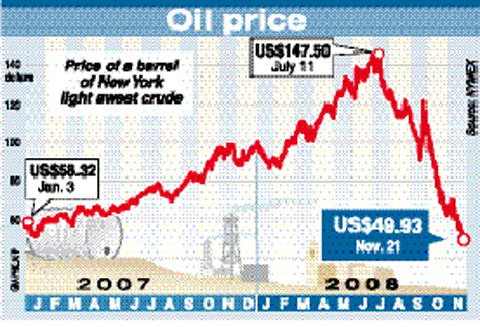

Oil prices collapsed this week to under US$50, their lowest levels in almost four years, as the market focused on the threat of a global recession and tumbling energy demand.

Base metals aluminum and copper also hit their worst levels for more than three years as traders fretted about weaker demand from struggling automakers in the US.

“The deterioration in the global economic outlook had led to a significant decline in commodity prices and, most notably, energy and industrial metal prices,” Deutsche Bank analyst Michael Lewis said. “It has also led to a significant increase in inventories, for example across the industrial metals complex.”

Oil prices have plunged two-thirds since striking record highs above US$147 in July when fears of supply disruptions had helped to send them into orbit.

The fall below US$50 reflects an assumption that demand will be affected not only in Western countries but in China and India, whose rapid growth was also a major force pushing prices to record highs earlier this year, Jason Feer of energy market analysts Argus Media said.

“The market is fully internalizing the realization that the coming recession is going to be pretty significant and is likely to affect demand in some of the emerging countries that have been propping up the market,” Feer said.

Analysts said sentiment has been hammered by an unrelenting series of bad economic data in the US, the world’s biggest energy consumer.

The eurozone is already in recession — defined as two successive quarters of negative economic growth.

Action should meanwhile be taken to halt the decline in oil prices, Libya’s OPEC representative told reporters on Friday.

Nevertheless, Shukri Ghanem — the head of Libya’s national oil firm and its envoy to the OPEC oil cartel — did not explicitly repeat his call for oil production to be cut when the organization meets in Cairo next Saturday.

Ghanem said the group should examine whether the fall in prices was the result of weaker consumption or of speculators liquidating their positions in the market.

“The oil market needs some kind of action,” he said. “Of course the falling price hits our earnings but we’re not worried because it can’t last. We expect a turnaround.”

Last month, OPEC, which produces 40 percent of world oil, decided at an emergency meeting to slash its official oil output quota by 1.5 million barrels a day from Nov. 1.

The London-based Centre for Global Energy Studies on Tuesday forecast a contraction in global demand for the first time in 25 years.

By Friday, light, sweet crude for January delivery rose US$0.51 to settle at US$49.93 a barrel on the New York Mercantile Exchange. Earlier, in electronic trading, the price dipped to US$48.25, the lowest level since May 18, 2005.

In London, January Brent crude rose US$1.17 to settle at US$49.19 on the ICE Futures exchange.

SECURITY: As China is ‘reshaping’ Hong Kong’s population, Taiwan must raise the eligibility threshold for applications from Hong Kongers, Chiu Chui-cheng said When Hong Kong and Macau citizens apply for residency in Taiwan, it would be under a new category that includes a “national security observation period,” Mainland Affairs Council (MAC) Minister Chiu Chui-cheng (邱垂正) said yesterday. President William Lai (賴清德) on March 13 announced 17 strategies to counter China’s aggression toward Taiwan, including incorporating national security considerations into the review process for residency applications from Hong Kong and Macau citizens. The situation in Hong Kong is constantly changing, Chiu said to media yesterday on the sidelines of the Taipei Technology Run hosted by the Taipei Neihu Technology Park Development Association. With

CARROT AND STICK: While unrelenting in its military threats, China attracted nearly 40,000 Taiwanese to over 400 business events last year Nearly 40,000 Taiwanese last year joined industry events in China, such as conferences and trade fairs, supported by the Chinese government, a study showed yesterday, as Beijing ramps up a charm offensive toward Taipei alongside military pressure. China has long taken a carrot-and-stick approach to Taiwan, threatening it with the prospect of military action while reaching out to those it believes are amenable to Beijing’s point of view. Taiwanese security officials are wary of what they see as Beijing’s influence campaigns to sway public opinion after Taipei and Beijing gradually resumed travel links halted by the COVID-19 pandemic, but the scale of

A US Marine Corps regiment equipped with Naval Strike Missiles (NSM) is set to participate in the upcoming Balikatan 25 exercise in the Luzon Strait, marking the system’s first-ever deployment in the Philippines. US and Philippine officials have separately confirmed that the Navy Marine Expeditionary Ship Interdiction System (NMESIS) — the mobile launch platform for the Naval Strike Missile — would take part in the joint exercise. The missiles are being deployed to “a strategic first island chain chokepoint” in the waters between Taiwan proper and the Philippines, US-based Naval News reported. “The Luzon Strait and Bashi Channel represent a critical access

Pope Francis is be laid to rest on Saturday after lying in state for three days in St Peter’s Basilica, where the faithful are expected to flock to pay their respects to history’s first Latin American pontiff. The cardinals met yesterday in the Vatican’s synod hall to chart the next steps before a conclave begins to choose Francis’ successor, as condolences poured in from around the world. According to current norms, the conclave must begin between May 5 and 10. The cardinals set the funeral for Saturday at 10am in St Peter’s Square, to be celebrated by the dean of the College