Asian stocks fell this week, ending a two-week rally, as companies lowered earnings forecasts amid mounting evidence that economies are slowing.

Commonwealth Bank of Australia fell 20 percent after saying bad loans may double and Australian business confidence fell to a record low. Citizen Holdings Co dropped 9.7 percent after cutting its profit forecast. Hana Financial Group Inc tumbled 36 percent after Fitch Ratings cut its outlook on South Korean banks.

China’s CSI 300 Index posted the biggest weekly gain since April, led by steelmakers, after the government announced a US$586 billion stimulus plan.

GRAPHIC: AFP

The MSCI Asia-Pacific Index fell 4.7 percent to 82.10 this week, snapping a two-week rally. Financial and technology stocks had the biggest falls among the 10 industry groups.

Japan’s Nikkei 224 Stock Average lost 1.4 percent this week and Australia’s S&P/ASX 200 Index dropped 7.5 percent. Most other markets in the region fell.

Asia-Pacific equities retreated on mounting evidence economies are slowing. China’s industrial output missed estimates, while South Korea’s exports increased at the slowest pace in 13 months last month. In the US, the Treasury scrapped plans to buy mortgage assets to focus on supporting consumer credit.

The MSCI index for the Asia-Pacific region has lost more than half its value since the peak in November last year in the rout triggered by a widening global credit crisis that originated in the US subprime mortgage market. That left shares on the gauge valued at 10 times trailing earnings after last month falling to as low as 8.2 times. Prior to the current turmoil, it never dropped below 10, Bloomberg data dating back to 1995 show.

TAIPEI

Taiwanese share prices are expected to extend losses next week as investors remain concerned over a global economic recession, dealers said on Friday.

Fears of volatility on Wall Street are likely to impact the local bourse owing to uncertainty after the US government changed tack on its use of a US$700 billion mortgage bailout package, they said.

Foreign institutional investors may continue to sell the bellwether electronics sector as it feels the pinch amid falling global demand, they said.

The market is expected to test the nearest technical resistance at around 4,200 points next week owing to fragile confidence, while a technical rebound is likely to follow with a cap at around 4,500 points, dealers said.

For the week to Friday, the weighted index closed down 289.63 points or 6.11 percent at 4,452.70, after a 2.63 percent fall a week earlier.

TOKYO

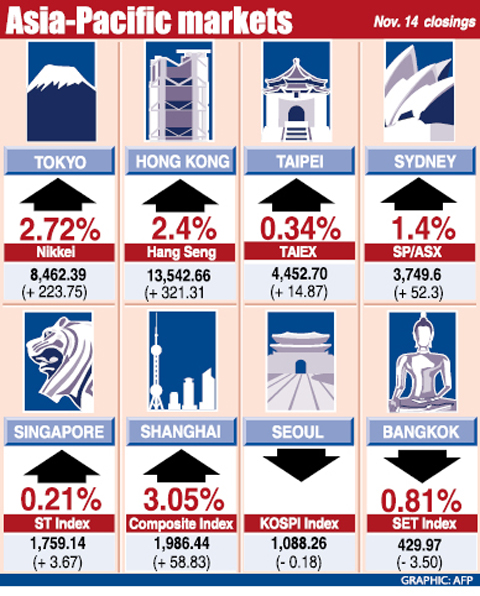

Japanese share prices gained 2.72 percent on Friday.

The Tokyo Stock Exchange’s benchmark climbed 223.75 points to finish at 8,462.39 after jumping more than 5 percent in early trading.

The broader TOPIX index of all first-section shares rose 9.38 points or 1.12 percent to 846.91. Exporters rallied after the US dollar jumped against the yen overnight, although the greenback eased back in Asian trading on Friday.

SHANGHAI

Chinese share prices jumped 3.05 percent. The benchmark Shanghai Composite Index, which covers A and B shares, closed up 58.83 points to 1,986.44.

Property developers gained on hopes that lower mortgage rates would give a boost to weakening demand.

KUALA LUMPUR

Malaysian share prices closed flat. The Kuala Lumpur Composite Index was up 1.06 points or 0.12 percent to closed at 881.65.

JAKARTA

Indonesian shares ended up 0.4 percent. The Jakarta Composite Index rose 4.67 points to 1,264.38.

MANILA

Philippine share prices closed 3.07 percent higher. The composite index rose 59.08 points to 1,978.05 points.

WELLINGTON

New Zealand share prices closed 1.39 percent higher. The benchmark NZX-50 index rose 38.05 points to close at 2,767.67.

MUMBAI

Indian shares fell 1.58 percent. The benchmark 30-share SENSEX fell 150.91 points to 9,385.42, at a near three-year low.

The US government has signed defense cooperation agreements with Japan and the Philippines to boost the deterrence capabilities of countries in the first island chain, a report by the National Security Bureau (NSB) showed. The main countries on the first island chain include the two nations and Taiwan. The bureau is to present the report at a meeting of the legislature’s Foreign Affairs and National Defense Committee tomorrow. The US military has deployed Typhon missile systems to Japan’s Yamaguchi Prefecture and Zambales province in the Philippines during their joint military exercises. It has also installed NMESIS anti-ship systems in Japan’s Okinawa

‘WIN-WIN’: The Philippines, and central and eastern European countries are important potential drone cooperation partners, Minister of Foreign Affairs Lin Chia-lung said Minister of Foreign Affairs Lin Chia-lung (林佳龍) in an interview published yesterday confirmed that there are joint ventures between Taiwan and Poland in the drone industry. Lin made the remark in an exclusive interview with the Chinese-language Liberty Times (the Taipei Times’ sister paper). The government-backed Taiwan Excellence Drone International Business Opportunities Alliance and the Polish Chamber of Unmanned Systems on Wednesday last week signed a memorandum of understanding in Poland to develop a “non-China” supply chain for drones and work together on key technologies. Asked if Taiwan prioritized Poland among central and eastern European countries in drone collaboration, Lin

TRAGEDY STRIKES TAIPEI: The suspect died after falling off a building after he threw smoke grenades into Taipei Main Station and went on a killing spree in Zhongshan A 27-year-old suspect allegedly threw smoke grenades in Taipei Main Station and then proceeded to Zhongshan MRT Station in a random killing spree that resulted in the death of the suspect and two other civilians, and seven injured, including one in critical condition, as of press time last night. The suspect, identified as a man surnamed Chang Wen (張文), allegedly began the attack at Taipei Main Station, the Taipei Fire Department said, adding that it received a report at 5:24pm that smoke grenades had been thrown in the station. One man in his 50s was rushed to hospital after a cardiac arrest

ON ALERT: Taiwan’s partners would issue warnings if China attempted to use Interpol to target Taiwanese, and the global body has mechanisms to prevent it, an official said China has stationed two to four people specializing in Taiwan affairs at its embassies in several democratic countries to monitor and harass Taiwanese, actions that the host nations would not tolerate, National Security Bureau (NSB) Director-General Tsai Ming-yen (蔡明彥) said yesterday. Tsai made the comments at a meeting of the legislature’s Foreign Affairs and National Defense Committee, which asked him and Minister of National Defense Wellington Koo (顧立雄) to report on potential conflicts in the Taiwan Strait and military preparedness. Democratic Progressive Party (DPP) Legislator Michelle Lin (林楚茵) expressed concern that Beijing has posted personnel from China’s Taiwan Affairs Office to its