Wall Street finally found something to cheer about as the holiday season starts, offering hope that the battered stock market has turned a corner.

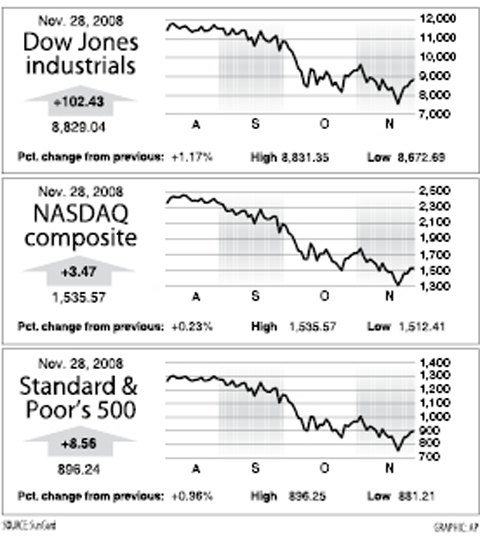

Rebounding from multiyear lows, the Dow Jones Industrial Average surged 9.73 percent in an abbreviated week to end Friday at 8,829.04, after a five-session win streak.

The tech-heavy NASDAQ rallied 10.92 percent to 1,535.57, while the broad-market Standard & Poor’s 500 came back from the prior week’s 11-year low to gain 12.03 percent to 896.24.

For some, the rally meant the market has managed to successfully hold above key lows, in a positive sign for an ailing Wall Street.

The coming week provides investors with another gut-check and more economic and corporate data likely to be gloomy.

Monthly sales from automakers, which have been dropping precipitously, will be closely followed by the market.

Although the economic news continues to be grim, many investors are looking past the current turmoil seeing signs of an easing of a crippling credit crunch that could mean a recovery for the economy and markets next year.

Ed Yardeni at Yardeni Research said the market was encouraged by the latest initiative by the US Treasury and Federal Reserve, allowing the Fed to buy up to US$600 billion in mortgage securities and pump US$200 billion into securities backed consumer credit.

Also helping was the government rescue of troubled bank Citigroup, which got a fresh capital injection of US$20 billion and a guarantee on US$300 billion in troubled mortgage assets.

“Investors may believe that the Treasury has finally stumbled on a good idea. Instead of buying troubled assets, why not just slap a government guarantee on them and ring-fence them?” Yardeni said. “If the government guarantees can deliver a good Santa Claus rally for the financials and the overall market over the rest of the year, that’s OK by me.”

The market has also been encouraged by US president-elect Barack Obama’s efforts to put in place a strong economic team to tackle the crisis when he takes office in January.

Al Goldman at Wachovia Securities said that “Obama’s selection of a very experienced and center-to-right economists for his administration hit a market that was short term very oversold.”

Some said the market is close to a bottom if that has not already been reached, with selling pressures exhausted after a dismal year that has pushed the broad market down nearly 40 percent.

“The economic news is dreadful, as it should be as we’re staring into the abyss of a recession,” Philip Orlando at Federated Investments said. “But the economic news should get progressively less dreadful as we proceed through the first half of 2009, as the fiscal and monetary policy stimulus begins to kick the economy back into gear.”

Based on this assumption, Orlando said the market may be poised to extend its gains.

Bonds rose sharply in the past week, with yields falling to unprecedented lows amid signs of easing credit conditions.

The yield on the 10-year Treasury bond tumbled to 2.957 percent from 3.167 percent a week earlier, and the 30-year Treasury bond yield slid to 3.487 percent from 3.663 percent. The lower yields reflect higher bond prices.

The CIA has a message for Chinese government officials worried about their place in Chinese President Xi Jinping’s (習近平) government: Come work with us. The agency released two Mandarin-language videos on social media on Thursday inviting disgruntled officials to contact the CIA. The recruitment videos posted on YouTube and X racked up more than 5 million views combined in their first day. The outreach comes as CIA Director John Ratcliffe has vowed to boost the agency’s use of intelligence from human sources and its focus on China, which has recently targeted US officials with its own espionage operations. The videos are “aimed at

STEADFAST FRIEND: The bills encourage increased Taiwan-US engagement and address China’s distortion of UN Resolution 2758 to isolate Taiwan internationally The Presidential Office yesterday thanked the US House of Representatives for unanimously passing two Taiwan-related bills highlighting its solid support for Taiwan’s democracy and global participation, and for deepening bilateral relations. One of the bills, the Taiwan Assurance Implementation Act, requires the US Department of State to periodically review its guidelines for engagement with Taiwan, and report to the US Congress on the guidelines and plans to lift self-imposed limitations on US-Taiwan engagement. The other bill is the Taiwan International Solidarity Act, which clarifies that UN Resolution 2758 does not address the issue of the representation of Taiwan or its people in

US Indo-Pacific Commander Admiral Samuel Paparo on Friday expressed concern over the rate at which China is diversifying its military exercises, the Financial Times (FT) reported on Saturday. “The rates of change on the depth and breadth of their exercises is the one non-linear effect that I’ve seen in the last year that wakes me up at night or keeps me up at night,” Paparo was quoted by FT as saying while attending the annual Sedona Forum at the McCain Institute in Arizona. Paparo also expressed concern over the speed with which China was expanding its military. While the US

SHIFT: Taiwan’s better-than-expected first-quarter GDP and signs of weakness in the US have driven global capital back to emerging markets, the central bank head said The central bank yesterday blamed market speculation for the steep rise in the local currency, and urged exporters and financial institutions to stay calm and stop panic sell-offs to avoid hurting their own profitability. The nation’s top monetary policymaker said that it would step in, if necessary, to maintain order and stability in the foreign exchange market. The remarks came as the NT dollar yesterday closed up NT$0.919 to NT$30.145 against the US dollar in Taipei trading, after rising as high as NT$29.59 in intraday trading. The local currency has surged 5.85 percent against the greenback over the past two sessions, central