Asian stocks had their second-best week this year after China slashed interest rates, spurring speculation government measures will pull the global economy out of recession and boost demand.

Inpex Corp, Japan’s largest energy explorer, jumped 26 percent in Tokyo after oil had its best week in six months. Zijin Mining Group Co, China’s largest gold producer, surged 25 percent as bullion climbed. Guangzhou R&F Properties Co jumped 41 percent after China cut its key lending rate by the most in 11 years to revive the world’s fourth-largest economy, three weeks after the government announced a stimulus plan worth more than US$500 billion.

“Sentiment is stabilizing,” said Kwon Hyeuk-boo, a fund manager at Daishin Investment Trust Management Co in Seoul, which oversees about US$1.4 billion in assets. “Investors are buying into expectations that support measures will keep coming. China’s strong will to support its economy is serving as a key catalyst to Asian markets.”

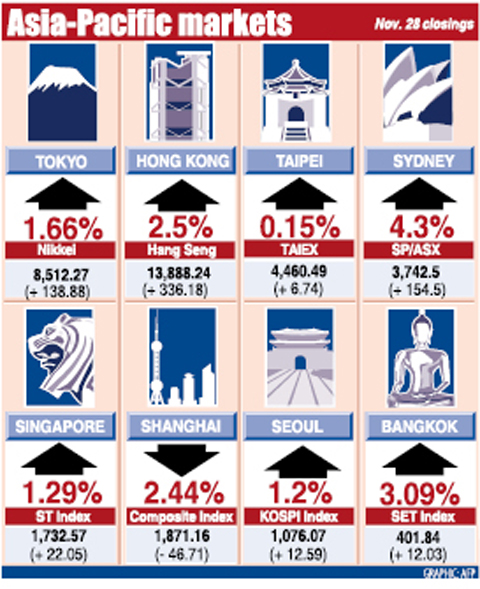

The MSCI Asia-Pacific Index rose 6.8 percent to 82.67, the second-best gain this year, surpassed only by a 6.9 percent rally at the end of last month, when central banks from Japan to Taiwan lowered borrowing costs. Commodities producers had the biggest gains among the 10 industry groups.

Japan’s Nikkei 225 Stock Average advanced 7.6 percent to 8,512.27. Elpida Memory Inc, Japan’s biggest memory-chip maker, climbed 27 percent after saying it plans to gain control of a production venture with Taiwan’s Powerchip Semiconductor Corp (力晶半導體).

Elpida jumped 27 percent to ¥445. The Tokyo-based chipmaker will increase its stake in joint venture Rexchip Electronics Corp (瑞晶) to 52 percent, Hsinchu-based Powerchip said on Thursday. The investment will give Elpida control of a factory that runs on the latest technology for making computer-memory chips at a fraction of the cost of building a plant.

Asian shares also climbed after the US Federal Reserve committed US$800 billion to unfreeze credit markets, while Citigroup Inc received a US$306 billion government rescue and the EU proposed a 200 billion euro (US$257 billion) spending package.

The gain for MSCI’s Asia-Pacific index pared this month’s drop to 3.8 percent, the seventh monthly decline and the longest losing streak since the gauge began in December 1987.

MSCI’s Asian index has plunged 48 percent this year as global financial companies’ losses and writedowns from the collapse of the US subprime-mortgage market neared US$1 trillion.

Shares on the MSCI gauge are now valued at 10.2 times trailing earnings after falling to as low as 8.2 times last month. That compares with 19.5 times on Nov. 11 last year, when the measure hit a peak of 172.32. Prior to the current market turmoil, the price-earnings ratio never dropped below 10, Bloomberg data show.

The People’s Bank of China on Wednesday cut its one-year lending rate by 108 basis points to 5.58 percent, less than three weeks after announcing a 4 trillion yuan (US$586 billion) economic stimulus plan. China is the largest trading partner for Japan and Australia and was the biggest contributor to global economic growth last year.

TAIPEI

Taiwanese share prices are expected to encounter strong resistance in the week ahead as the index approaches the upper technical 4,500 to 4,600 point range, dealers said on Friday.

Despite a recent significant technical rebound, market confidence remains weak amid lingering concerns over a global economic downturn and further volatility on Wall Street, they said.

Investors have turned cautious before bellwether electronics companies release their sales figures for this month, starting from next week, to give a clearer indication on economic fundamentals, they added.

While profit taking may continue to weigh in the market next week, a short-term technical support could be seen at around 4,100 points, dealers said.

For the week to Friday, the weighted index closed up 289.39 points, or 6.94 percent, at 4,460.49 after a 6.32 percent fall a week earlier.

Other regional markets:

KUALA LUMPUR: Malaysian shares closed 0.4 percent lower. The Kuala Lumpur Composite Index shed 3.84 points to end the day at 866.14.

JAKARTA: Indonesian shares ended 3.3 percent higher. The Jakarta Composite Index rose 39.47 points to 1,241.54.

MANILA: Philippine share prices closed 0.2 percent higher. The composite index added 4.56 points to 1,971.57. Trading resumes on Tuesday as markets will be closed tomorrow for a public holiday.

WELLINGTON: New Zealand shares closed 1.58 percent higher. The benchmark NZX-50 index rose 42.22 points to 2,710.96.

MUMBAI: Indian shares closed up 0.73 percent. The benchmark 30-share SENSEX rose 66 points to 9,092.72.

AIR SUPPORT: The Ministry of National Defense thanked the US for the delivery, adding that it was an indicator of the White House’s commitment to the Taiwan Relations Act Deputy Minister of National Defense Po Horng-huei (柏鴻輝) and Representative to the US Alexander Yui on Friday attended a delivery ceremony for the first of Taiwan’s long-awaited 66 F-16C/D Block 70 jets at a Lockheed Martin Corp factory in Greenville, South Carolina. “We are so proud to be the global home of the F-16 and to support Taiwan’s air defense capabilities,” US Representative William Timmons wrote on X, alongside a photograph of Taiwanese and US officials at the event. The F-16C/D Block 70 jets Taiwan ordered have the same capabilities as aircraft that had been upgraded to F-16Vs. The batch of Lockheed Martin

GRIDLOCK: The National Fire Agency’s Special Search and Rescue team is on standby to travel to the countries to help out with the rescue effort A powerful earthquake rocked Myanmar and neighboring Thailand yesterday, killing at least three people in Bangkok and burying dozens when a high-rise building under construction collapsed. Footage shared on social media from Myanmar’s second-largest city showed widespread destruction, raising fears that many were trapped under the rubble or killed. The magnitude 7.7 earthquake, with an epicenter near Mandalay in Myanmar, struck at midday and was followed by a strong magnitude 6.4 aftershock. The extent of death, injury and destruction — especially in Myanmar, which is embroiled in a civil war and where information is tightly controlled at the best of times —

China's military today said it began joint army, navy and rocket force exercises around Taiwan to "serve as a stern warning and powerful deterrent against Taiwanese independence," calling President William Lai (賴清德) a "parasite." The exercises come after Lai called Beijing a "foreign hostile force" last month. More than 10 Chinese military ships approached close to Taiwan's 24 nautical mile (44.4km) contiguous zone this morning and Taiwan sent its own warships to respond, two senior Taiwanese officials said. Taiwan has not yet detected any live fire by the Chinese military so far, one of the officials said. The drills took place after US Secretary

THUGGISH BEHAVIOR: Encouraging people to report independence supporters is another intimidation tactic that threatens cross-strait peace, the state department said China setting up an online system for reporting “Taiwanese independence” advocates is an “irresponsible and reprehensible” act, a US government spokesperson said on Friday. “China’s call for private individuals to report on alleged ‘persecution or suppression’ by supposed ‘Taiwan independence henchmen and accomplices’ is irresponsible and reprehensible,” an unnamed US Department of State spokesperson told the Central News Agency in an e-mail. The move is part of Beijing’s “intimidation campaign” against Taiwan and its supporters, and is “threatening free speech around the world, destabilizing the Indo-Pacific region, and deliberately eroding the cross-strait status quo,” the spokesperson said. The Chinese Communist Party’s “threats