China’s sovereign wealth fund, which last year poured US$5 billion into Morgan Stanley, is reluctant to plow more money into foreign banks until governments hash out coherent policies to cope with the global economic and financial turmoil, the fund’s head said yesterday.

The remarks by Lou Jiwei (樓繼偉), chairman of the US$200 billion China Investment Corp (CIC, 中國投資公司), represent a new blow for ailing banks that were hoping the Chinese government investment fund would use its deep pool of cash to bail them out.

Lou said that he was unwilling to invest in foreign banks amid so much turbulence and uncertainty. Confidence in financial institutions is lacking because foreign governments seem to be changing their policies every week, he said.

“Right now, we do not have the courage to invest in financial institutions,” said Lou, speaking on a panel discussion in Hong Kong at a conference organized by former US president Bill Clinton.

“We have to wait for the time when there won’t be massive collapses of financial institutions,” he said.

The Chinese government investment arm was set up to make profitable use of Beijing’s foreign reserves, which totaled US$1.9 trillion by the end of September.

Most of those funds are kept in US Treasuries and other safe but low-yielding securities. But there have been complaints about the performance of some of the fund’s higher profile investments amid the recent market turmoil.

CIC’s biggest investment to date was a US$5 billion investment in Morgan Stanley in last December — one of nine major banks that subsequently sought relief from the deepening credit crisis through the US government’s US$700 billion banking bailout. That investment gave CIC a 9.9 percent stake in the investment bank.

The Chinese sovereign wealth fund was also said by Chinese media to have invested more than US$100 million in Visa Inc’s US$19.1 billion initial public offering in March and has invested in a fund managed by JC Flowers, a US private equity firm.

Last month, the private equity firm Blackstone Group said in a regulatory filing that it has agreed to raise CIC’s ownership limit from 9.9 percent to 12.5 percent. CIC paid US$3 billion for a stake in Blackstone’s June initial public offering, but it has seen the value of that investment plunge — a major sore point for many Chinese officials and citizens.

Lou said China’s fund would help soften the bite of the ongoing global crisis by continuing to invest in wealthy countries as well as in developing nations. But he said people should not count on China to pull the world out of the economic crisis.

“China can’t save the world. It can only save itself,” he said.

Lou said China’s economy, the world’s fourth largest, is in relatively good shape, but is facing several major challenges, such as boosting domestic consumption and becoming less dependent on exports.

“This will be very difficult and requires a lot of reforms,” he said. “It might take one to two years.”

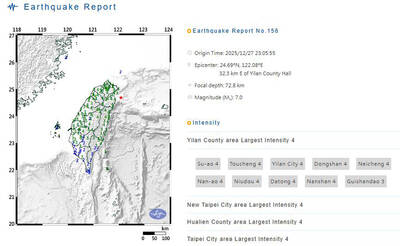

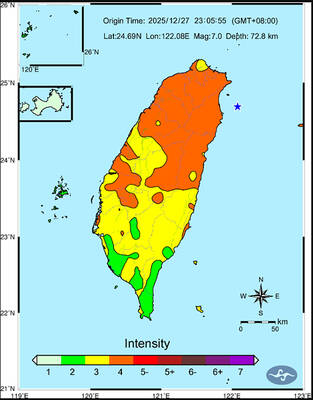

A magnitude 7.0 earthquake struck off Yilan at 11:05pm yesterday, the Central Weather Administration (CWA) said. The epicenter was located at sea, about 32.3km east of Yilan County Hall, at a depth of 72.8km, CWA data showed There were no immediate reports of damage. The intensity of the quake, which gauges the actual effect of a seismic event, measured 4 in Yilan County area on Taiwan’s seven-tier intensity scale, the data showed. It measured 4 in other parts of eastern, northern and central Taiwan as well as Tainan, and 3 in Kaohsiung and Pingtung County, and 2 in Lienchiang and Penghu counties and 1

FOREIGN INTERFERENCE: Beijing would likely intensify public opinion warfare in next year’s local elections to prevent Lai from getting re-elected, the ‘Yomiuri Shimbun’ said Internal documents from a Chinese artificial intelligence (AI) company indicated that China has been using the technology to intervene in foreign elections, including propaganda targeting Taiwan’s local elections next year and presidential elections in 2028, a Japanese newspaper reported yesterday. The Institute of National Security of Vanderbilt University obtained nearly 400 pages of documents from GoLaxy, a company with ties to the Chinese government, and found evidence that it had apparently deployed sophisticated, AI-driven propaganda campaigns in Hong Kong and Taiwan to shape public opinion, the Yomiuri Shimbun reported. GoLaxy provides insights, situation analysis and public opinion-shaping technology by conducting network surveillance

‘POLITICAL GAME’: DPP lawmakers said the motion would not meet the legislative threshold needed, and accused the KMT and the TPP of trivializing the Constitution The Legislative Yuan yesterday approved a motion to initiate impeachment proceedings against President William Lai (賴清德), saying he had undermined Taiwan’s constitutional order and democracy. The motion was approved 61-50 by lawmakers from the main opposition Chinese Nationalist Party (KMT) and the smaller Taiwan People’s Party (TPP), who together hold a legislative majority. Under the motion, a roll call vote for impeachment would be held on May 19 next year, after various hearings are held and Lai is given the chance to defend himself. The move came after Lai on Monday last week did not promulgate an amendment passed by the legislature that

AFTERMATH: The Taipei City Government said it received 39 minor incident reports including gas leaks, water leaks and outages, and a damaged traffic signal A magnitude 7.0 earthquake struck off Taiwan’s northeastern coast late on Saturday, producing only two major aftershocks as of yesterday noon, the Central Weather Administration (CWA) said. The limited aftershocks contrast with last year’s major earthquake in Hualien County, as Saturday’s earthquake occurred at a greater depth in a subduction zone. Saturday’s earthquake struck at 11:05pm, with its hypocenter about 32.3km east of Yilan County Hall, at a depth of 72.8km. Shaking was felt in 17 administrative regions north of Tainan and in eastern Taiwan, reaching intensity level 4 on Taiwan’s seven-tier seismic scale, the CWA said. In Hualien, the