months of the year and may cut about 800 jobs, or 5 percent of the unit’s staff.

Separately, a Belgian court froze the lender’s plans to buy Fortis assets and the bank said it has as much as 350 million euros at risk from investments with Madoff.

Fortis, the insurer that was once Belgium’s largest financial services company, rallied 22 percent in Brussels.

HSBC Holdings Plc slipped 16 percent. CLSA Asia-Pacific Markets said Europe’s largest bank may seek to raise about US$14 billion as increasing bad-loan provisions erode profits. HSBC also has US$1 billion at risk after providing financing to funds that invested with Madoff.

SECURITY: As China is ‘reshaping’ Hong Kong’s population, Taiwan must raise the eligibility threshold for applications from Hong Kongers, Chiu Chui-cheng said When Hong Kong and Macau citizens apply for residency in Taiwan, it would be under a new category that includes a “national security observation period,” Mainland Affairs Council (MAC) Minister Chiu Chui-cheng (邱垂正) said yesterday. President William Lai (賴清德) on March 13 announced 17 strategies to counter China’s aggression toward Taiwan, including incorporating national security considerations into the review process for residency applications from Hong Kong and Macau citizens. The situation in Hong Kong is constantly changing, Chiu said to media yesterday on the sidelines of the Taipei Technology Run hosted by the Taipei Neihu Technology Park Development Association. With

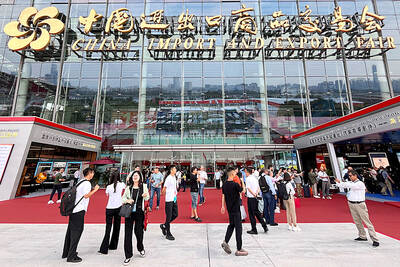

CARROT AND STICK: While unrelenting in its military threats, China attracted nearly 40,000 Taiwanese to over 400 business events last year Nearly 40,000 Taiwanese last year joined industry events in China, such as conferences and trade fairs, supported by the Chinese government, a study showed yesterday, as Beijing ramps up a charm offensive toward Taipei alongside military pressure. China has long taken a carrot-and-stick approach to Taiwan, threatening it with the prospect of military action while reaching out to those it believes are amenable to Beijing’s point of view. Taiwanese security officials are wary of what they see as Beijing’s influence campaigns to sway public opinion after Taipei and Beijing gradually resumed travel links halted by the COVID-19 pandemic, but the scale of

A US Marine Corps regiment equipped with Naval Strike Missiles (NSM) is set to participate in the upcoming Balikatan 25 exercise in the Luzon Strait, marking the system’s first-ever deployment in the Philippines. US and Philippine officials have separately confirmed that the Navy Marine Expeditionary Ship Interdiction System (NMESIS) — the mobile launch platform for the Naval Strike Missile — would take part in the joint exercise. The missiles are being deployed to “a strategic first island chain chokepoint” in the waters between Taiwan proper and the Philippines, US-based Naval News reported. “The Luzon Strait and Bashi Channel represent a critical access

Pope Francis is be laid to rest on Saturday after lying in state for three days in St Peter’s Basilica, where the faithful are expected to flock to pay their respects to history’s first Latin American pontiff. The cardinals met yesterday in the Vatican’s synod hall to chart the next steps before a conclave begins to choose Francis’ successor, as condolences poured in from around the world. According to current norms, the conclave must begin between May 5 and 10. The cardinals set the funeral for Saturday at 10am in St Peter’s Square, to be celebrated by the dean of the College